China’s steady easing of COVID-19 restrictions finally allowed the beleaguered economy to begin reopening. Many experts expect a renewed demand for steel, which means an increased appetite for steel-making raw materials such as iron ore. Both analysts and traders believe the lifting the restrictions was a step in the right direction. This current positivity is […]

Tag: Iron Ore

Iron Ore Demand Remains Strong, But Will It Last?

Concern over China’s economy notwithstanding, iron ore remained relatively stable in September and October. This is of note because historically, these months are one of China’s highest peak demand periods. That said, whether the iron ore price will continue to weather the economic storm remains a point of intense debate. The Many Factors Affecting the […]

Chinese Steel Manufacturing Profitability Down 20%

Is it all doom and gloom for Chinese steel manufacturing? It’s hard to tell at the moment. Indeed, China finds itself in a precarious place financially. What’s more, a sizable section of global financial and stock analysts have predicted the crises will only get worse as the country prepares to face its toughest winter yet. […]

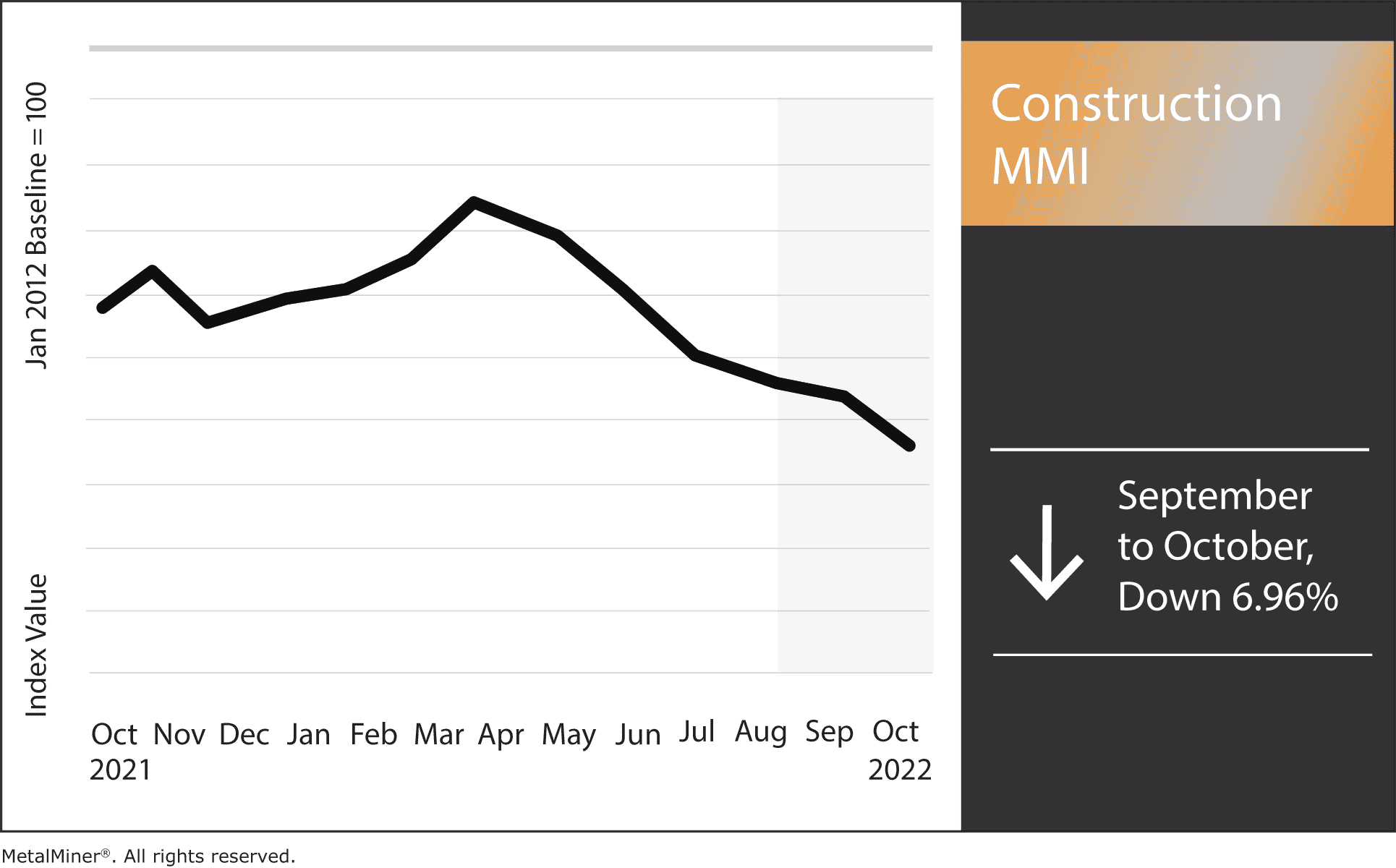

Construction MMI: High Interest Rates Haunt US Construction

The October Construction MMI (MetalMiner Monthly Index) dropped 6.96%. Not only did the construction cost index fall recently, but high interest rates have seriously impacted the US housing construction sector. Billings are on the rise in both the US commercial construction sector and on the consumer end. Meanwhile, new housing construction continues to cool due […]

China Creates New Centralized Company to Tackle Global Iron Ore Market

It’s no secret that China believes in the concentration of power. However, that philosophy extends far beyond governance. It also dramatically affects the way the country does business. For instance, earlier this week, we saw the inauguration of the state-owned and centrally administered China Mineral Resources Group. Many mining companies perceive the move as China […]

Oil Prices: Have OPEC and the IEA Gotten it Right?

Both OPEC and the International Energy Agency are predicting next year’s market to be one of the tightest in recent history. According to a Financial Times post, the two bodies have based this assumption on recovering demand in China and continued growth in India. The prediction also runs counter to widespread fears of recession. With […]

China Steel Mills Hurting, Iron Ore Prices Reeling

2022 has been a roller coaster ride for iron ore prices, which dipped yet again on Monday. Of course, demand from Chinese steel remains the top reason for either a rise or downturn in prices. This week, as it turns out, was no different. In fact, prices tumbled immediately after analysts explained their “bleak outlook” […]

Iron Ore Prices Show Gains in China, but Is This a Temporary Rebound?

It’s still touch-and-go for the steel sector in China despite the sprouting of the first shoots of a possible manufacturing recovery. However, last Monday, benchmark iron ore prices in the country gained a surprising 7%. This is the biggest daily rise in two-and-a-half months. Is it a sign that we should be more optimistic, or […]

Steel prices slipping in Europe

Steel prices for hot rolled coil in Europe have started to decline as end users push back from earlier offers. Meanwhile, benchmark iron ore prices in China dropped, due to the country’s zero-Covid policy. One analyst noted that steelmakers in Europe are cutting back their production. “Steel would get a bit of support from production […]

Forecasters call for rising Chinese iron ore prices

Ed note: MetalMiner analysts will present an aluminum and carbon steel price market outlook on Wednesday, March 2 at 11:00-11:30 am The price decline of iron ore appears short-lived as the Chinese government cracks down on speculative trading. This has led many market analysts to forecast a rise in ore prices in the coming months. […]