The copper market outlook for the second half of 2025 has seen significant debate in recent weeks. On the supply side of the equation, new production is coming online. However, this may not happen fast enough to flood the market. According to mining.com, the ICSG projects global mined copper output will rise about 2.3% in […]

Tag: Copper

Price of Copper Braces for H2 2025: Are Demand Jitters on the Way?

Copper prices are entering the second half of 2025 on a knife’s edge. After a roller-coaster first half that included soaring to record highs in March only to plunge weeks later, the outlook for the price of copper remains clouded by dueling forces. On the one hand, robust long-term demand drivers like electrification and EVs […]

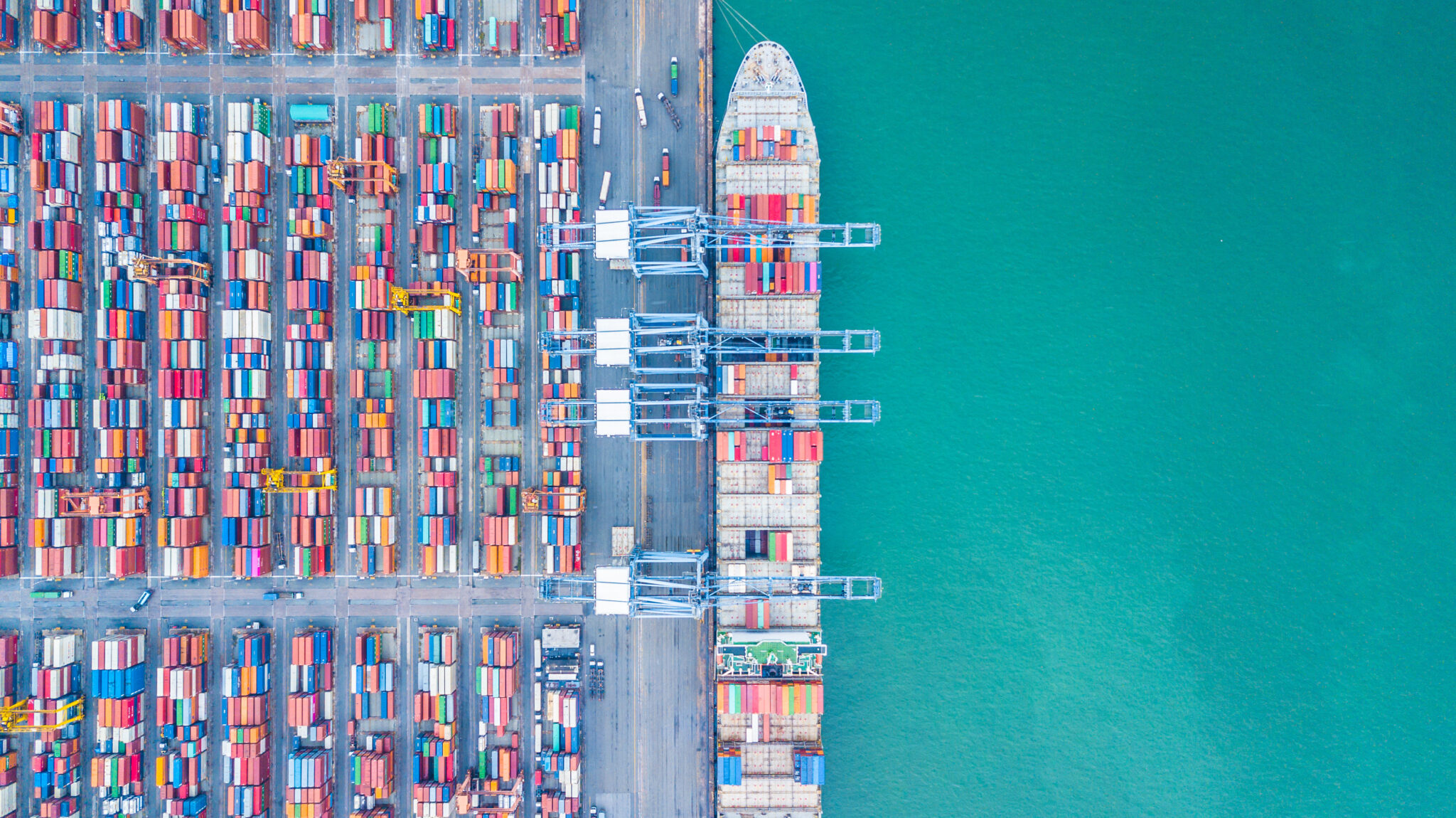

China’s Metal Anti-Dumping is Back. What You Need to Know

Chinese mills are churning out steel, aluminum and even refined copper at near-record levels and sending the surplus abroad, a trend steel industry analysts say could pressure industrial metal prices in the United States. After a year of lagging domestic demand, China’s exports of construction and manufacturing metals have surged, flooding global markets with cheap […]

