Overall, the Copper Monthly Metals Index (MMI) rose 3.48% from May to June. A short squeeze helped the price of copper peak at a new all-time high in late May, followed by a sharp downside correction. This resulted in an overall 3.7% rise from the close of April. CME copper prices then continued to retrace […]

Category: Exchange Traded Funds

Stock Market Soars as S&P 500 and NASDAQ Hit Record Highs

With the most recent economic data coming in hot for this month, overall financial markets presented optimistic signals. Amid futures tied to major stock indexes rallying to new highs, markets could see a significant impact on metal prices, including gold and copper prices. The S&P500 closed just over $528, and the NASDAQ composite index closed […]

LME and CME Russian Metal Ban Prompting Speculation About Market Fragmentation

By now, anyone in the metals market will know that the U.S. and UK recently banned the consumption of Russian aluminum, copper, and nickel produced from April 13 onward. While metal already on the London Metal Exchange (LME) and the Chicago Mercantile Exchange (CME) are still available for consumption, no metal delivered after this date […]

Copper MMI: Sanctions Hit Copper Market, Volatility Ahead

Copper prices continued their breakout during March, rising 4.25%. Prices then formed a second higher high on March 15, followed by a new higher low on March 27. The rally continued throughout April as prices climbed an additional 7.59%. As of April 15, they stand at their highest level since June 2022. Subscribe to MetalMiner’s […]

Aluminum MMI: Prices Inch Toward 2023 High Amid China Supply Cut

Overall, the Aluminum Monthly Metals Index (MMI) remained sideways, with a 2.03% rise from March to April. Aluminum prices outperformed all base metals throughout March, with a 4.71% rise from the close of February. Prices continued their rally throughout April, hitting their highest level since February 2023 by April 8. Aluminum Prices Chase 2023 Highs […]

Subdued Market Reaction So Far to China’s Targeted 2024 Growth Rate

Investors, traders, and the metals community continue to anticipate fresh stimulus measures from China’s top leaders, which could potentially kickstart economic growth, increase metals consumption, and affect metal prices. However, they remain rather disappointed with Beijing’s target 5% growth for 2024. Moreover, demand has remained subdued since the Lunar New Year holiday. Almost everyone was […]

Copper MMI: Deep Market Contango, Index Moves Sideways

Copper prices saw a 1.90% increase during the final month of the year. By late December, this managed to bring them to their highest level since August, leading to mixed copper price forecasts for 2024. However, prices began to retrace from their 5-month peak by the start of 2024. By mid-January, they remained trapped within […]

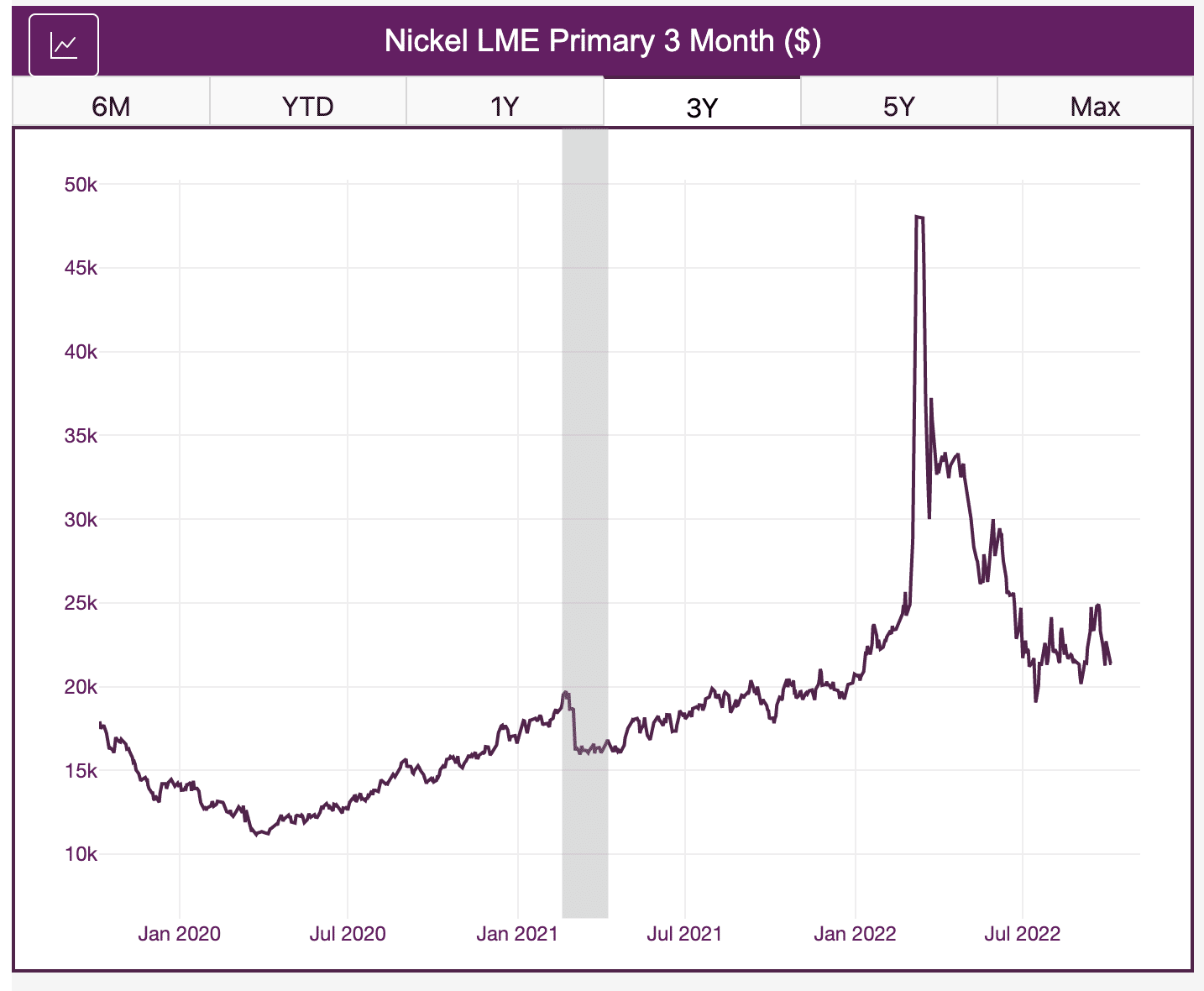

CMC Poland Opens New Rolling Mill, London Metal Exchange Explores New Nickel Contract Options

According to an official with the bourse, the London Metal Exchange (LME) is not ruling out the prospect of introducing contracts connected with Category II nickel. This comes despite the incident with the LME nickel contract back in March 2022. “We are focusing on the contract as we have it,” said Robin Martin, the bourse’s […]

Nickel Prices: LME Nickel Contract Continues to Lack Liquidity, Harming Price Discovery

Nickel prices are seeing a lot of attention due to an overall lack of liquidity on the LME contract. But what exactly does this mean? Moreover, what does it mean for buyers looking to mitigate price problems in the face of global supply problems? The metals market moves fast. Sign up for the weekly MetalMiner […]

Platinum has seen surprisingly strong demand this year

You could be excused for thinking gold has been eclipsed this year — bought in record amounts by central banks in the first half of this year — as the price rose strongly through the late summer but has since drifted off. A recent report suggests, at least for some investors, gold has been sidelined […]