Automotive MMI: Ford, Fiat Chrysler Start Strong in 2019

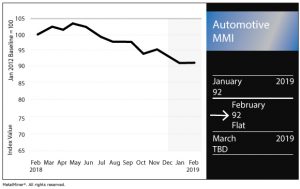

The Automotive Monthly Metals Index (MMI) held flat this month, sticking at a reading of 92.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

U.S. Auto Sales

General Motors reported U.S. deliveries of 2.95 million vehicles in 2018, including more than 1 million crossovers, almost 974,000 pickup trucks and more than 280,000 large SUVs.

GM’s fourth-quarter deliveries hit 785,229 units.

As for the automaker’s electric Chevrolet Bolt, it increased production of the EV in the fourth quarter, and says it projects increased demand for the Bolt in GM’s major markets this year.

In personnel news, GM announced that a new round of layoffs has begun, with 4,000 set to lose their jobs (as part of a 15% workforce reduction announced late last year).

Ford Motor Co., meanwhile, bounced back in January after sales dropped 8.8% year over year in December. Ford recently announced that, like GM, it will not report sales on a monthly basis (instead moving to a quarterly schedule). However, according to Bloomberg, Ford’s January sales increased 7% year over year.

Fiat Chrysler saw its January sales jump 2% year over year.

“In spite of some frigid January weather, we remain bullish on 2019 given the continued underlying strength of the US economy,” Fiat Chrysler’s U.S. Head of Sales Reid Bigland said in a release. “We expect a good cadence of new product throughout the year led by our Ram heavy-duty pickup trucks and Jeep® Gladiator midsize truck in the first half of this year.”

Honda sales jumped 1.5% year over year.

Tesla Pushes for More Affordable EV

Revisiting last month’s article on the subject, Tesla CEO Elon Musk last month announced the company would be slashing approximately 7% of its workforce as it looks to bring down the price tag for its electric vehicles.

“Attempting to build affordable clean energy products at scale necessarily requires extreme effort and relentless creativity, but succeeding in our mission is essential to ensure that the future is good, so we must do everything we can to advance the cause,” Musk wrote in a letter to staff published on Tesla’s website.

“As a result of the above, we unfortunately have no choice but to reduce full-time employee headcount by approximately 7% (we grew by 30% last year, which is more than we can support) and retain only the most critical temps and contractors. Tesla will need to make these cuts while increasing the Model 3 production rate and making many manufacturing engineering improvements in the coming months.

“Higher volume and manufacturing design improvements are crucial for Tesla to achieve the economies of scale required to manufacture the standard range (220 mile), standard interior Model 3 at $35k and still be a viable company. There isn’t any other way.”

Actual Metal Prices and Trends

U.S. HDG steel prices fell 4.6% month over month to $880/st as of Feb. 1. U.S. platinum bars rose 3.3% to $820/ounce, while palladium surged 5.8% to $1,325/ounce.

U.S. shredded scrap steel fell 11.0% to $314/st. Korean aluminum 5052 coil fell 0.03% to $3.43/kilogram.

Chinese primary lead fell 3.5% to $2,595.42/mt.

MetalMiner’s Annual Outlook provides 2019 buying strategies for carbon steel

LME copper rose 3.1% to $6,167.50/mt.

Leave a Reply