This morning in metals news, the deadline for Section 232 tariffs exemptions for certain countries falls tonight at midnight, AK Steel’s stock is up and the LME copper price tracked up Monday. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Tariff Exemption Expiration Approaches Several countries negotiated temporary exemptions from the […]

Category: Ferrous Metals

This Morning in Metals: Steels Mills Shut Down in China’s Xuzhou

This morning in metals, steel mills in China’s second-biggest steelmaking province are shutting down, U.S. Steel reports its Q1 financials and Ecuadorian officials are engaging in talks to potentially bring a copper refinery to the country. Chinese Mills Shut Down in Pollution-Curbing Measure Several steel mills in the Chinese city of Xuzhou have been shut […]

This Morning in Metals: U.S. Steel Imports Jump 34% in March

This morning in metals, steel imports rose in March, global steel output was also up in March and miner Antofagasta reported a 10.5% drop in production in Q1. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook U.S. Steel Imports Jump in March Citing U.S. Census Bureau data, the American Iron and […]

EUROFER Says E.U. Steel Safeguard Measures Must Prevent Surge of Imports

The E.U.’s steel safeguard mechanism should work to prevent a “surge of imports” but should not “close the market,” European Steel Association (EUROFER) Director General Axel Eggert said Monday. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook “The safeguard mechanism should be broad, but the purpose is not to close the […]

Steel Price Trends: An Upcoming Top?

U.S. domestic steel prices steadily increased after the release of the Section 232 report and President Donald Trump’s formal proclamation. However, the pace of the increases has started to slow down, signaling a possible top. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook After what now looks like sluggish steel momentum […]

This Morning in Metals: Saudi Arabia Seeks $100/Barrel Oil Price, Chinese Iron Ore Rebounds from 10-Month Low

This morning in metal news, Chinese iron ore futures rebound from a 10-month low, Saudi Arabia emerges as OPEC’s leading supporter for further reducing oil supply, and researchers discover a major supply of rare earth minerals in the seabed near a remote Japanese island. Need buying strategies for steel? Try two free months of MetalMiner’s […]

Stainless Steel MMI: LME Nickel Prices Fall But Stainless Steel Surcharges Rise

The Stainless Steel MMI (Monthly Metals Index) inched one point higher in April. The current reading is 76 points.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The index’s increase was driven by the rise in stainless steel surcharges, despite slightly falling LME nickel prices this month. Other related metals in the stainless steel basket increased.

LME Nickel

In April, nickel price momentum appears to have recovered from its previous pace.

LME nickel prices dropped in March, along with other base metals. However, the drop appears less sharp than for aluminum or copper.

[caption id="attachment_91260" align="aligncenter" width="580"]

LME nickel prices remain high and far away from 2017 lows back in May or June, when MetalMiner recommended buying organizations buy some volume forward. Prices back at that time were around $8,800/mt versus the current $13,200/mt price level.

Domestic Stainless Steel Market

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased this month.

The 316/316L-coil NAS surcharge reached $0.96/pound. Therefore, buying organizations may want to look at surcharges to identify opportunities to reduce price risk either via forward buys or hedging.

[caption id="attachment_91261" align="aligncenter" width="580"]

The pace of stainless steel surcharge increases appears to have slowed this month. However, surcharges have increased from 2017. The 316/316L-coil NAS surcharge is closer to $0.96/pound.

What This Means for Industrial Buyers

Stainless steel momentum appears stronger this month, with steel prices skyrocketing.

As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial of our Monthly Outlook now.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends

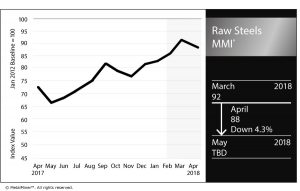

Raw Steels MMI: Domestic Steel Price Momentum Picks Up

The Raw Steels MMI (Monthly Metals Index) fell four points this month, dropping to 88. Despite the drop in the Raw Steels MMI, domestic steel price momentum has been on a tear throughout March. All prices for the main forms of flat-rolled steel products have reached more than seven-year highs.

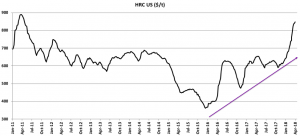

Domestic steel prices accelerated their pace of increases in such a way that HRC domestic prices have risen from the $600-$650/st level to around $850 in the last three months.

[caption id="attachment_91239" align="aligncenter" width="580"]

The steel price increase comes as a result of several factors. First, the long-term trend that started in 2016 created upward movement for steel prices. Second, the delayed steel sector cyclicality (seasonality) has pushed the steel price slope even steeper.

Historically, prices usually increase during Q4 as many companies renegotiate their annual agreements as part of the budgeting season for the following year. However, this year, steel price increases didn’t occur until later. Prices appeared to wait for the Section 232 outcome (with its corresponding tariffs), which acted as a support for domestic steel prices.

However, domestic steel prices seem closer to the end of this latest price rally. Based on historical steel price cyclicality, lower Chinese steel prices and decreasing raw material prices, domestic steel prices may fall in the coming months.

