Nickel prices continued to the upside during the first half of March, taking a momentary pause from their long-term downtrend. However, prices found a peak by March 13, reaching their highest level since October 2023. Following that, the rally collapsed, and prices returned to the downside. Overall, nickel prices fell 5.56% month over month. The […]

Tag: stainless steel price

Stainless MMI: Outokumpu Looks to Expand After Q2 Drop, Nickel Prices Find Lower High

Although nickel prices rose more than 8% during July, prices found a peak at the beginning of August and fell to create a higher high. Indeed, prices began to retrace downward as bearish patterns became apparent in price action. While prices have yet to substantially break below monthly support or create a new lower low, […]

Stainless MMI: Stainless Output Dropped, 304 Surcharge Bearish, Nickel Prices Return Sideways

After nickel prices saw a sharp slowdown in May, prices started to form sideways trends in relief to the downtrend. Like other base metals, nickel prices rallied during the first weeks of June until bullish momentum exhausted itself and prices retraced to the downside. Prices found a bottom at the end of June and continue […]

Stainless MMI: LME Riddled With Challenges, Nickel Prices Rebound

The Stainless Monthly Metals Index (MMI) broke to the downside from May to June, with stainless steel prices falling 10.15% After falling over 14% throughout May, nickel prices began to rebound during the first half of June. Since prices remain within their short-term range without an established trend, uncertainty and volatility may increase in the […]

Stainless MMI: Stainless Remains a Buyer’s Market Amid Flat Global Demand Projections

The Stainless Monthly Metals Index (MMI) rose a modest 0.67% from April to May. Following increased volatility over the last few months, nickel prices began to slow down in terms of sharp breakouts or breakdowns. As a result, the larger sideways trend continued with no clear direction. Does your company have a stainless buying strategy […]

Stainless MMI: Index Falls as Stainless Steel Price Appears Bearish

The Stainless Monthly Metals Index (MMI) fell 7.53% from March to April. Downside momentum continued to pressure the nickel market, sending prices down into support zones. Meanwhile, no bullish reversal patterns have formed, leaving the global stainless steel price at high risk of further decline. Get weekly updates on nickel and stainless steel price trends […]

Stainless MMI: Price of Nickel and Stainless Steel Continue to Drop

The Stainless Monthly Metals Index (MMI) dropped 4.68% from February to March. Meanwhile, the price of Nickel also fell significantly. Does your company have a stainless buying strategy based on a recessionary market? Stainless Spot Pricing for Buyers U.S. cold rolled stainless steel import licenses remain depressed. Indeed, many importers appear apprehensive, as it remains […]

Stainless MMI: Nickel Prices Return Sideways

The Stainless Monthly Metals Index (MMI) rose 5.82% from January to February as the nickel price index lost upward momentum. Nickel prices returned sideways in the short term after finding a peak in January. Since the price has not bounced high enough to confirm an uptrend, downside risk may increase. Meanwhile, volume levels appear at […]

Stainless MMI: Nickel Prices Pull Back as Downside Risk Mounts

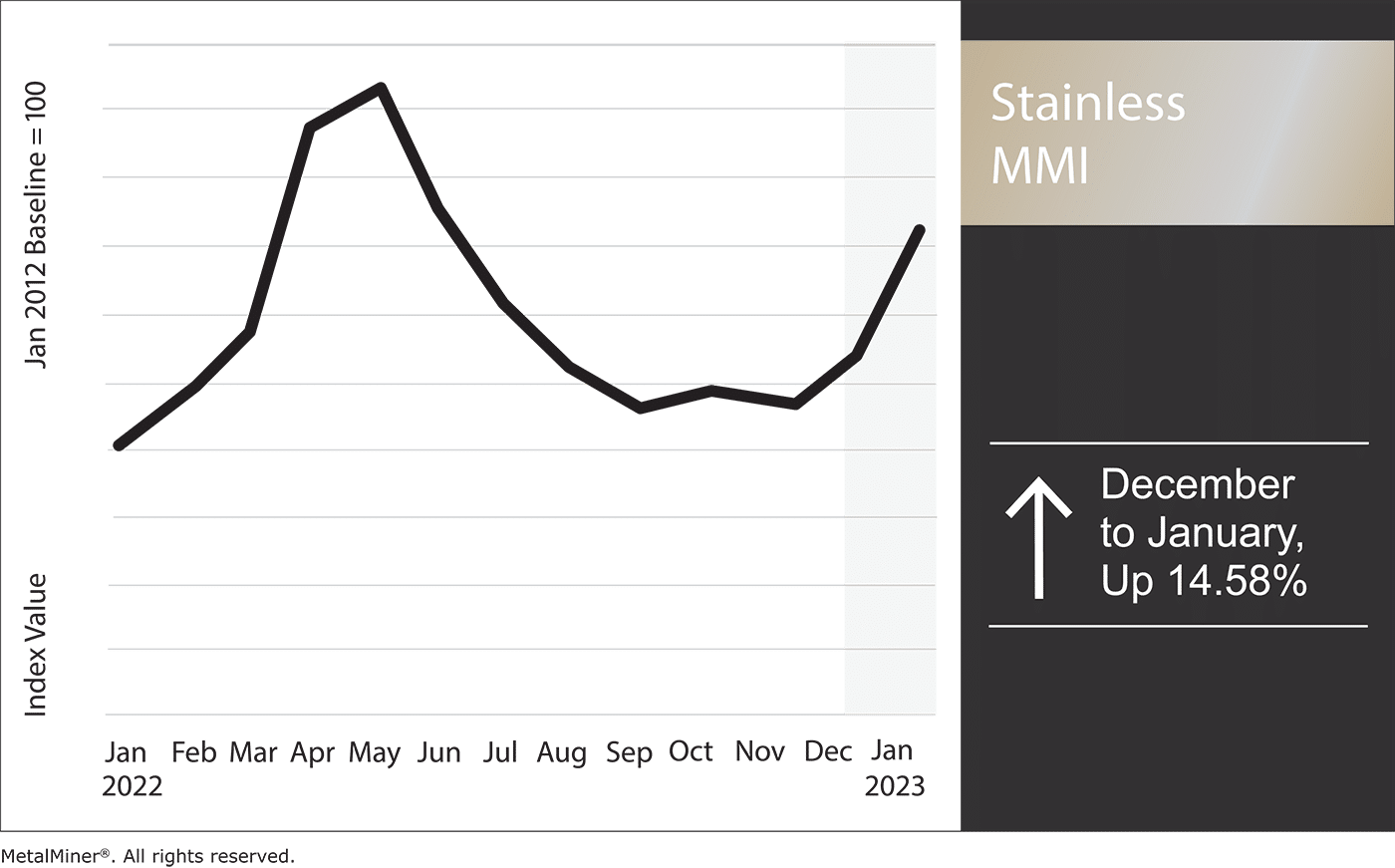

The Stainless Monthly Metals Index (MMI) rose 14.58% from December to January as nickel prices retreated. Nickel prices continued to rally throughout December. But by January, prices began to show minor pullbacks that could become the beginning of a short-term sideways trend. Until prices break the new range, the market direction will remain unclear. Market […]

2022 Stainless Steel and Nickel Price Trends

Stainless and nickel price trends fluctuated much more than carbon steel throughout 2022. The LME nickel squeeze greatly strained both the nickel and stainless steel markets. Indeed, LME nickel prices skyrocketed by almost $25,000 per metric ton back in March. Soon after, the rally cooled down again, eventually bottoming out in July. Come November, prices […]