Construction MMI: High Interest Rates Haunt US Construction

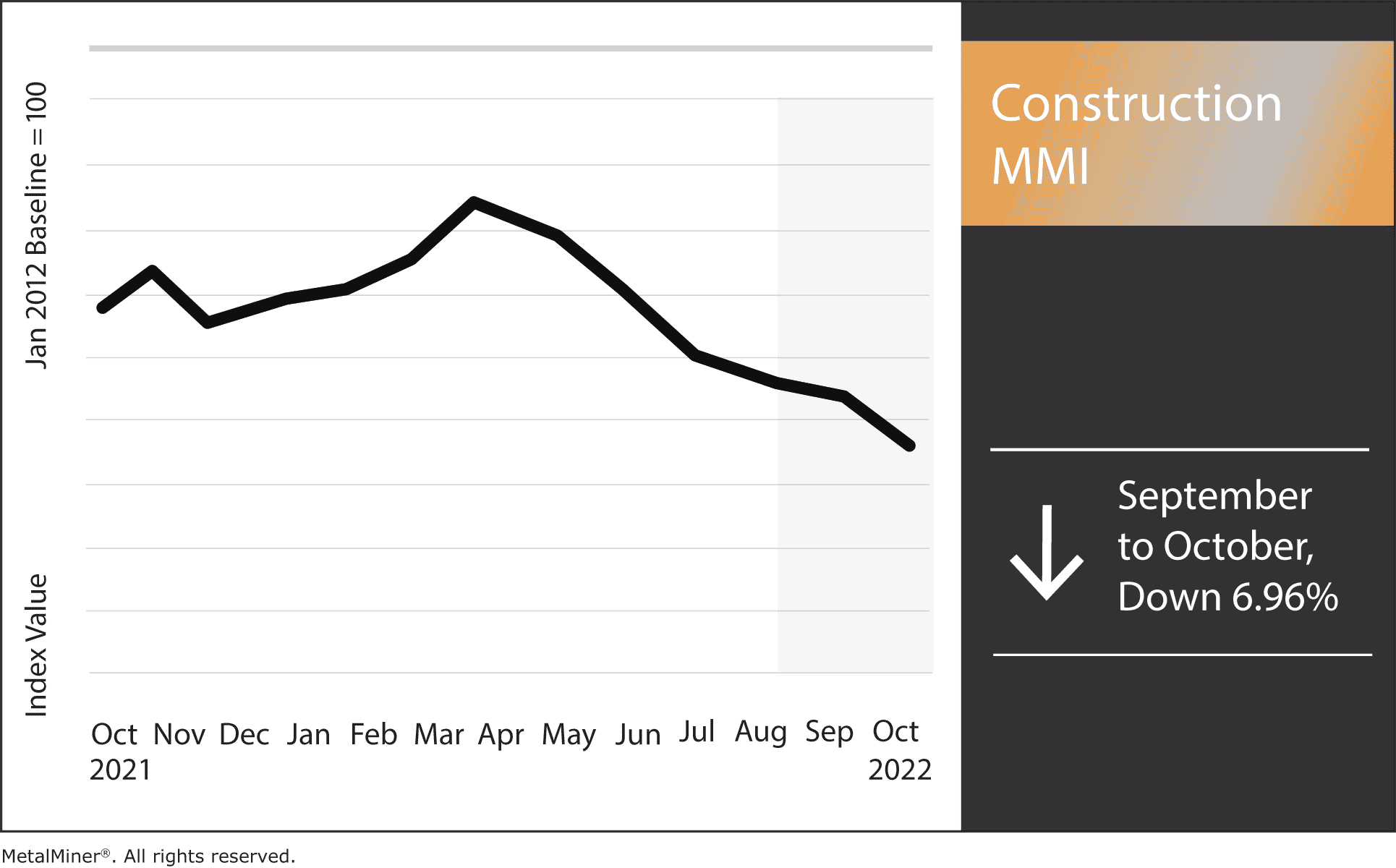

The October Construction MMI (MetalMiner Monthly Index) dropped 6.96%. Not only did the construction cost index fall recently, but high interest rates have seriously impacted the US housing construction sector. Billings are on the rise in both the US commercial construction sector and on the consumer end. Meanwhile, new housing construction continues to cool due to high interest rates.

The MetalMiner Annual Outlook consolidates our 12-month view. This provides buying organizations with a complete understanding of the fundamental factors driving prices and a detailed forecast for sourcing metals in 2023. It includes expected average prices, support and resistance levels, and more.

Issues Plaguing US Housing Construction Cost Index

In the non-commercial sector, housing construction dropped in recent months. This was partially due to the Fed continuing to raise interest rates. Another issue facing the US construction market is companies selling construction materials like steel still having an overabundance of materials. This extra supply results from overstocking during the price spike of early 2022, and with cooling demand, steel sellers find themselves sitting on inventory which isn’t selling quickly enough.

According to AIA, construction billings rose slightly year-over-year (August 2021 – August 2022). This included a substantial increase in billings within the institutional and residential sectors, thus impacting the construction cost index.

However, these trends could prove short-term at best. Indeed, the pandemic placed a particularly jaded opinion in consumers’ minds about commuting and working remotely. Could this cause the housing construction cost index to boom in the long run?

Never second guess your metal buying decisions again. Request a free demo for MetalMiner’s versatile metal price and forecast platform MetalMiner Insights.

US Commercial Construction Sees a Boost in Funds

The Biden-Harris Administration Bipartisan Infrastructure Law recently provided a $15.4 billion boost to America’s infrastructure system. The increase in funding aims to fund several areas of America’s infrastructure, including roads, bridges, dams, and water delivery systems. With any luck, this will aid the construction cost index.

However, some question whether the $60 billion initiative will prove enough to repair aging bridges and roadways. With 45,000 bridges nationwide in a deteriorating state, civil engineers argue that nearly $125 billion is needed to mount sufficient repairs. Only $40 billion is currently set aside for bridge building and maintenance.

Still, aside from funding, the construction job market in the US remains strong. In August, experts noted that US construction jobs were still increasing, aided by August’s slight bounce-back. However, a shortage of workers still exists. According to Forbes, the US construction industry was still short 430,000 in August, and these numbers are expected to increase over the next two years.

With shrinking demand due to high interest rates and a shortage of available workers, steel distributors in-particular are still sitting on an over-abundance of material purchased during early 2022’s price rally. The Bipartisan Infrastructure Law could increase demand, but overcoming the Fed’s rising interest rates will prove a challenge for commercial construction and the construction cost index.

MetalMiner’s Monthly Buying Outlook Report gives you pricing and specific buying strategies for and steel and nine other metal industries. Request your trial now.

Construction MMI: Biggest Price Shifts

- Shredded scrap steel traded sideways, falling 1.7% in prices. October 1 prices sat at $406 per short ton

- Weekly Midwest bar fuel surcharges fell 8.86%. Prices on October 1 sat at $0.72 per mile

- H-beam steel dropped in price by 5.8%. October 1 prices per metric ton sat at $553.27

- Lastly, iron ore PB fines remained stationary in price, sitting at $81 per dry metric ton

Leave a Reply