This morning in metals news, the U.S.-China trade conflict escalated further on Thursday, ABB’s chief executive hopes some relief might be offered by the U.S. vis-a-vis Chinese steel import tariffs and Japan’s second-quarter steel outlook reflect a year-over-year increase in production but includes uncertainty about the ultimate impact of the U.S.’s Section 232 tariffs. Trump […]

This Morning in Metals: Japan Continues Efforts to Win Tariffs Exemptions

This morning in metals news, Japan is opting for a “low-key” approach in its efforts to win Section 232 tariff exemptions, Ukraine’s steel production dropped 3% in the first quarter and Turkey sent a letter to the U.S. lobbying for tariff exemptions of its own. Need buying strategies for steel? Try two free months of […]

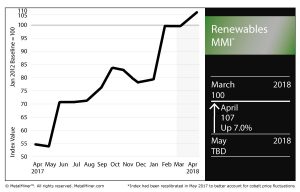

Renewables MMI: Cobalt, U.S. Steel Plate Post Big Price Jumps

The Renewables Monthly Metals Index (MMI) rose seven points on the month, hitting 107 for our April reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Korean, Chinese and U.S. steel plate posted price increases, while Japanese steel plate traced back slightly. U.S. steel plate jumped significantly, posting a 13.6% increase for the month.

U.S. grain-oriented electrical steel (GOES) coil fell on the month, while neodymium picked up by 0.7%.

The always volatile cobalt price shot up significantly last month, rising 10.6%.

Tesla Strategy Places Premium on Neodymium

As we mentioned earlier this week, growing demand for neodymium from electric vehicle (EV) maker Tesla will put even more pressure on what is already a constrained market.

In short, that means rising prices for the material, reflected in this month’s activity.

Tesla is looking to neodymium for magnetic motors in its Model 3 Long Range cars, as mentioned in the Reuters report we cited Tuesday. Last year, supply fell short of demand by 3,300 tons, according to that report.

DRC Looks to Shake Up 2002 Mining Charter

When it comes to anything cobalt, the Democratic Republic of Congo is typically at the center, being the source of the majority of the world’s cobalt.

Earlier this week, MetalMiner’s Stuart Burns wrote about President Joseph Kabila’s move to readjust the nation’s 2002 mining charter to, essentially, secure a bigger piece of the pie vis-a-vis the country’s vast mineral resources.

It comes as no surprise that the multinational miners doing business in the DRC aren’t exactly thrilled by the proposition of increased royalties and levies. However, as Burns noted, value of materials like cobalt and the demand they draw, combined with their relative scarcity, means such multinationals will continue to do business there, no matter what happens with the charter.

“If the state takes a little more of the pie, it will probably be reflected in prices,” Burns wrote. “But with limited alternatives for products like cobalt, it is unlikely to dent mining companies’ enthusiasm for investing in the DRC.”

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

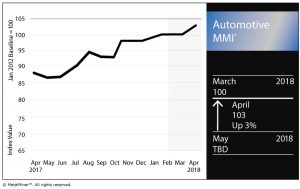

Automotive MMI: U.S. Auto Sales Rev Up for 6.3% Year-Over-Year Jump in March

The Automotive Monthly Metals Index (MMI) jumped three points for an April reading of 103 after a month that saw the U.S. impose Section 232 tariffs of 25% and 10% on steel and aluminum imports, respectively, in addition to escalating trade tensions between the U.S. and China.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. shredded scrap jumped 3.1%, while LME copper continued its 2018 cooling down, dropping 2.5% month over month.

Chinese primary lead jumped 1.3%.

U.S. Auto Sales

According to monthly sales data release by Autodata Corp, it was a strong month for several of the top automakers in the U.S. market.

General Motors posted a 15.7% increase in sales year over year, and is up 3.8% in the year to date compared with the same time frame last year.

Ford Motor Co. saw its sales jump 3.5% year over year in March, but remains down 2.7% in the year to date.

Fiat Chrysler’s March sales jumped 13.6% year over year, and boasts an 0.8% increase for the year to date. Toyota’s sales jumped 3.5% in March year over year and is up 7.4% in the year to date. Honda also had a good month, posting a year-over-year sales increase of 3.8%; however, its year-to-date sales are down 0.8%.

Volkswagen, Mitsubishi and Mazda continued what has been a strong 2018 for each of them. Volkswagen’s March sales rose 13.5% year over year, while the German automaker’s year-to-date sales are up 9.9%. Mitsubishi jumped 21.7% in March and is up 22.7% in the year to date. Mazda, meanwhile, posted a 35.7% increase in March and is up 21.6% in the year to date.

In total, vehicle sales in March were up 6.3% year over year and are up 1.9% in the year to date. American consumers continue to prize light trucks, as sales of those vehicles rose 16.3% year over year in March and are up 9.8% for the year to date.

U.S.-China Trade Tensions Rise

Earlier this week, the Office of the United States Trade Representative released a list of 1,300 Chinese products that could be hit with tariffs (stemming from the administration’s Section 301 probe of Chinese trade practices).

Not long after, China announced it would place 25% tariffs on 106 U.S. products, including autos, Reuters reported.

