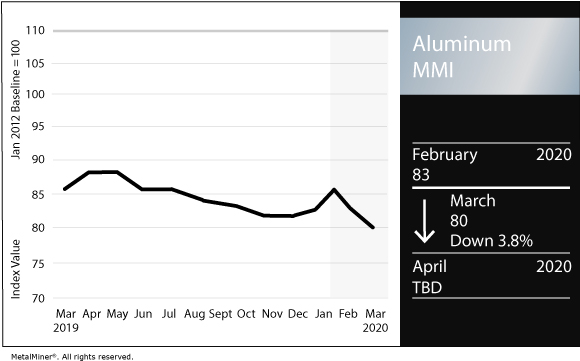

Aluminum MMI: Demand weakness leads to further price deterioration

The Aluminum Monthly Metals Index (MMI) dropped three points once again, falling to 80 this month.

Request a 30-minute demo of the MetalMiner Insights platform now.

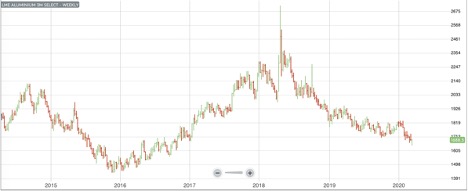

After holding sideways for most of February, LME aluminum prices once again grew weaker later in the month. Prices hit new short-term lows as of early March.

Prices also fell to three-year lows recently.

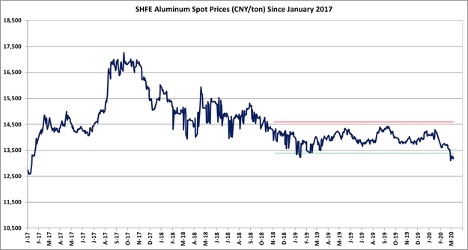

SHFE aluminum prices break one-year sideways trading band

SHFE aluminum prices dropped in February, with the price finally breaking the firm sideways trading band in play throughout 2019.

Like LME aluminum, SHFE aluminum dropped to a three-year low as price weakness resulted from the coronavirus demand hit.

As aluminum demand stalled out in China, production generally continued, as noted in a recent article by MetalMiner’s Stuart Burns. As a result, the global market looked particularly oversupplied during February 2020.

Traders reacted to reports of stock build-up at exchange warehouses and traded on that information.

The China Nonferrous Metals Industry Association (CNIA) issued a statement requesting stockpiling of metals by producers in order to help support prices, according to Aluminium Insider.

[MetalMiner’s monthly buying outlook reports give you pricing and specific buying strategies for 10 metal types, including aluminum. Request your trial now.]

Coronavirus could cause further deterioration of aluminum market fundamentals in H1 2020

Rusal noted coronavirus might impact the recent economic activity rebound that started during January 2020, with further deterioration of aluminum market fundamentals possible for H1 2020.

Rusal indicated global demand increased by 0.1% during 2019 (compared to 2018), totaling 65.3 million tons. Demand in China increased by 2.5% to 36.8 million tons, while demand ex-China dropped by 2.6% to 28.5 million tons.

The company sees demand increasing by 1.3% to 66.1 million tons in 2020 if coronavirus issues get solved quickly, with demand pull coming from the transportation sector. Most demand growth will come from ex-China (1.1% of total growth forecast for 2020).

More smelters announce possible closure due to high power costs

Pacific Aluminum, a division of Rio Tinto Group, recently reported a loss due to high power and transmission costs at its Tiwai Point aluminum smelter in New Zealand, according to industry reports.

The company noted rising power costs were more harmful than weak aluminum prices, which dropped by around 15% last year.

The company previously announced it would make a decision on whether to keep the smelter operating by the end of March 2020.

Australian operations face similar issues.

According to a recent report from the Institute for Energy Economics and Financial Analysis, Australia’s four major aluminum smelters all face critical power issues that could result in closures.

Rio Tinto’s Icelandic Aluminum Company (ISAL) smelter is also currently under review for similar reasons, including high power costs, according to press reports. The review will be completed during H1 2020.

In SEC filings, Century Aluminum, of Mt. Holly, South Carolina, noted recently that it needs a more cost-effective power agreement in order to stay open, as reported on by Aluminum Insider.

What this means for industrial buyers

Aluminum prices continued to weaken.

However, a couple of different potential shock factors now in play could turn around the price trend at any time.

Improve metal purchase timing and mitigate price risk — trial MetalMiner’s monthly metal buying outlook

Actual metal prices and trends

Aluminum prices weakened globally during February, with Chinese prices showing the largest price declines.

Chinese aluminum scrap prices dropped after four months of increases, falling 7.4% to $1,788/mt.

Chinese aluminum billet and bar also showed sizable declines of 6.6% and 6.3%, respectively, down to $1,984/mt and $2,080/mt.

Chinese aluminum primary cash prices dropped by 5.4% to $1,867/mt.

European commercial 1050 sheet dropped 6.4% to $2,375/mt, while 5083 plate dropped 4.2% to $2,786/mt.

The LME primary three-month price lost 2.6%, falling to $1,680/mt.

Remaining price declines in the index were milder.

Leave a Reply