Last month MetalMiner made the following statement: “The impact on Grain Oriented Electrical steel buying organizations, MetalMiner believes, will not exactly mirror the broader impact of the tariffs on commonly purchased steel forms, alloys and grades.”

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

We don’t always get it right but indeed, GOES M3 prices fell last month in comparison to across-the-board price increases for all or nearly all other carbon flat rolled product categories.

Meanwhile, although MetalMiner knows of one buying organization pursuing an exclusion request via the recently published exclusion process, no company has yet to file one (at least as of April 11). That will change as GOES imports continue to arrive.

This month import levels jumped, as did Japanese imports, in particular.

[caption id="attachment_91308" align="aligncenter" width="580"]

Of note, Chinese imports remain negligible (240 tons) and no imports came from South Korea.

What About the Section 301 Investigation?

A quick search revealed that the 301 investigation also includes grain-oriented electrical steel with HTS Codes: 72261110, 72261190, 72261910 and 72261990 — basically “alloy silicon electrical steel (grain-oriented) of various widths.”

However, the 301 investigation does not include either transformer parts (8504.90.9546) or wound cores (8504.90.9542), both of which could come into the U.S. under current prevailing market treatment.

MetalMiner will update readers when/if President Trump publishes a proclamation on the 301 investigation.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Exact GOES Coil Price This Month

Category: Metal Prices

This Morning in Metals: Thyssenkrupp, Tata Delay Signing Joint Venture Pending Labor Talks

This morning in metals news, big firms Thyssenkrupp and Tata Steel are delaying the signing of a previously agreed to joint venture for their European operations, Chinese steel is retracing and LME zinc has hit a four-month low. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Thyssenkrupp, Tata Delay Inking Deal […]

This Morning in Metals: Rusal Metal Pulled from LME, CME

This morning in metals news, Russian aluminum giant Rusal saw its shares pulled from global indexes and its metal disallowed from the London Metal Exchange and CME Group, one analyst says Russian aluminum will find its way to market in some way and the Chinese iron ore price dropped Wednesday. Need buying strategies for steel? […]

Stainless Steel MMI: LME Nickel Prices Fall But Stainless Steel Surcharges Rise

The Stainless Steel MMI (Monthly Metals Index) inched one point higher in April. The current reading is 76 points.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

The index’s increase was driven by the rise in stainless steel surcharges, despite slightly falling LME nickel prices this month. Other related metals in the stainless steel basket increased.

LME Nickel

In April, nickel price momentum appears to have recovered from its previous pace.

LME nickel prices dropped in March, along with other base metals. However, the drop appears less sharp than for aluminum or copper.

[caption id="attachment_91260" align="aligncenter" width="580"]

LME nickel prices remain high and far away from 2017 lows back in May or June, when MetalMiner recommended buying organizations buy some volume forward. Prices back at that time were around $8,800/mt versus the current $13,200/mt price level.

Domestic Stainless Steel Market

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased this month.

The 316/316L-coil NAS surcharge reached $0.96/pound. Therefore, buying organizations may want to look at surcharges to identify opportunities to reduce price risk either via forward buys or hedging.

[caption id="attachment_91261" align="aligncenter" width="580"]

The pace of stainless steel surcharge increases appears to have slowed this month. However, surcharges have increased from 2017. The 316/316L-coil NAS surcharge is closer to $0.96/pound.

What This Means for Industrial Buyers

Stainless steel momentum appears stronger this month, with steel prices skyrocketing.

As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips.

To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial of our Monthly Outlook now.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends

This Morning in Metals: China Files Complaint at WTO Over U.S. Tariffs

This morning in metals news, China filed a complaint at the World Trade Organization (WTO) over the U.S. steel and aluminum tariffs, the president of the China Baowu Steel Group says the tariffs would have a limited impact on Chinese exports and LME aluminum prices jumped more than 7% after the U.S. sanctions on Russian […]

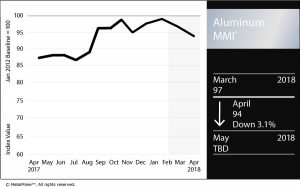

Aluminum MMI: LME Aluminum Continues Downtrend

The April Aluminum MMI (Monthly Metals Index) fell three points. A weaker LME aluminum price led to the price retracement. The current Aluminum MMI index stands at 94 points, 3% lower than in March.

LME aluminum price momentum slowed again this month. LME aluminum prices remain in a current two-month downtrend.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_91252" align="aligncenter" width="580"]

Though some may want to declare a bearish market for aluminum, prices are still over the $1,975 level, when MetalMiner recommended buying organizations buy forward. Prices may retrace back toward that level. However, if prices fall below the blue-dotted line, aluminum prices could shift toward bearish territory.

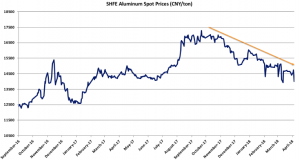

SHFE Aluminum

SHFE aluminum spot prices also fell this month. The degree of the decline appears less sharp than for LME prices. However, SHFE aluminum spot prices started to fall in October 2017.

[caption id="attachment_91253" align="aligncenter" width="580"]

Shanghai Futures Exchange (SHFE) aluminum stocks fell in March for the first time in more than nine months. Decreasing stocks sometimes point to falling inventories of aluminum in China, the world’s biggest aluminum producer and consumer. SHFE stocks dropped by 154 tons in March, according to exchange data released at the beginning of April. However, SHFE aluminum stocks still stand at 970,233 tons.

