Europe’s Steel War? EU Targets Japan, Vietnam and Egypt with Dumping Tariffs

The European Commission recently implemented provisional dumping tariffs on hot rolled coil imports from several countries. The move follows an investigation initiated in Q3 on behalf of the EU steel industry. The European Union’s executive arm stated in a March 14 release that the new measures will come into force on April 7 and will cover imports from Egypt, Japan, and Vietnam.

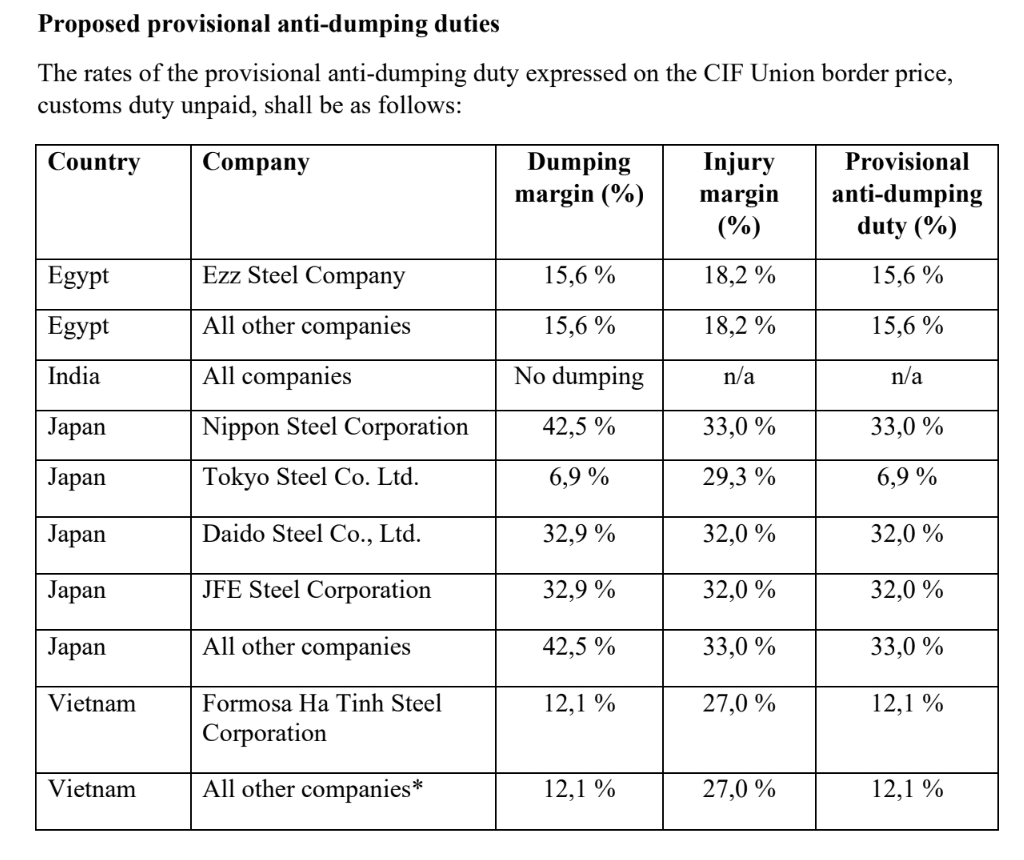

“The rates are calculated on the CIF Union border price, customs duty unpaid.” the EC statement noted.

Worried about tariffs in the steel industry? Read our free comprehensive steel & aluminum tariff guide for recommendations on how to avoid losing money.

Steel Industry: Who is Affected and by How Much?

EC data showed that Egypt’s main flats producer, Ezz Steel, along with other producers of the flat rolled product in that country, are now subject to a provisional anti-dumping duty of 15.6%. Tokyo-headquartered Nippon Steel is now subject to 33% duty, while JFE Steel and Aichi-headquartered Daido Steel are subject to 32%. However, the EC stated that while all other Japanese steelmakers must pay 33%, Tokyo Steel is subject to just 6.9%.

Meanwhile, HRC imports from Vietnam’s Formosa Ha Tinh Steel Corporation need to pay a 12.1% provisional anti-dumping duty, as do all other companies in the Southeast Asian state. That said, there is a proposal to not impose provisional duties on the Hoa Phat

Dung Quat Steel Joint Company. Also, as the EC did not find any evidence of dumping by any Indian steelmakers, it did not implement tariffs on that country’s steel industry.

Provisional duties are temporary tariffs imposed during an active trade investigation, such as against dumping or subsidies, the market shifts of which were recently covered in MetalMiner’s weekly newsletter. European authorities initiated the HRC anti-dumping investigation of four countries in August, It followed a June complaint filed by the European Steel Association, the body representing EU steelmaker interests, which alleged dumping from April 1, 2023, to March 31.

Exemptions Continue for the Ukrainian Steel Industry

Meanwhile, the EC last week proposed leaving current exemptions on steel imports from Ukraine unchanged. In a March 7 release, the organization stated that “The proposal will now go to the Council and European Parliament for approval. If adopted, it will ensure that Ukrainian steel exports into the EU continue to be exempt from EU steel safeguard measures even after the expiration of the EU’s temporary autonomous trade measures (ATMs).”

Ukraine received temporary exemption from import duties, quotas and trade defense measures for imports in June 2022, under the Autonomous Trade Measures Regulation.

“The measures were renewed for subsequent years on June 6 2023 and June 6 2024, with the current measures due to remain in force until June 5 2025,” the EC noted. “The Commission is currently working on a longer-term solution which will provide economic certainty and a stable framework for trade to both Ukraine and the EU.”

The new steel industry and aluminum industry tariffs mean manufacturers that are directly importing need to be able to break out the metal portion of their part spend. Companies can do this with ease using Insights SV. Learn more.