Automotive MMI: U.S. automakers restart production after two-month suspension

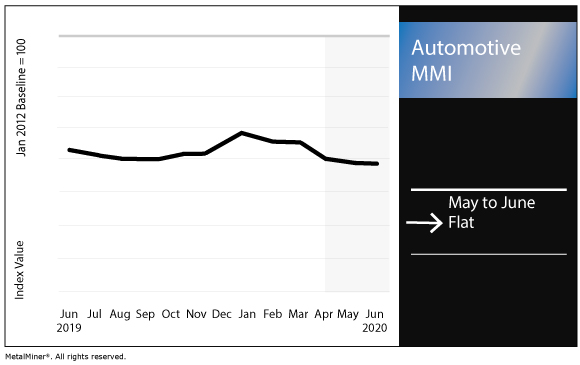

The Automotive Monthly Metals Index (MMI) held flat this month.

U.S. automotive sales

General Motors, Ford, Fiat Chrysler and Nissan all report sales on a quarterly basis.

Unsurprisingly, however, U.S. auto sales have taken a hit in recent months, as showrooms have closed to comply with shelter-in-place orders stemming from the coronavirus outbreak.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

However, with many restrictions being lifted around the country, sales could receive a bump in the coming months; some of the available sales figures indicate May was not quite as bad as April for the U.S. automotive sector.

Honda, meanwhile, still saw double-digit decreases in May sales. After falling 54.1% in April on a year-over-year basis, Honda’s May sales were down 16.9%. For the first five months of the year, Honda sold 477,513 vehicles in the U.S., down 25.5% on a year-over-year basis.

Toyota Motor North America sales were down 25.7% year over year, CNBC reported.

Hyundai reported a 13% year-over-year decline in May sales.

“We were able to achieve a remarkable retail sales rebound thanks to our dealer partners, implementation of digital retail tools and providing customers with the right offers,” said Randy Parker, vice president of national sales for Hyundai Motor America. “We’ve also equipped our dealers with resources to ensure we are taking the necessary precautions to keep vehicles and facilities clean. Our inventory pipeline is in a good place as Hyundai Motor Manufacturing Alabama has been up and running since May 4. We’re optimistic for the months ahead.”

Earlier this year, Nissan reported Q1 sales decline of 29.6%. GM’s Q1 sales fell 7%.

Automakers restart

On the production side, U.S. automakers began to restart production May 18 after suspending production for approximately two months in response to the coronavirus outbreak.

General Motors commented on the production restarts late last month.

“The restart of vehicle production at General Motors’ component and assembly plants in North America has gone smoothly thanks to strong teamwork,” the Big 3 automaker said. “Our comprehensive safety procedures are working well, and our suppliers have done a great job implementing their return-to-work strategies and safety playbooks. We are now in a position to increase production to meet strengthening customer demand and strong dealer demand.

“Starting Monday, three crossover assembly plants in the United States and Canada will be operating two production shifts, and three U.S. assembly plants building mid- and full-size pickups will move from one- to three-shift operations. Five other U.S. assembly plants will operate one production shift.”

Ford also restarted its operations — but not without some challenges.

On May 26, the automaker temporarily paused production at its Kansas City Assembly Plant in accordance with its coronavirus protocols.

“The safety of our workforce is our top priority,” Ford said in a release. “Working closely with the UAW and external experts in infectious disease and epidemiology, we have developed safety standards to protect our workforce. In this instance, our protocol calls for us to deep clean and disinfect the employees’ work area, equipment, team area and the path that the employee took while at the plant today. We are temporarily pausing production at Kansas City Assembly Plant – on the Transit side – until the deep cleaning is completed. We are notifying people known to have been in close contact with the infected individual and asking them to self-quarantine for 14 days.”

On May 27, Ford temporarily closed production on one line at its Chicago Stamping Plant after a positive case there.

Earlier, just two days after restarting production, Ford temporarily paused its Dearborn and Chicago operations after positive coronavirus cases at the plants, the Detroit News reported.

Fiat Chrysler also welcomed workers back to the production lines May 18. As of June 1, 88% of full-time Fiat Chrysler workers in Canada, the U.S. and Mexico were back to work (85% in the U.S.).

South of the border, automotive plants in Mexico reopened this week, as the country has erred on the side of caution in its COVID-19 approach.

The North American automotive supply chain in inextricably linked, with approximately 40% of U.S. automotive parts being imported from Mexico.

Ciudad Juarez Mayor Armando Cabada, as quoted by Reuters, estimated about 30% of the city’s 300,000-member factory workforce had returned to work this week.

Improve metal purchase timing and mitigate price risk — trial MetalMiner’s monthly metal buying outlook

Actual metals prices and trends

U.S. HDG steel rose 4.6% month over month to $744/st as of June 1.

LME three-month copper rose 2.7% to $5,357/mt.

U.S. shredded scrap steel fell 4.6% to $268/st.

Korean 5052 aluminum coil premiums fell 6.4% to $2.78/kg.

Leave a Reply