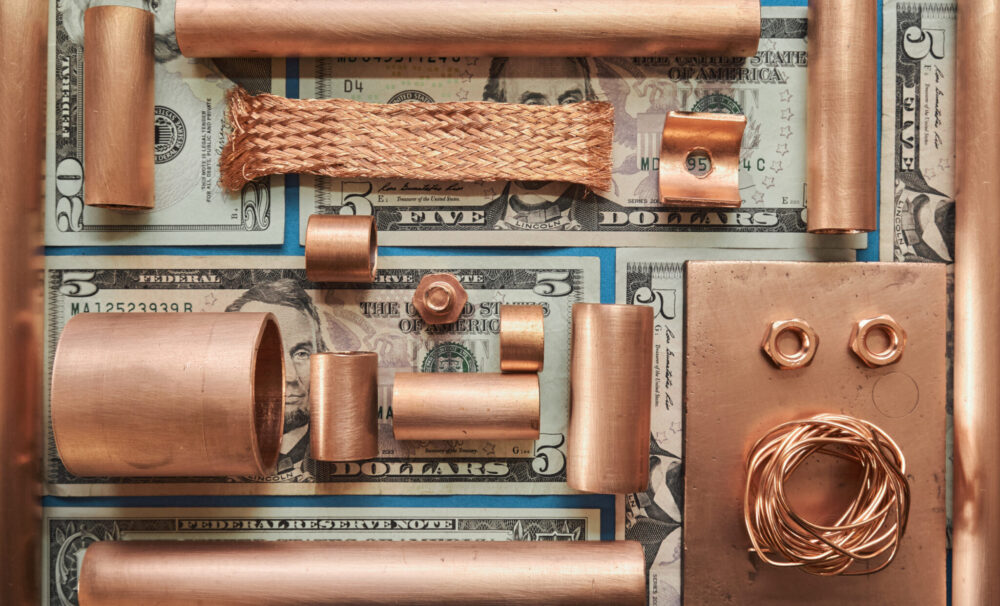

Volatility’s Back, and It’s Wreaking Havoc on Metal Sourcing Strategies

Speculators may love volatility, but metal buyers hate it. As for Trump Tariffs 2025, the jury is still out. The truth is that a bout of unexpected turbulence like we’ve seen over the last couple of months can knock even the best-laid strategies sideways. The reasons are clear: markets nosedived in March and hit bottom […]

Copper MMI: Copper Prices Volatile on Tariff Shifts

The Copper Monthly Metals Index (MMI) retraced to the downside with a 4.23% decline from March to April. Looking at copper prices today, analysts seem to be struggling with ongoing trade policy shifts. Copper Prices Zigzag Amid Uncertain Trade Policy Comex copper prices have experienced wild swings over the past few months. First, they […]

