Germany, or rather, the entire continent of Europe, faces an extreme gas shortage this winter if the Nord Stream 1 pipeline does not come back online soon. The controversial pipeline carries gas from Russia to Europe by way of Germany. It was shut down for annual maintenance on July 11. Meanwhile, European underground storage sites […]

Category: Uncategorized

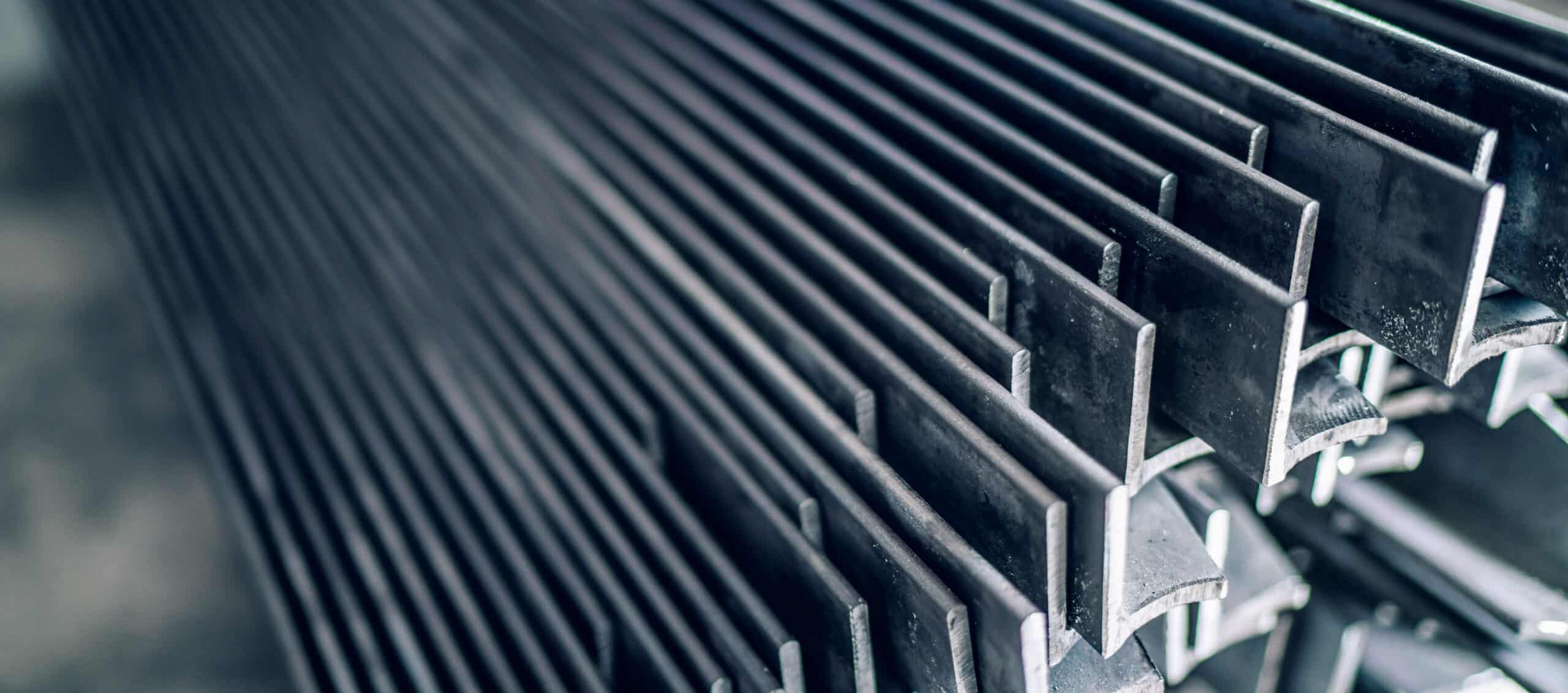

Raw Steels MMI: Hot Rolled Coil Prices Hit New Lows

U.S. steel prices continued their decline this month alongside other steel markets. Hot rolled coil, cold rolled coil, and hot dipped galvanized prices all dropped beneath their early March bottoms. HRC prices, in particular, continue to close in on the $1,000/st mark, while plate prices saw their second consecutive month-over-month decline.The Raw Steels Monthly Metals […]

Battery Metald Demand on the Rise, Global Supply Could Run Tight

As the desire for electric vehicles increases, the demand for battery metals like lithium and cobalt continues to rise. Will this cause a global pinch on rare earth resources? Considering all the challenges facing metal commodities (and commodities in general), it remains a distinct possibility. The Cobalt Craze and Mining Competition China Molybdenum, a large […]

International Commodities Market Fluctuates, Global Slowdown Impending

Mexico’s steel metal market recently saw a slowdown on metal prices, leading experts to believe that Mexico’s industrial metal market may soon turn bearish. Flat steel prices, along with long steel prices, have been dropping over the past several weeks. In fact, Mexico’s steel prices have been in steady decline since April. However, in mid-May, […]

Aluminum MMI: Aluminum Prices Trade Sideways After Decline

Aluminum prices declined overall in May. However, near the end of the month, they appeared to hit bottom and began to trade sideways. Conflicting macroeconomic and geopolitical factors continue to pressure markets, resulting in unclear direction and price trends. Overall, the Aluminum Monthly Metals Index (MMI) dropped by 6.21% month over month. Shanghai Lockdowns Return, […]

Stainless MMI: Nickel Prices Fall and Start Consolidating

Nickel prices appeared to hit a bottom in mid-May, but the trend remains down. Moreover, recent price action showed few signs of any bullish structures on a weekly scale. All in all, the Stainless Monthly Metals Index (MMI) dropped 9.4% from May to June. LME Faces Nearly $500 Million in Lawsuits The nickel crisis returned […]

Lithium Prices Surge Amid a Global Rush for Supply

After Russia’s invasion of Ukraine and the subsequent sanctions, the race is on around the world to find new sources of lithium. The prospect of running out of the rare element is a worst-case scenario for many countries. After all, it is a crucial component in the lithium-ion batteries used in electric vehicles. As EV […]

EU to Take in Ukrainian Steel With New Tariff Adjustments

NOTE: This story was updated on 6.7.22 The European Commission (EC) has extended its existing safeguard tariffs on steel to June 30, 2024, but with some adjustments. In a letter to the WTO, the executive body for the 27-member group said the annual rate of liberalization is due to increase from 3% to 4% as […]

Big Trouble in Big China: Lack of Metals Demand

Metal processors and traders throughout China are facing a grim reality today. Thanks to major economic shifts both within the country and without, metals demand has plummeted. Of course, it’s not great news for the world’s biggest metals manufacturer. But what does it mean for the rest of the world? A Hard Few Years with […]

Rolled Aluminum Anti Dumping Suspension on China by European Commission Ends

The EU has announced an end to the temporary suspension of anti-dumping duties on rolled aluminum products into the block. The suspension was set to expire in July. The news comes hot on the heels of last week’s announcement that the UK would establish provisional duties for six months while it carries out an anti-dumping […]