Month-over-month, the Construction MMI (Monthly Metals Index) moved sideways for the fourth month in a row, only sliding down a slight 2.87%. Of all industrial metals, iron ore suffered the worst drop in price by far, hitting a 10-month low before a slight rebound. The main component holding the index up was aluminum 1050 sheet […]

Rare Earths MMI: Have Rare Earth Prices Finally Found a Bottom?

Month over month, rare earth metals witnessed new price lows not seen since September 2020. While neodymium oxide and praseodymium oxide witnessed the sharpest drop out of all of the components of the Rare Earths MMI (Monthly Metals Index), the index fell by 5.08% overall. But with price points nearing pre-pandemic lows, the index may […]

Automotive MMI: How Will the Port Shutdown in Baltimore Impact Automotive Imports?

Month-over-month, the Automotive MMI (Monthly Metals Index) exhibited little movement. The index trended sideways, only moving up a slight 0.28%. However, recent events continue to raise questions about the future of the industry, especially where automotive imports are concerned. Despite the index itself not witnessing much movement, individual components of the index saw much more […]

Renewables MMI: Is U.S. Renewable Energy Facing Backlash?

After several months of slight upward momentum, the Renewables MMI (Monthly Metals Index) broke the sideways-to-upward trend, declining by 8.89%. Neodymium dropping in price proved to be the main culprit for the index dropping. Every other component of the index either moved sideways or slightly down. Meanwhile, renewable energy news sources continue to keep their […]

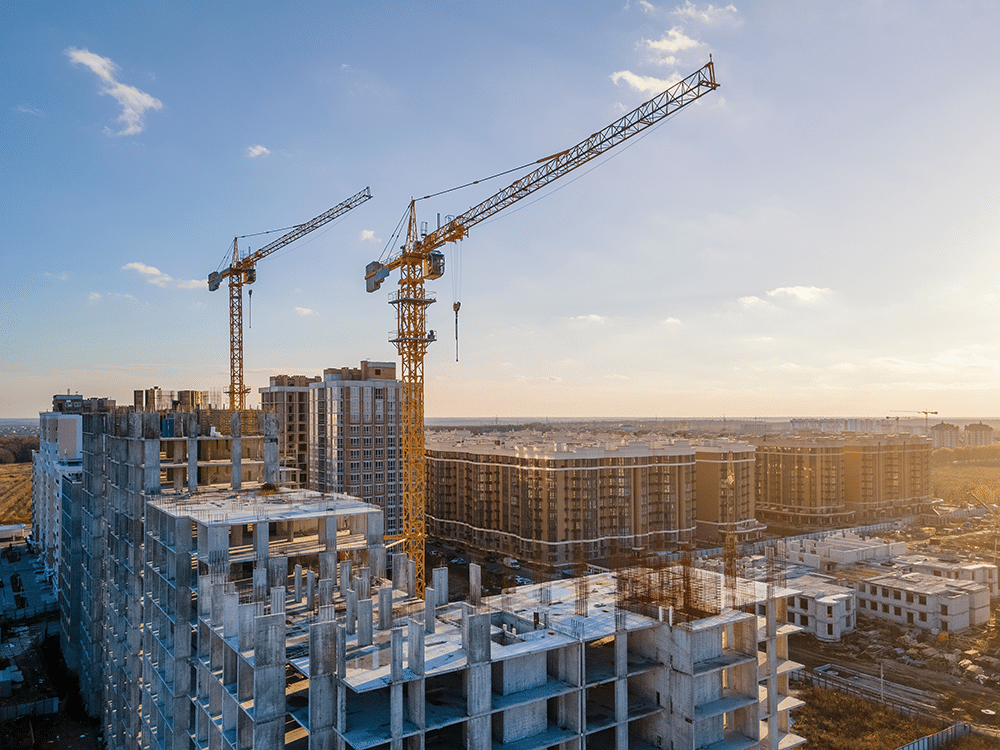

Construction MMI: Potential Manufacturing Boom Could Impact Steel Prices

Month-over-month, the index experienced little movement. Overall, the Construction MMI (Monthly Metals Index) moved sideways, inching down just 1.2%. Steel prices moving downward placed some bearish pressure on the index. However, several significant factors continue to press on construction from both a bearish and bullish standpoint, including the Fed holding off on adjusting interest rates, […]

Automotive MMI: Automotive Market Improves, but Bears Show Up for Steel Prices

Month-over-month, the Automotive MMI (Monthly Metals Index) dropped by 3.03%. While the automotive market continued to improve overall, bearish pressure on certain steel prices like hot-dipped galvanized steel, ultimately forced the index down. Experts anticipate this bearish pressure to continue impacting both steel prices and automotive manufacturing in the short term. Despite this, the automotive […]

Rare Earths MMI: Prices Drop, Huge Rare Earths Reserve Discovered in Wyoming

Month-on-month, rare earths prices exhibited sharp downward movement. While weaker downstream demand could potentially prove one culprit in the dropping prices, another potential factor is an increase in global rare earth production outside of China. If true, China could find itself bumped down the totem pole in terms of rare earth magnets dominance. Meanwhile, China’s […]

Aluminum Market Projections for 2024: Stability Amidst Economic Uncertainty?

Recently, I had the pleasure of interviewing Hydro, a green aluminum producer with multiple plants and locations around the globe. Mike Stier, Hydro’s Vice President of Finance, and Duncan Pitchford, President of Hydro Aluminum Metals in the U.S. (whom I’ve had the pleasure of interviewing before), sat down to discuss Hydro’s views on aluminum performance […]

Construction MMI: U.S. Construction Industry Enters 2024 Lacking Skilled Craftsman

The Construction MMI (Monthly Metals Index) moved in a relatively sideways trend, only budging up 0.65%. Steel prices continuing to flatten out, along with bar fuel surcharges dipping in price, kept the index from breaking out of the sideways movement we’ve witnessed since December. As the index enters 2024, U.S. construction news continues to focus […]

Automotive MMI: Hot-Dipped Galvanized Prices Flatten, EV Market Moving Too Quickly?

All components of the Automotive MMI moved sideways or down month-on-month. Moreover, January saw prices flatten out across the steel market, causing hot-dipped galvanized steel prices to trend close to support zones. Meanwhile, China’s wavering economy continues to prove a concern for global markets because the country is such a large steel demand driver. Many […]