January 2024 unfolded as a dynamic and volatile month for financial markets and commodity prices. The early weeks of January saw euphoria among investors fueled with hopes of receding inflation concerns and a dovish fed. However, a hawkish central bank and geopolitical tensions soon dampened that optimism. Meanwhile, falling oil prices and tightened investments drove […]

Tag: Oil

Is China’s Surge in Crude Oil, Coal, and Iron Ore Imports Really a Sign of Economic Strength?

News coming out of China indicates the country set new records in 2023 for the import of crude oil, coal, and iron ore. The revelation caught many by surprise, but analysts caution that this may not really signify a robust demand for these essential materials. Nor does it indicate that there has been any reversal […]

Investors Seek Safe Haven Assets Amidst Geopolitical Conflict

Precious metals like gold and silver are often seen as a safe haven asset during times of economic uncertainty. In recent weeks, we have witnessed a significant increase in the number of global conflicts, imposing high uncertainty and risk among markets for investors. Still, the jury is still out on how this will affect precious […]

Precious Metal Prices Losing Steam After Fed Announces Intent to Keep Interest Rates Elevated

In recent weeks, leading up to the end of the month, indices like the S&P500 and metals like silver and gold began to run out of steam. The impetus for the decline in stock and precious metal prices was recent Fed comments regarding higher interest rates in the foreseeable future. Meanwhile, other indexes such as […]

Metal Manufacturing News: Glencore Proposes Merger with Canada’s Teck Resources

On April 3, multinational commodity trader and mining group Glencore announced its proposal for a merger with Canada’s Teck Resources. Estimates say the metal manufacturing merger could potentially create $4.25-5.25 billion of post-tax synergy value. However, Vancouver-headquartered Teck announced its rejection of the offer on the same day. “The board of directors of Teck has […]

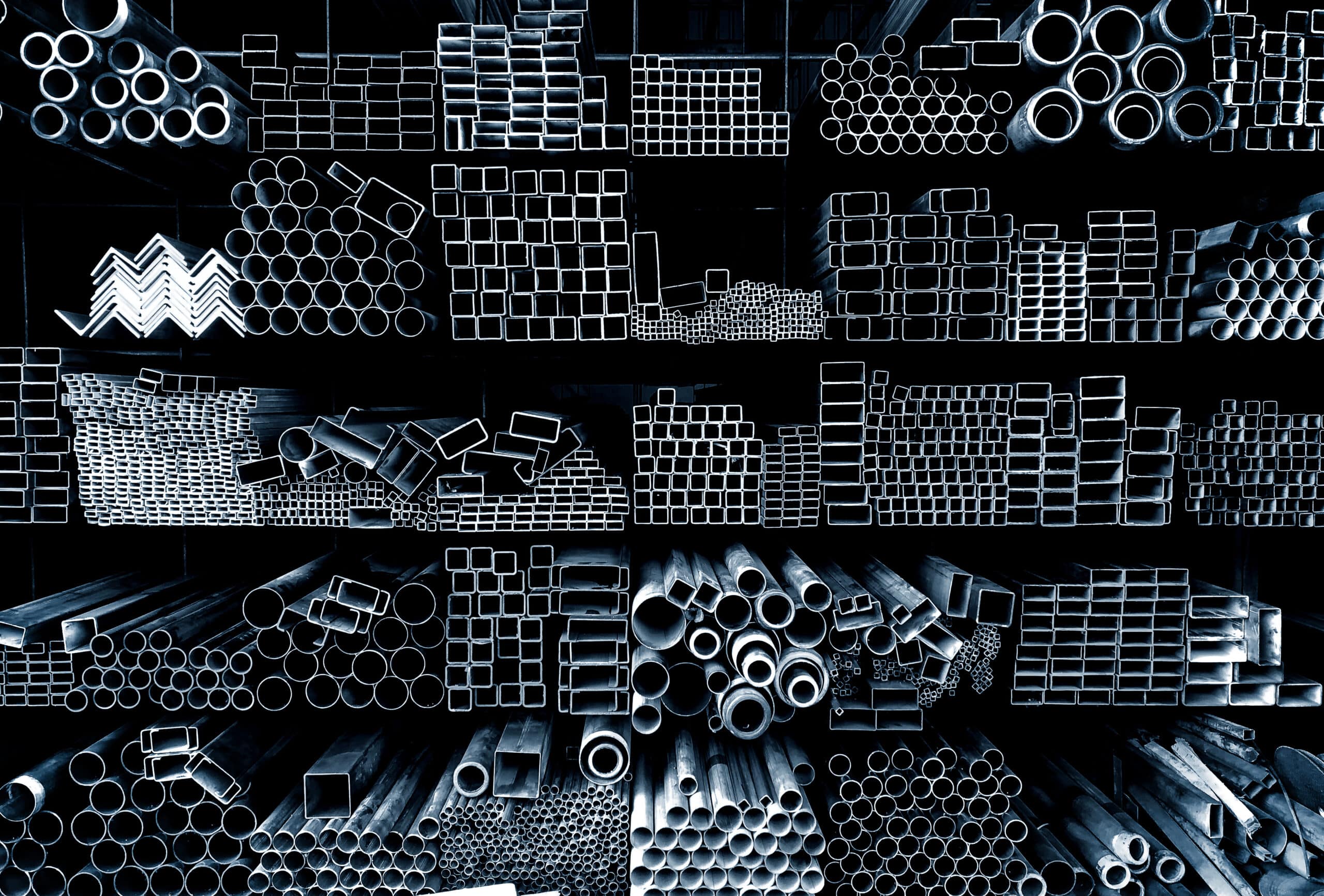

Raw Steels MMI: Market in Backwardation Suggests U.S. Steel Prices May Be Near Peak

The Raw Steels Monthly Metals Index (MMI) moved sideways from March to April, with a mere 0.65% increase. A sharp reversal to the downside for Midwest HRC future prices placed additional weight on the index. Meanwhile, HRC price action continued to the upside during the month, with the HRC rally yet to show a meaningful slowdown. […]

Global Natural Gas Competition Gets Fierce

Both experts and everyday consumers remain at odds about the current state of the global natural gas market. The main point of contention is whether US prices will drop significantly or rise further. With inflation hitting record highs this past year, nobody can blame consumers for being wary. Most experts agree that gas prices and demand […]

Gas Shortage: The Ramifications of Russian Oil and Gas Cutoffs

It’s no secret that Russia’s invasion of Ukraine has had a massive global impact. From the sanctions to the natural gas supply cutoffs, the economic toll is both catastrophic and far from over. Currently, economists and other experts are trying to predict how different parts of the world will react to the gas shortage. So […]

Aluminum Prices Drop Sharply Amid Increasing European Challenges

A curious tug of war continues in the Aluminum industry. It remains focused on likely demand destruction due to recessionary forces, generally blamed on central banks’ rapid raising of interest rates. Of course, we’ve all watched base metals come off sharply since the end of Q1, and Aluminum has been no exception. Indeed, after peaking […]

Oil Prices: Have OPEC and the IEA Gotten it Right?

Both OPEC and the International Energy Agency are predicting next year’s market to be one of the tightest in recent history. According to a Financial Times post, the two bodies have based this assumption on recovering demand in China and continued growth in India. The prediction also runs counter to widespread fears of recession. With […]