Amid Declines, China Tops Global Steel Production Charts Again

China was the largest end-user of steel in 2022. According to the World Steel Association’s (Worldsteel) “2023 World Steel Report,” the country consumed 51.7% of the 1.78 million metric tons of finished products rolled last year. That percentage was unchanged from the previous year. At that time, China’s apparent steel consumption was 954 million metric tons out of 1.84 billion tons of finished products. Obviously, demand, consumption, and production all have vast implications or global steel prices.

At 52%, more than half the global steel consumption in 2022 was in building and infrastructure. This included residential and office buildings as well as roads, bridges, railroads, pipelines, and green applications. A diagram from the report also showed that mechanical equipment and the automotive sector occupied a distant second and third place, at 16% and 12%, respectively.

The world’s second-largest economy also produced the highest volume of crude steel in 2022, pouring 1.02 billion metric tons. This figure represents a 1.66% year-on-year from about 1.04 billion metric tons. Meanwhile, global crude production totaled 1.89 billion metric tons, reflecting a 3.91% decline from the 1.96 billion metric tons poured in 2021.

Stay ahead of steel market shifts. MetalMiner Insights provides comprehensive (METAL TYPE HERE) price forecasting and AI feeds which give copper buyers a competitive edge over the competition. Schedule a consult.

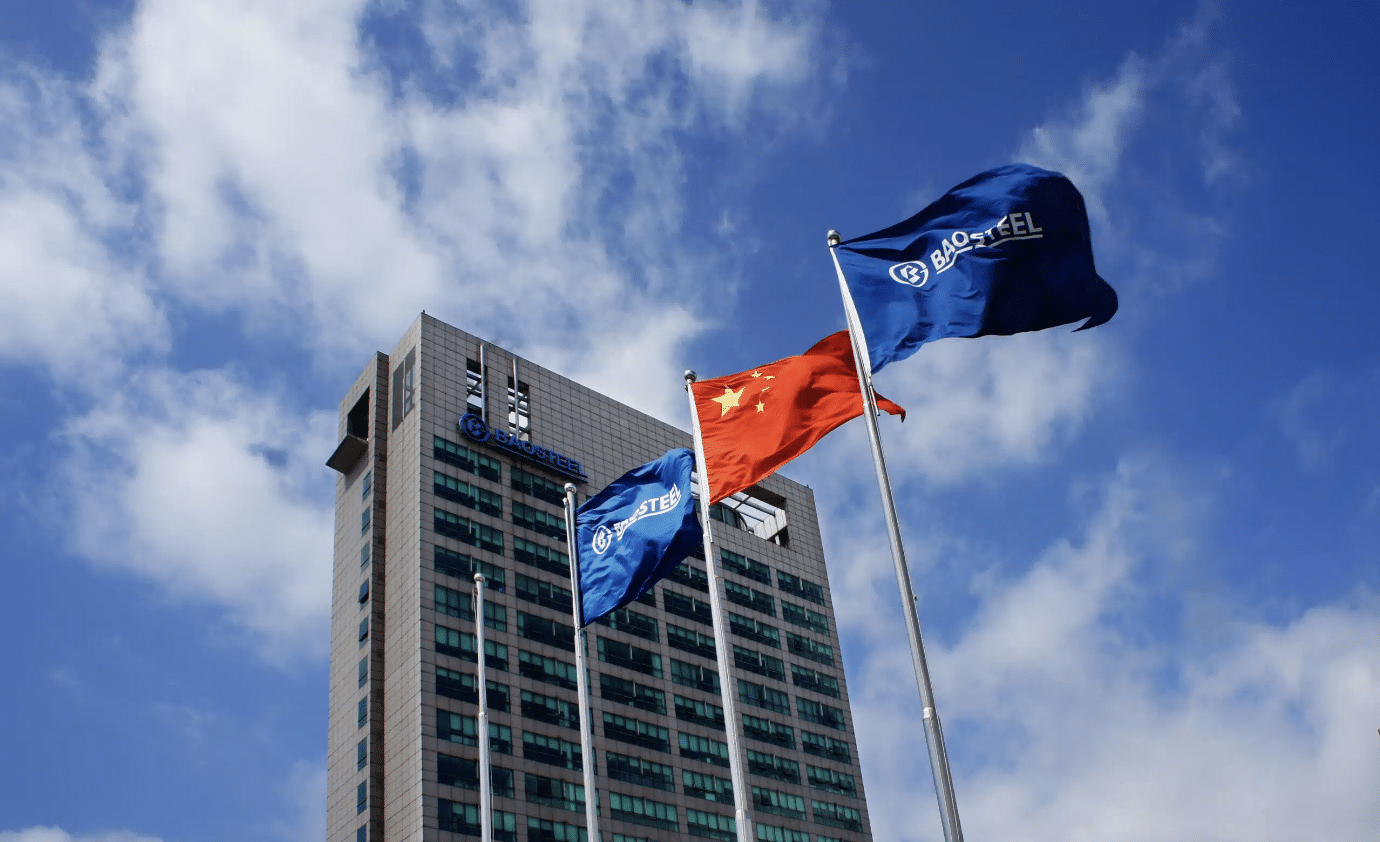

Amid Lower Steel Prices, Baowu and ArcelorMittal Up Production

China Baowu Group poured the highest volume of crude in 2022, at almost 132 million metric tons. Worldsteel indicated this was an increase of 9.86% from a reported 120 million metric tons poured in 2021. Indeed, Baowu became the world’s largest steelmaker in 2016. That was the same year the company absorbed Hubei-headquartered Wuhan Iron & Steel.

However, figures show that Luxembourg-headquartered ArcelorMittal occupied second place in 2022, pouring 69 million metric tons. This reflects a 9.52% rise from the 62.9 million metric tons poured over 2021.