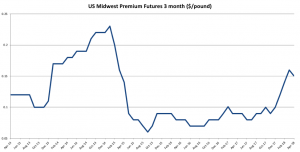

MW Aluminum Premiums

Meanwhile, U.S. Midwest aluminum premiums fell for the first time since November 2017. The $0.01/pound drop at the beginning of April comes after a sharp uptrend in the premium. Despite the lower premium this month, the pace of the increases may continue for some time.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

However, as prices are currently trading lower, buying organizations may want to wait until the market shows a clearer direction. Therefore, adapting the “right” buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to take a free trial now to our Monthly Metal Buying Outlook.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

Copper MMI: LME Copper Prices Fall

The Copper MMI (Monthly Metals Index) traded lower again this month, falling two points to 85. The Copper MMI dropped to December 2017 levels, driven by falling LME copper prices.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

When looking at the long-term trend, copper prices have held above the dotted blue line since September 2016. Although prices dipped a bit below the blue dotted line at the end of March, the line represents the current copper floor. Prices falling below the dotted line could suggest a short-term price correction.

[caption id="attachment_91215" align="aligncenter" width="580"]

Meanwhile, trading volume appears to be about the same as last month, when selling volume appeared weak. As the selling volume remains weak, the downtrend seems more like a short-term price correction than a change of trend.

Buying organizations may want to closely follow copper prices in the coming month or read our Monthly Metal Outlook in order to anticipate copper price movements.

Copper Stocks and Supply

LME copper stocks currently stand at 324,900 tons, up by 13,075 tons since the start of 2017 and 85,500 tons since the start of 2016.

According to the International Copper Study Group (ICSG), the provisional 2017 refined copper deficit was 163,000 tons. The situation for 2018 will also depend on the supply side, as many of the largest copper mines have upcoming labor contract negotiations still pending.

On top of that, the Caserones copper mine in Chile announced a shutdown this month in order to replace a leaking pipe. However, this shutdown is only partial and may not have a big effect on copper production.

Copper Scrap

Both Chinese copper scrap prices and LME copper prices typically trade together. In March, Chinese copper scrap prices fell to $6,035/mt. LME prices also fell but remain in a long-term uptrend. The same is true for copper scrap.

[caption id="attachment_91216" align="aligncenter" width="580"]

The spread between Chinese scrap copper prices and LME copper seems to be wider than it was back in 2016 and 2017. A wider spread may boost scrap copper demand for the applications that it are suitable due to its lower price.

What This Means for Industrial Buyers

Copper prices are currently approaching December support (at $6,530/mt) levels, when prices last dipped during the bullish rally.

Buying organizations bought some volume then. As long as copper prices remain bullish, buying organizations may want to buy on the dips. For those who want to understand how to reduce risks, take a free trial now to the MetalMiner Monthly Outlook.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Copper Prices and Trends

Week in Review: DRC Mining Charter, Hong Kong Housing and MMI Week

Before we head into the weekend, let’s take a look back at the week that was and some of the stories here on MetalMiner: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Joseph Kabila, president of the Democratic Republic of Congo, is looking to rip up a 2002 mining charter in […]

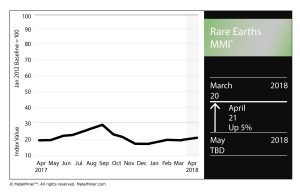

Rare Earths MMI: Metals Prices Move Up, Demand for Neodymium Grows

The Rare Earths Monthly Metals Index (MMI) picked up a point this month, rising from 20 for an April reading of 21.

The basket of metals posted price gains across the board this past month.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Yttrium rose 1.2%, while terbium oxide rose 1.6%. Neodymium oxide rose 0.2%, europium oxide was up 1.3% and dysprosium oxide was up 0.8%.

Growing Demand for Neodymium

A move by Tesla to a magnetic motor for its Model 3 Long Range car, Reuters reported last month, will add pressure on an already constrained neodymium market.

According to the research group imarc, the market for the neodymium-iron-boron magnet used for the magnetic motors is now worth more than $11.3 billion, Reuters reported.

Global demand for neodymium exceeded supply by 3,300 tons, according to the report.

With the demand for electric vehicles growing more and more, so too will the demand for rare-earth metals like neodymium. Complicating the supply landscape, however, is China’s total dominance in the rare earths market. Given rising trade tensions, stemming from the Trump administration’s recent Section 232 steel and aluminum tariffs, plus the recent Section 301 announcement — the Office of the United States Trade Representative yesterday posted a proposed list of Chinese products that could be subject to tariffs — the neodymium supply market is something to be monitored.

As Reuters notes, China previously instituted a neodymium export ban, which was lifted in 2015 — could it happen again? That remans to be seen, but increasingly inflamed global trade relations certainly don’t do anything to tamp down the possibility.

Speaking of Trade Tensions…

Bloomberg speculated last month on ways China could retaliate against the U.S. should the latter eventually impose tariffs on Chinese goods amounting to potentially $50-$60 billion.

The article notes that in 2010, China stopped giving Japan export licenses for rare earth metals used in cars and electronics, as a result of tensions related to islands in the East China Sea.

Again, it remains to be seen what the rising tensions mean for the rare-earths market, but it is certainly worth monitoring going forward.

Searching from Above

In the search for new deposits of rare earths (and metals, in general), scientists are looking from a bird’s eye view — or, rather, a drone’s eye view.

According to a report in The Guardian, German scientists are using drones to scout out potential new sources of metals. The scientists are using drones, equipped with special cameras and sensors, to identify potential deposits based on the unique reflections of light various minerals produce, according to the report.

As noted above, the demand for rare earth materials is only going to increase, not just for application in electric vehicles, but also in other high-tech products.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

LME, SHFE Copper Prices Trend Down in March

Last year, the metal affectionately dubbed “Dr. Copper” — essentially, for its role as a general indicator of economic health — saw its price soar. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook This year? Not so much. The metal climbed above $7,200/metric ton on the LME in December, but has […]