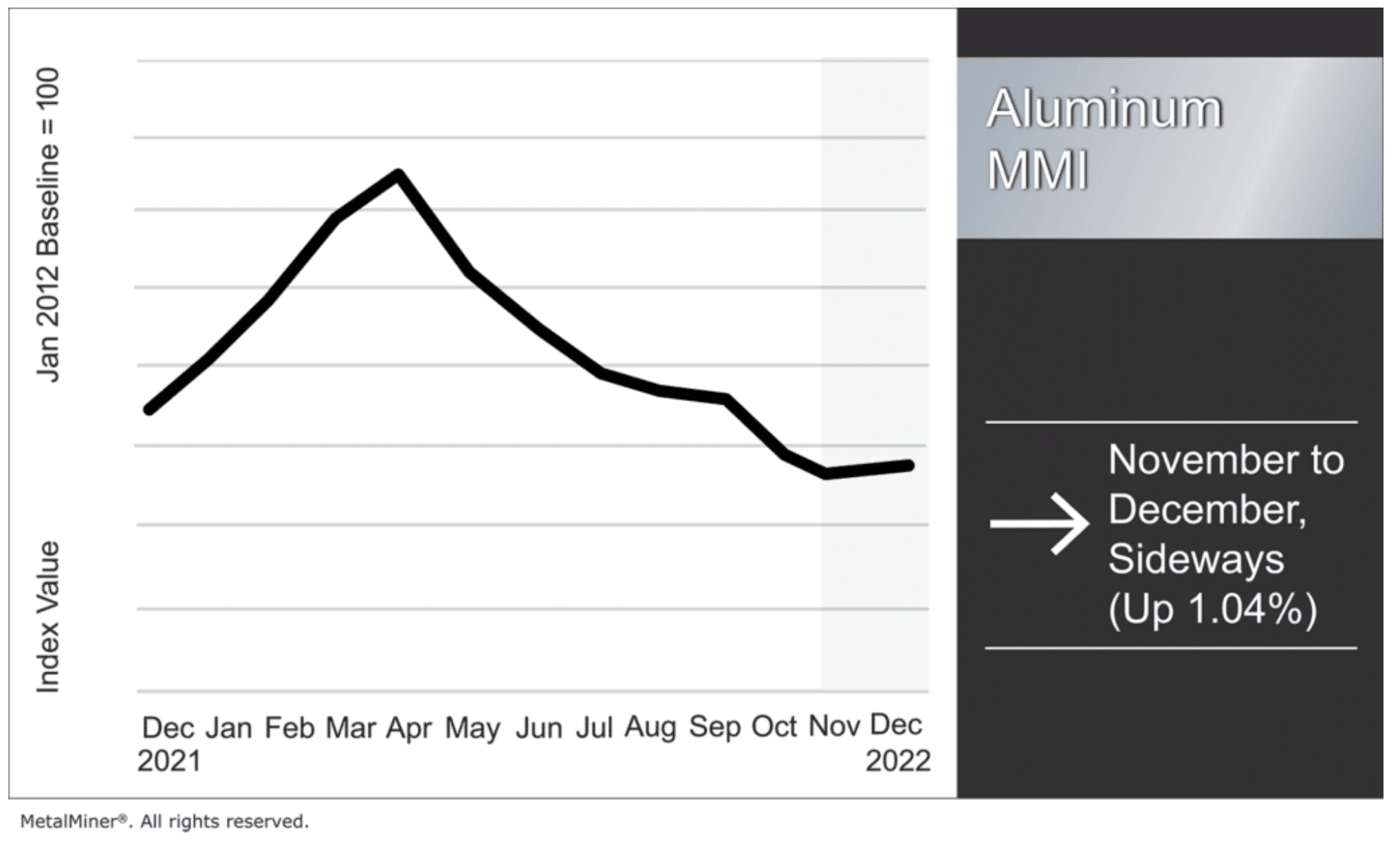

Although aluminum prices started to rebound in the short term, they have yet to breach ranges that would signal the beginning of a new trend. Indeed, prices continue to create an uncertain environment for the aluminum market due to the lack of direction. Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, rising a modest […]

Tag: aluminum price

Aluminum MMI: Russian Metal Hits 80% of LME, Aluminum Prices Rise in July

Aluminum prices continued to slide throughout June but appeared to find a bottom in early July. Prices started to form relief patterns in the short term, rising following bearish price action over recent months. Meanwhile, cooling inflation data saw market sentiment improve. The U.S. dollar index, which has an inverse correlation to metal prices, dropped […]

Aluminum MMI: Aluminum Prices Sideways Amid LME’s Russia Problem

Aluminum prices continue to lack enough strength to form either bearish or bullish trends. Since aluminum prices have yet to break out of range meaningfully and there is no established uptrend or downtrend, the market remains highly risky. Altogether, the Aluminum Monthly Metals Index (MMI) dropped 3.19% from May to June. Russian Aluminum in LME […]

