Copper MMI: Global Prices Make Modest Gains Amid Output Disruptions

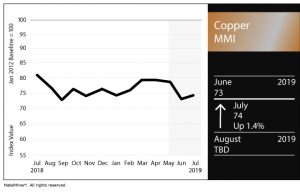

The Copper Monthly Metals Index (MMI) rebounded to 74 following last month’s fairly sizable drop from 78 to 73 (hitting a 2019 index low).

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

LME copper prices dropped by nearly $100/mt around the first of July after gaining strength in June, then traded sideways during the first week of the month.

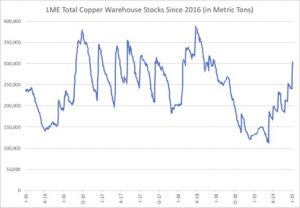

Meanwhile, LME warehouse stocks increased.

However, copper mining disruptions continue to impact mine output. According to Reuters, Chile’s exports of copper declined by 14% in June compared with June of 2018, coming on the heels of extremely rainy weather early in 2019. Additionally, falling ore grades continue to hurt Chilean mining production.

The Congo army recently evicted illegal miners working at Kamoto Copper Company (KCC), a Glencore subsidiary in the Kolwezi area. According to the company, around 2,000 illegal, small-scale miners intruded illegally daily, on average. The move followed a landslide that killed 43 people at the KCC concession.

Zambia announced plans for a law that will compel miners to procure locally, according to the country’s mine minister, as reported by Reuters. Zambia continues to take a greater role in the mining sector. Zambia ranks second in Africa in copper export volume, with the metal dominating the country’s exports.

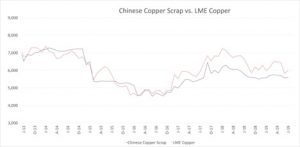

Chinese Copper Scrap vs. LME Copper

The price gap between Chinese copper scrap and LME copper narrowed last month considerably due to the steep LME price drop. This month, however, the slight LME price increase exceeded the slight increase in Chinese copper scrap prices.

Notably, China’s refined copper output in May dropped by 5.2% compared with May 2018. Output totaled 711,000 tons, marking a 3.9% decrease compared with the previous month.

The recent crackdown on scrap imports has likely caused the production decline. Further restrictions impacting high-grade copper scrap came down in early July as the Chinese government continues to ramp up its crackdown on scrap.

Given that scrap imports fueled about 10% of production last year, producers need to find alternative sources of raw material. According to China Minmetals Corporation in press reports, copper imports made by the company from a preferred Chilean trading partner look set to increase this year to a value of $900 million.

What This Means for Industrial Buyers

With copper prices showing some strength in June, industrial buying organizations will need to pay careful attention to macroeconomic growth, which could continue to support prices.

It’s important for buying organizations to understand how to react to copper price movements. The MetalMiner Monthly Metal Buying Outlook helps buyers understand the copper marketplace.

Actual Copper Prices and Trends

Copper prices strengthened this month across the index with the exception of Korean copper strip, which dropped 0.4% to $8.29 per kilogram.

The Indian copper cash price increased by 10.9%, the largest increase in the index this month, to $6.53 per kilogram.

Chinese prices turned around this month, as all of the Chinese prices in the index increased. China’s primary cash price and copper wire price increased by 2.7% to $6,898/mt and $6,892/mt, respectively. Copper bar increased 2.8% to $6,885/mt.

Chinese scrap copper #2 increased by 0.6% to $5,592/mt.

U.S. prices in the index all increased by 1.7%. U.S. copper producer copper grade 110 increased to $3.49 per pound, grade 102 priced at $3.68 per pound and grade 122 at $3.49 per pound.

Want to a see Cold Rolled price forecast? Get two monthly reports for free!

The Japanese primary cash price increased by 2.1% to $6,163/mt. The LME primary 3-month increased by 2.8%, up to $5,982/mt.

Leave a Reply