The European Commission (EC) has expressed concern about Donald Trump’s announcement of plans to double import tariffs on steel. The U.S. President proclaimed the new “Trump Tariffs” during a speech at US Steel’s Mon Valley-Irwin works in Pennsylvania on May 30. “We strongly regret the announced increase of U.S. tariffs on steel imports from 25% […]

Tag: Aluminum

Tariff Ticking Time Bomb: Trump Gives UK Until July 9th to Avoid Steel Shock

Trump tariffs are back once again putting U.S trade partners in a tough spot. President Donald Trump recently exempted the United Kingdom from his doubling of import tariffs on steel and aluminum into the United States, but only temporarily. While import tariffs from UK steelmakers remain at 25% for now, failure to reach an agreement […]

China’s Metal Anti-Dumping is Back. What You Need to Know

Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap […]

Aluminum MMI: Aluminum Prices Stabilize as Midwest Premium Hold onto Gains

The Aluminum Monthly Metals Index (MMI) appeared increasingly bearish with a 3.08% decline from April to May. What do other metal and commodity market trends mean for aluminum trends? Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Aluminum Prices Stabilize Following Post-Tariff Drop Aluminum prices found an […]

Construction MMI: Construction Market Braces Itself as Recession Fears Loom

The Construction MMI (Monthly Metals Index) moved sideways month-over-month, dropping by 2.72%. In the wake of fresh federal policy moves this spring, construction news reports indicate that the industry is navigating a sudden spike in material costs. Over the past month, new government tariffs and trade measures have caused significant price fluctuations in critical inputs […]

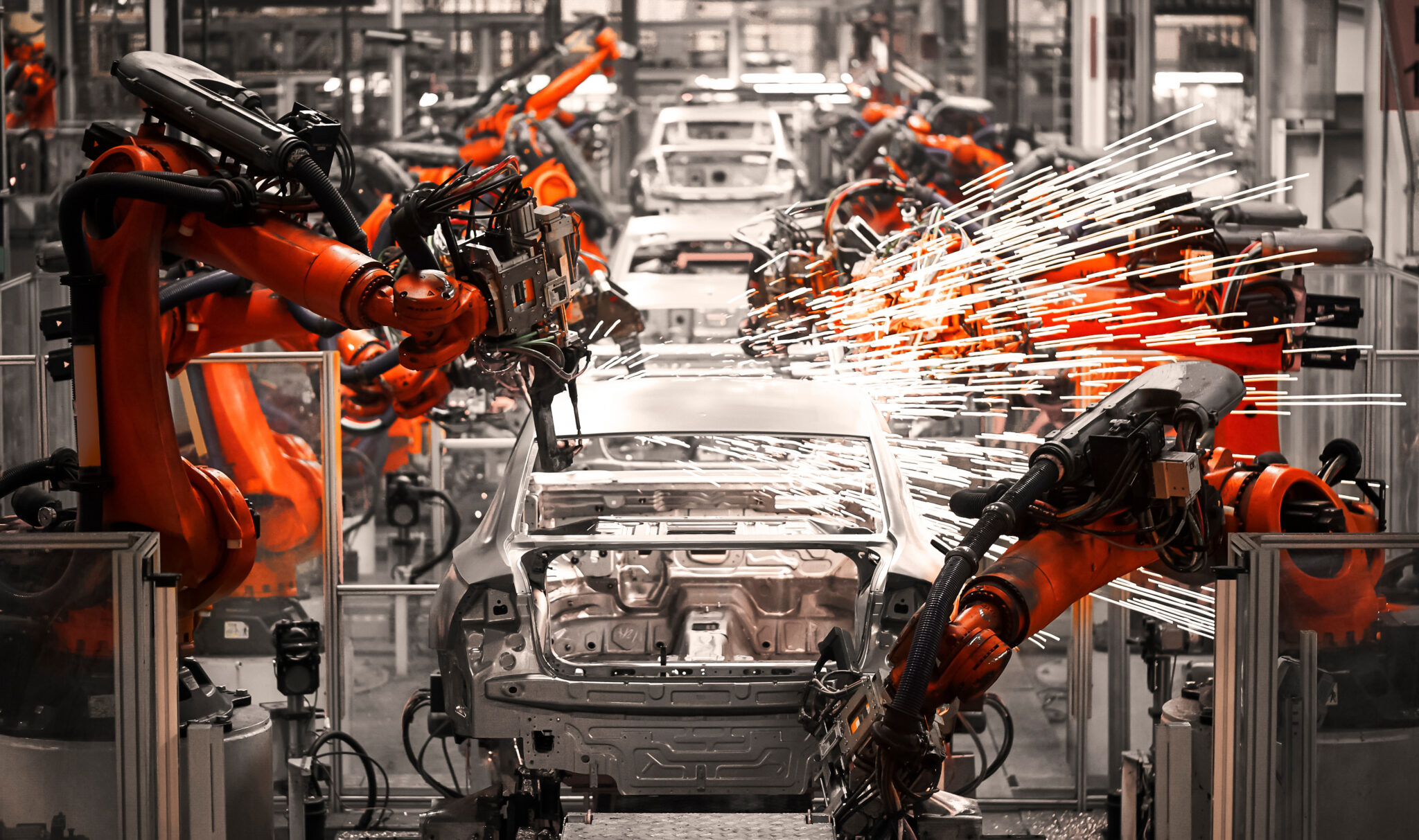

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times […]

U.S. Aluminum vs. European Aluminum: A Comprehensive Short-Term Market Outlook

A striking aspect of the aluminum premium and the aluminum market turmoil currently unfolding after Trump’s aluminum tariffs is how differently it’s playing out in the U.S. versus other regions. While premiums inside of the U.S. are rising, outside the United States, aluminum premiums are actually falling. With U.S. tariffs shutting out or discouraging some […]

Aluminum Delivery Premiums Spiking After Tariffs, are Aluminum Freight Bottlenecks Coming?

In the past month, the cost of importing aluminum into the United States has risen sharply. This occurred as aluminum market delivery premiums, the added charges above the base metal price for physical shipments, came close to record highs. This surge in costs stems primarily from a combination of fresh U.S. tariffs, global shipping delays, […]

Aluminum MMI: How Suppliers Handle Tariffs and What Aluminum Buyers Need to Know

The Aluminum Monthly Metals Index (MMI) remained sideways, as most components appeared consolidated. Overall, the index slid 0.74%, while aluminum prices experienced continued instability. Aluminum Price Volatility After Tariffs Aluminum prices have appeared increasingly volatile since the announcement of tariffs. Prices plunged after reaching a mid-March peak, breaking below their sideways range. The implementation of […]

China Just Redrew the Aluminum Map, and the World Is Watching

At a time when analysts expect the global demand for aluminum to rise, a new development in China may significantly impact both aluminum market demand and the country’s internal consumption. That said, market watchers know that any announcement around metals coming out of Beijing these days also has to be looked at through the lens […]