Tesla and Tariffs

It’s been a rough couple of weeks for Tesla.

In late March, the fatal crash of a Tesla Inc. Model X led to a massive selloff, leading to an 8.2% drop in its stock and its lowest closing in almost a year, CNBC reported.

On top of that, the electric vehicle (EV) maker continues to struggle with the cold, hard reality of production timelines. CNBC reported that Tesla missed its quarterly goal of producing 2,500 Model 3s per week.

The stock price recovered Tuesday, but Wednesday’s news of $50 billion in tariffs from China — in retaliation to the U.S.’s own recent announcement regarding a potential $50 billion in tariffs on Chinese imports — is another hit to the EV firm.

According to Bloomberg, China accounted for 17% of Tesla’s 2017 revenue.

Actual Metal Prices and Trends

This Morning in Metals: USTR Publishes Section 301 List of Chinese Products

This morning in metals news, the Office of the United States Trade Representative (USTR) releases the list of Chinese products that could be hit with tariffs (stemming from the Section 301 probe), China responds with a tariff announcement of its own and copper drops in line with escalating trade tensions. Need buying strategies for steel? Try […]

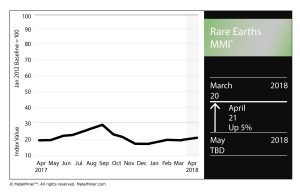

Rare Earths MMI: Metals Prices Move Up, Demand for Neodymium Grows

The Rare Earths Monthly Metals Index (MMI) picked up a point this month, rising from 20 for an April reading of 21.

The basket of metals posted price gains across the board this past month.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Yttrium rose 1.2%, while terbium oxide rose 1.6%. Neodymium oxide rose 0.2%, europium oxide was up 1.3% and dysprosium oxide was up 0.8%.

Growing Demand for Neodymium

A move by Tesla to a magnetic motor for its Model 3 Long Range car, Reuters reported last month, will add pressure on an already constrained neodymium market.

According to the research group imarc, the market for the neodymium-iron-boron magnet used for the magnetic motors is now worth more than $11.3 billion, Reuters reported.

Global demand for neodymium exceeded supply by 3,300 tons, according to the report.

With the demand for electric vehicles growing more and more, so too will the demand for rare-earth metals like neodymium. Complicating the supply landscape, however, is China’s total dominance in the rare earths market. Given rising trade tensions, stemming from the Trump administration’s recent Section 232 steel and aluminum tariffs, plus the recent Section 301 announcement — the Office of the United States Trade Representative yesterday posted a proposed list of Chinese products that could be subject to tariffs — the neodymium supply market is something to be monitored.

As Reuters notes, China previously instituted a neodymium export ban, which was lifted in 2015 — could it happen again? That remans to be seen, but increasingly inflamed global trade relations certainly don’t do anything to tamp down the possibility.

Speaking of Trade Tensions…

Bloomberg speculated last month on ways China could retaliate against the U.S. should the latter eventually impose tariffs on Chinese goods amounting to potentially $50-$60 billion.

The article notes that in 2010, China stopped giving Japan export licenses for rare earth metals used in cars and electronics, as a result of tensions related to islands in the East China Sea.

Again, it remains to be seen what the rising tensions mean for the rare-earths market, but it is certainly worth monitoring going forward.

Searching from Above

In the search for new deposits of rare earths (and metals, in general), scientists are looking from a bird’s eye view — or, rather, a drone’s eye view.

According to a report in The Guardian, German scientists are using drones to scout out potential new sources of metals. The scientists are using drones, equipped with special cameras and sensors, to identify potential deposits based on the unique reflections of light various minerals produce, according to the report.

As noted above, the demand for rare earth materials is only going to increase, not just for application in electric vehicles, but also in other high-tech products.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

This Morning in Metals: Copper Hits Over One-Week High

This morning in metals news, copper hits an over one-week high, President Trump is pushing for a preliminary deal on the North American Free Trade Agreement (NAFTA) by mid-April and gold could reach $1,400 if a trade war ensues. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Copper Surges Strong manufacturing […]

This Morning in Metals: China Responds With $3B in Tariffs on U.S. Goods

This morning in metals news, China responds to the U.S.’s Section 232 tariffs with $3 billion in tariffs on U.S. goods, several firms put in new bids for the distressed Essar Steel, and President Donald Trump and Japanese Prime Minister Shinzo Abe will meet this month to discuss trade. Need buying strategies for steel? Try […]

LME, SHFE Copper Prices Trend Down in March

Last year, the metal affectionately dubbed “Dr. Copper” — essentially, for its role as a general indicator of economic health — saw its price soar. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook This year? Not so much. The metal climbed above $7,200/metric ton on the LME in December, but has […]

This Morning in Metals: Output, Profit Up for Chile’s Codelco in 2017

This morning in metals news, 2017 was a good year for Chilean miner Codelco, the city of Handan in China has called for a 25% reduction in steel mill production and the impact on Mexico of a terminated North American Free Trade Agreement (NAFTA). State Miner Says Profit, Output Rose Last Year Codelco announced that its […]