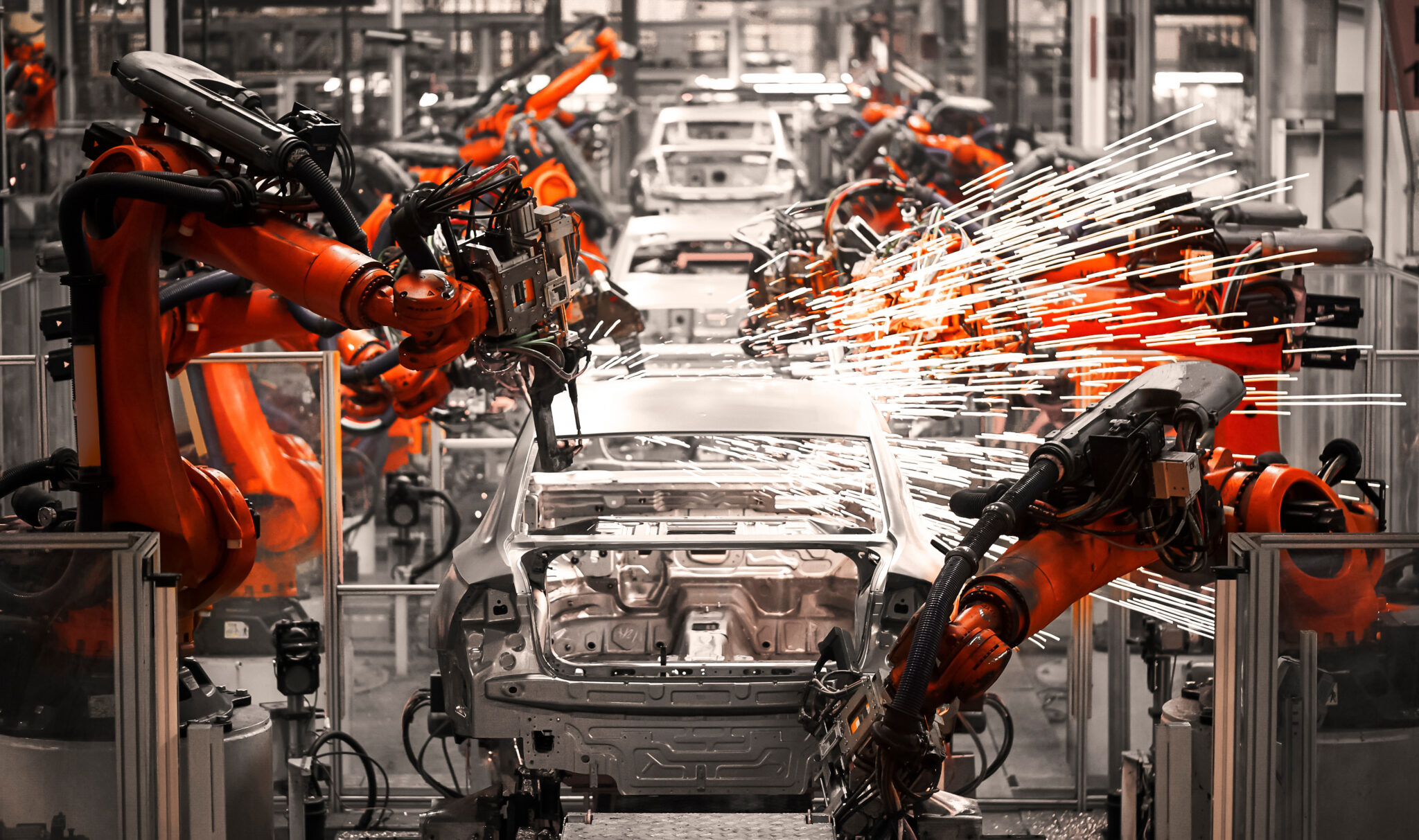

How U.S. Manufacturers Shift Gears and Save Money Amid Metal Price Volatility

U.S. manufacturers in the automotive, appliance and general industrial sectors are overhauling procurement strategies as economic volatility and swings in steel, aluminum and copper prices squeeze margins. Recent U.S. tariff actions have jolted metals markets, sending input costs soaring for downstream manufacturers. According to Reuters, the uncertainty not only triggered panic buying but extended lead times […]

Is Copper About to Spark a Global Commodities Rally?

Copper was touted as the hottest commodity of 2025, as covered in MetalMiner’s weekly newsletter. Capped by April’s tariff-driven turbulence, the last quarter only reinforced that view. Now it seems copper prices are poised to lead other metals in the short term. Many experts believe copper has reached an inflection point. As such, they expect […]

Copper MMI: What’s Next for Copper Prices After Peak

The Copper Monthly Metals Index (MMI) moved up, accelerating gains from the previous month. The Bullish U.S. price of copper saw the index rise by 4.75% from March to April. Price of Copper Finally Finds Peak Although they have subsequently been delayed, reciprocal tariffs helped copper prices find a peak. At the start of 2025, […]

Historical Price Trends for Industrial Metals Over the Past Decade

Over the last ten years, industrial metal prices have gone on a wild ride, rising, falling and rising again, thanks to everything from global economic swings to supply chain hiccups and geopolitical drama. If you’re in manufacturing, investing, or policy, keeping tabs on these price trends isn’t just helpful, it’s essential. Steel Historical Price Trends […]

The Global Copper Race Heats Up: India Moves into Zambia’s Mining Sector

Much like neighboring China has been doing for decades, India is now making inroads into the African continent to mine copper reserves, among other mineral assets. It is a move that is sure to shake up the already-competitive international copper market, where multiple nations continue to show significantly increased interest in Africa. Staring in the face […]