The Divergence in Steel Prices

Chinese steel prices and U.S. steel prices usually trade together. However, the short-term trend sometimes shows some divergences.

Short-term trends may be created by local uncertainty or sudden disruptions with local supply. But these short-term trends tend to correct, and return to their historical pattern.

[caption id="attachment_91240" align="aligncenter" width="580"]

When looking at Chinese and U.S. HRC prices in tandem, the price divergence observed this month leaves no one surprised.

U.S. HRC prices skyrocketed, while Chinese HRC prices continue to fall. It is true that Chinese HRC prices increased sooner in 2017 (starting June 2017), supported by the steel industry cuts in China. The spread between Chinese and domestic steel prices dropped in Q3 2017, as U.S. domestic steel prices traded sideways. The recent drop in Chinese steel prices may create downward price pressure for domestic steel prices.

Global Steel Market

Chinese steel production cuts continue. The city of Handan ordered steel mills to cut around 25% of their steel production to continue the pollution curb measures. These cuts will be extended from April to mid-November. The coking coal industry will also cut production by around 25% over that period. The cuts started on April 1.

According to the Mexican government’s official gazette, the Mexico economy ministry has formally imposed anti-dumping duties on carbon steel pipe imports from South Korea, Spain, India and Ukraine.

Raw Materials

After the prior raw material price increases at the end of 2017, raw material dynamics seem to have slowed down.

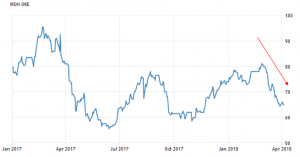

Iron ore prices fell sharply in March. Iron ore prices increased slightly at the beginning of this month. However, the sharp decrease in prices last month may not support the current highs in domestic steel prices.

[caption id="attachment_91243" align="aligncenter" width="580"]

Coal prices also fell in March. Coal prices seem to be increasing slightly again this month, even if current prices remain far away from the $110/mt highs in January 2018.

[caption id="attachment_91244" align="aligncenter" width="580"]

What This Means for Industrial Buyers

As steel price dynamics showed a strong upward momentum this month, buying organizations may want to understand price movements to decide when to commit to mid- and long-term purchases. Buying organizations looking for more clarity on when to buy and how much to buy of their steel products may want to take a free trial now to our Monthly Metal Buying Outlook.

Actual Raw Steel Prices and Trends

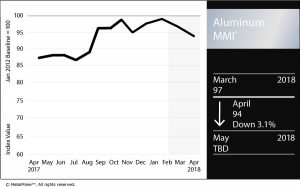

Aluminum MMI: LME Aluminum Continues Downtrend

The April Aluminum MMI (Monthly Metals Index) fell three points. A weaker LME aluminum price led to the price retracement. The current Aluminum MMI index stands at 94 points, 3% lower than in March.

LME aluminum price momentum slowed again this month. LME aluminum prices remain in a current two-month downtrend.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_91252" align="aligncenter" width="580"]

Though some may want to declare a bearish market for aluminum, prices are still over the $1,975 level, when MetalMiner recommended buying organizations buy forward. Prices may retrace back toward that level. However, if prices fall below the blue-dotted line, aluminum prices could shift toward bearish territory.

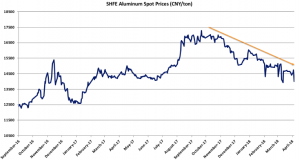

SHFE Aluminum

SHFE aluminum spot prices also fell this month. The degree of the decline appears less sharp than for LME prices. However, SHFE aluminum spot prices started to fall in October 2017.

[caption id="attachment_91253" align="aligncenter" width="580"]

Shanghai Futures Exchange (SHFE) aluminum stocks fell in March for the first time in more than nine months. Decreasing stocks sometimes point to falling inventories of aluminum in China, the world’s biggest aluminum producer and consumer. SHFE stocks dropped by 154 tons in March, according to exchange data released at the beginning of April. However, SHFE aluminum stocks still stand at 970,233 tons.

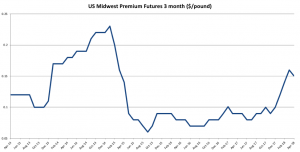

MW Aluminum Premiums

Meanwhile, U.S. Midwest aluminum premiums fell for the first time since November 2017. The $0.01/pound drop at the beginning of April comes after a sharp uptrend in the premium. Despite the lower premium this month, the pace of the increases may continue for some time.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

However, as prices are currently trading lower, buying organizations may want to wait until the market shows a clearer direction. Therefore, adapting the “right” buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to take a free trial now to our Monthly Metal Buying Outlook.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

World Steel Association: February Global Crude Steel Production Up 3.5% Year Over Year

According to a World Steel Association report this week, global crude steel production in February was up 3.5% compared with February 2017. The 64 countries reporting to the World Steel Association produced 131.8 million tons in February, according to the report. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook China’s crude […]