Construction MMI: Canadian Wildfire Smoke Puts a Halt on NYC Construction

The Construction MMI (Monthly Metals Index) stayed within a tight range, but dropped more than in the previous three months. Overall, the index fell by 5.04% month-on-month. Meanwhile, steel prices continued to slide, which brought noticeable bearish pressure to the index. However, within the first couple weeks of June, H-beam steel and steel rebar prices […]

Aluminum MMI: Aluminum Prices Slide as LME Faces Russian Supply Glut

Aluminum prices continued to slowly edge downward, but remained within an overall sideways trend. After prices fell 1.31% throughout April, they dropped an additional 2.22% during the first week of May. But despite the softness, aluminum prices have not yet formed lower lows, so an established downtrend is still not confirmed at this time. Interested […]

Aluminum MMI: Price of Aluminum Falls, Tariffs Back On

Aluminum prices reacted bearishly in the short term. At the beginning of February, price action showed a short-term sideways trend with no new lows or highs. Indeed, the price of aluminum would need to break out of its current range to form a continuation trend or a reversal downward. However, future price direction currently remains […]

Aluminum MMI: Aluminum Prices Pause Following Surge

Aluminum prices have stayed bearish in the short term. At the beginning of February, price action showed a short-term sideways trend, as no new lows or highs formed. This means prices need to break out of their current range to form a continuation trend or a downward reversal. Currently, however, future price direction remains unclear. […]

Aluminum MMI: Aluminum Prices Slide From Early-December Peak

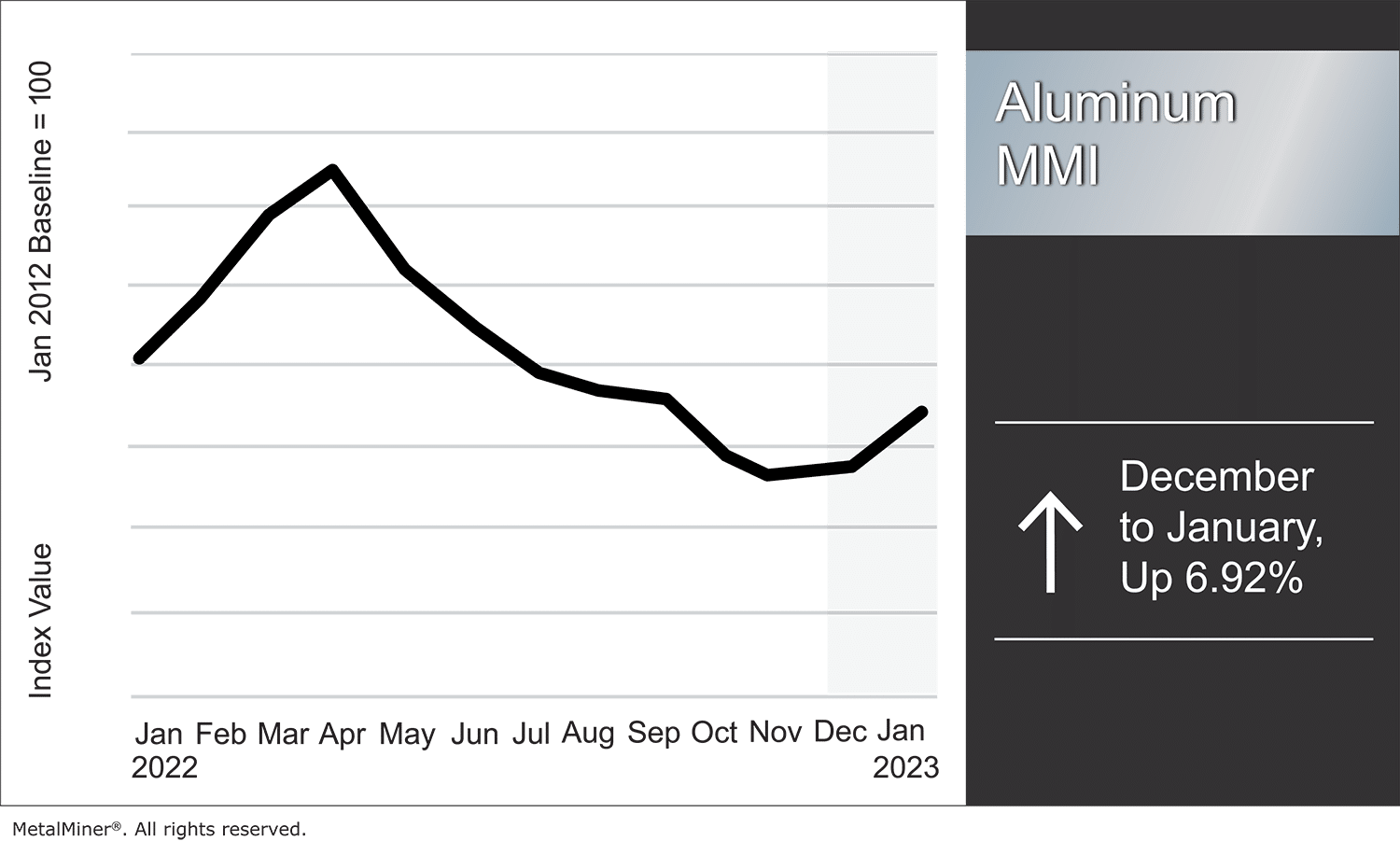

Despite the recent short-term bounce, aluminum prices have not quite reversed to the upside following their long decline from March 2022. Ultimately, the rally between November and December was not strong enough to indicate a reversal. Moreover, bearish pressure continues to dominate the market environment at this time. Instead, prices remain largely indecisive. However, the […]