Chinese producers accounted for six out of the top-ten producers in 2022. The country also had the largest apparent steel use per capita, at about 646 kilograms. However, it’s worth noting that consumption was down 3.46% year on year from 669 kilograms in 2021. The largest per-capita consumer outside of China in 2022 was South Korea at 988 kilograms. However, that country also saw a decline of 8.62% from 1,081.2 kilograms.

MetalMiner customizes price points, price forecasts and procurement solutions based on the specific metal type your company purchases. See MetalMiner’s full metal catalog.

Europe and North American Production Also Down

In Europe, Czechia held first place at 631 kilos per capita. Again, World Steel notes that this is still a 15% decline from 743 kilos last year. By comparison, Europe’s economic powerhouse Germany saw its per capita consumption decline 11% to 379 kilograms from 425.7 kilograms.

On May 15, European Commission that Czechia’s gross domestic product (GDP) grew 2.5% in 2022, compared to Germany’s 1.8%. However, forecasts indicate that GDP growth in Czechia is also due to contract to 0.2% in 2023 before rising to 2.6% in 2024.

One source connected the higher number in Czechia with post-command economies in Europe building out infrastructure as well as lower steel prices.

Per capita steel use in the European Union was down more than 10.3% to 310.3 kilos from 346.1. Indeed, the 27-member bloc experienced significant economic uncertainty in Q1 due to several factors. Among the most notable were interest rate hikes, which meant lower credit availability, and higher energy prices following Russia’s February 2022 invasion of Ukraine.

Worldsteel’s Other Europe category, which includes the United Kingdom, Turkey, and other states not in the EU, saw a 12.1% decline to 242.9 kilos from 276.4 kilos.

Across the Atlantic Ocean, per capita apparent steel use in the United States saw a notably lower decline. Worldsteel’s figures have the U.S. experiencing a slightly less than 3% drop to 279.4 kilos from 288. Meanwhile, North America as a region saw a 3.91% decline to 228.2 kilos from 237.5 kilos.

MetalMiner customers have saved millions of dollars by following our industrial buying strategies. Take a look at MetalMiner’s track record.

Leave a Reply