Raw Steels MMI: U.S. Steel Market After Tariffs

Although the index started to rebound in early June, the Raw Steels Monthly Metals Index (MMI) remained bearish in May, falling 3.27% to its lowest level since November 2020. Amid new tariffs announcements from the Trump Administration, U.S. buyers have their eyes fixed on steel prices, developments which MetalMiner’s weekly newsletter recently covered.

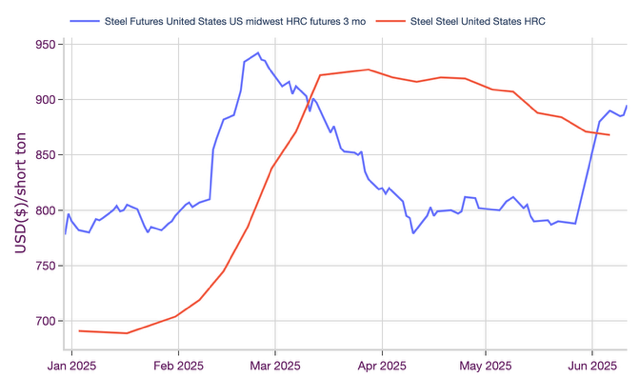

HRC Futures Jump, HRC Spot Prices Slide

While it remains to be seen whether futures can hold onto their gains, the early June tariff announcement, which doubled Section 232 steel duties from 25% to 50%, saw futures jump significantly. Rebounding from a modest decline throughout May, futures rose nearly 14% in the first half of June. This saw the market shift to a narrow contango after roughly three months in backwardation, with futures now hovering above spot prices.

While tariffs saw futures appreciate, spot prices remain somewhat stable with a downside bias. Unlike the first 25% announcement issued earlier this year, its doubling caught markets by surprise. This gave buyers no window of opportunity to refill stocks before tariffs went into effect. As a result, the tariff jump offered little momentum to spot prices as buyers had no meaningful incentive to jump back into the market.

Keep your team in sync with steel market shifts and fluctuating steel prices. You can plan better and avoid unnecessary spending by signing up for MetalMiner’s weekly newsletter.

Trade Agreements Start to Roll In

Buyers appear largely cautious as the market approaches the second half of 2025. While the expressed goal of Trump’s tariff hikes has been to support domestic producers, they are mainly being used as a bargaining chip as the U.S. works to forge new trade agreements. As countries make progress in their negotiations in the coming months, the current tariff landscape is likely to see further changes.

Notably, the UK secured at least a temporary exemption from the additional 25% steel tariff hike. This move helped place a cap on HRC futures in June. As of June 11, futures stood roughly $60/st short of where they peaked in March as investors appeared to price in the prospect of future trade deals. Meanwhile, Mexico has also reportedly neared a deal with the U.S.

Although it has yet to become official, this will likely result in a quota system for steel imports, akin to those that emerged with certain countries under the Biden administration. In this arrangement, a certain volume of Mexican steel will likely be allowed in free of duties, and anything above that quota will be subject to a tariff.

Import Volumes Dropped

Both of these deals will offer relief to the domestic market now grappling with a sharp drop in imports. By April, data from the Department of Commerce showed combined HRC, CRC and HDG import volumes dropped to below where they stood at their weakest point in 2020.

While the slowdown in imports has started to cause a slide in U.S. supply, the drop thus far appears to be somewhat modest. Additionally, the Q1 buying rush significantly lifted inventories, leaving a meaningful buffer as the market awaits future trade deals.

Desire precision steel pricing without paying for unnecessary price points? Purchase only what you need with MetalMiner Select, ensuring your procurement strategy is cost-efficient.

What’s Next For Steel Prices?

For now, steelmakers have been quick to capitalize on tariff news, with Nucor recently increasing its consumer spot price. While lower import supply may help firm spot prices in the short term, the plateau is likely to prove temporary.

Overall, tariffs will probably create higher bottom U.S. steel prices, but do not necessarily mean prices have found that bottom yet. Future trade agreements will likely see more tariff relief as it relates to steel, which leaves little incentive for buyers to build inventories at this time. Without buying activity, mills will have trouble maintaining upside momentum to prices.

As outlined above, the U.S. market remains well-supplied at the moment, both because of the Q1 buying rush and higher output levels from U.S. mills. From a seasonal perspective, the summer months typically experience a slowdown in activity. Combined with well-stocked inventories, this adds another drag to the steel price trend.

With the U.S. manufacturing sector continuing to trend in contractionary territory, it remains difficult to support a bullish outlook at this time. Instead, the many headwinds suggest the risk for U.S. steel prices remains to the downside.

Biggest Moves for Raw Material and Steel Prices

- Korean steel scrap prices witnessed the largest increase of the overall index, with a 17.63% jump to $193 per metric ton as of June 1.

- Meanwhile, HRC three-month futures moved sideways, sliding by a modest 1.75% to $788 per short ton.

- Chinese HRC prices fell by 3.07% to $408 per short ton.

- U.S. shredded scrap steel prices experienced a 10% drop to $378 per short ton.

- Chinese coking coal prices declined by 19.48% to $107 per metric ton.

MetalMiner steel price should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.