Aluminum Prices and Global Market: a 2022 Review

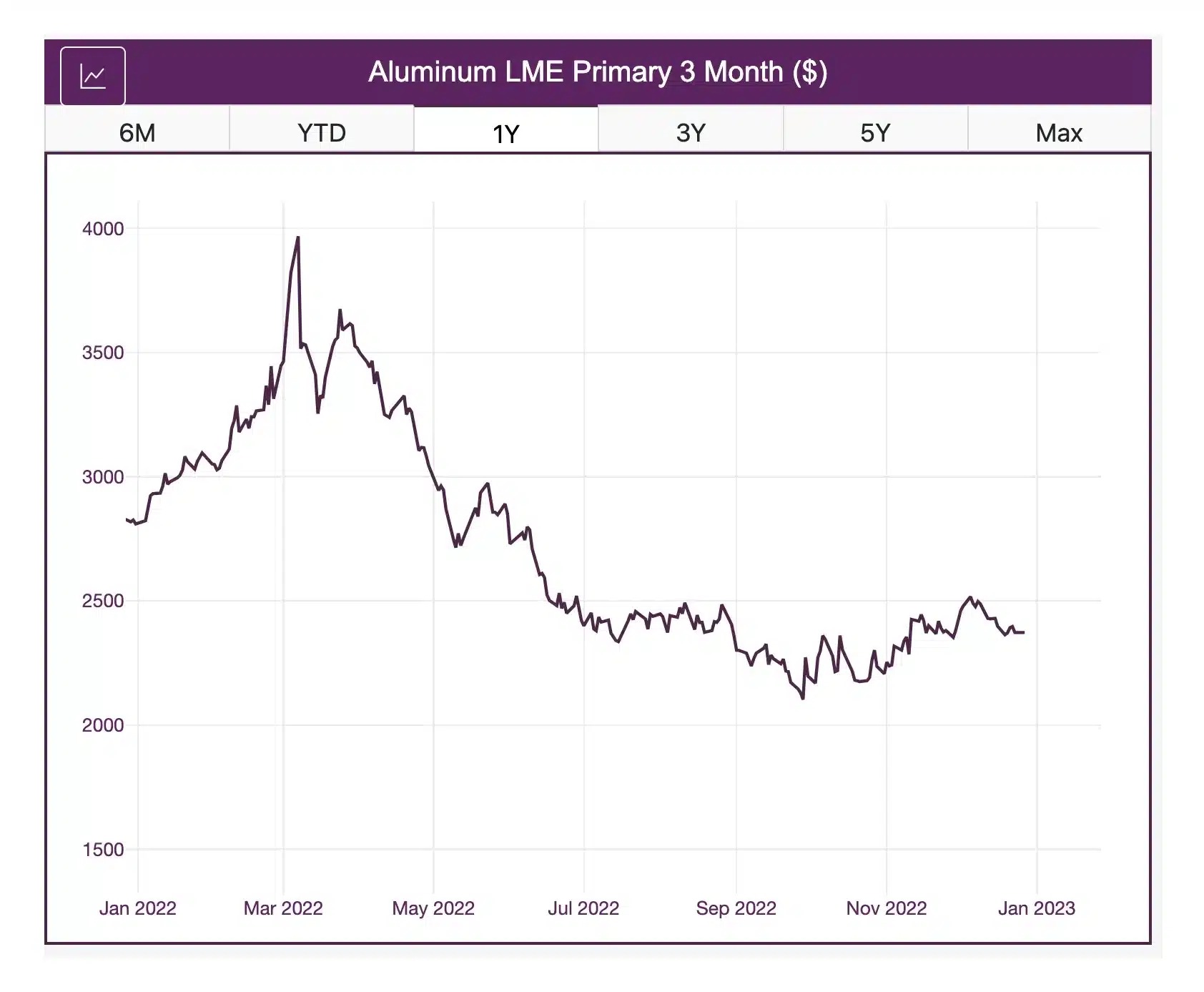

Aluminum prices reached a high price of almost $4,000 per metric ton on the LME primary 3-month in 2022. However, there were plenty of sales for roughly half that amount, attesting to the wide range of the 2022 index. When March’s rally ended, prices began a decline that resulted in them hitting a yearly low […]

Aluminum MMI: Rally Continues as Aluminum Prices Remain Bullish

Aluminum prices broke out of their sideways trend last month with strong upside price action. Prices rallied during the first half of November, followed by a modest retracement before they continued upward. Overall, the Aluminum Monthly Metals Index (MMI) saw a modest 1.04% increase from November to December. The MetalMiner Insights platform includes global aluminum […]