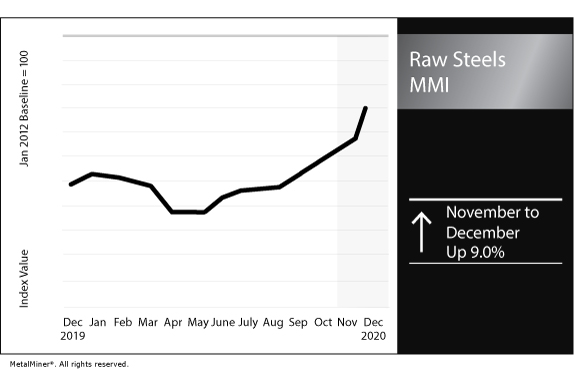

Raw Steel MMI: Index increases by 9%

The Raw Steels Monthly Metals Index (MMI) increased by 9% for this month’s value.

Cut-to-length adders. Width and gauge adders. Coatings. Feel confident in knowing what you should be paying for metal with MetalMiner should-cost models.

U.S. demand continues to recover

Year-to-date production through Nov. 28, 2020 declined 18.4%, according to the American Iron and Steel Institute. However, several indicators show that demand continues to recover.

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development announced that a total of 1.53 million new residential units started construction in October. This represented a 4.9% rise from almost 1.46 million in September and 14.2% higher than October of last year. Meanwhile, the Census Bureau announced an increase for the sixth consecutive month for new orders for manufactured durable goods. New orders increased 1.3% month over month to almost $241 billion.

The U.S. commercial construction sector also continued to show recovery, as the Architecture Billings Index (ABI) rose from 47 in September to 47.5 in October. The Design Contracts Index rose by 5.7% to 51.7, which signals an increase in contracts signed for new work.

U.S. Steel restarts capacity

As demand continues to strengthen and steel prices increase, U.S. Steel decided to restart its blast furnace #4 at Gary Works sooner than anticipated. It’s expected to start today, Dec. 8.

The decision to restart earlier may also be in response to the recent antitrust clearance from the U.S. Department of Justice. That is one of the final steps to complete the acquisition of ArcelorMittal USA by Cleveland-Cliffs.

The consolidation should allow U.S. Steel and Cleveland-Cliffs to navigate the U.S. steel market swings more smoothly.

Tight scrap market in the Americas

Steel mills have begun to ramp up in Mexico and South America, increasing scrap demand in several regions of the U.S.

Nathan Fruchter, a principal analyst at Idoru Trading, told Recycling Today: “Buyers from Mexico, Peru, Ecuador and Brazil are all out there buying en masse. Over the years, we have seen all these countries buying scrap, some on a regular basis, others on and off, and some even — like Brazil — often off. But I cannot recall seeing so many LatAm buyers converging simultaneously on the market during the same month.”

As economies in Latin America start recovering from extended coronavirus locksdowns, the steel sector has started to ramp up. In doing so, these mills that usually buy domestic scrap, have not been able to cover their demand. As a consequence, they are looking for scrap in the largest and closest scrap market, the U.S.

If this trend continues, the effect could impact U.S. scrap prices in the next few months.

Actual metals prices and trends

The Chinese slab price rose 4.3% month over month to $590.92/mt as of Dec. 1, and the Chinese billet price rose 1.7% to $536.23/mt.

Chinese coking coal increased 14.3% to $385.01/mt.

U.S. three-month HRC rose 22.0% to $799/st. U.S. shredded scrap steel remained flat at $290/st.

The MetalMiner 2021 Annual Outlook consolidates our 12-month view and provides buying organizations with a complete understanding of the fundamental factors driving prices and a detailed forecast that can be used when sourcing metals for 2021 — including expected average prices, support and resistance levels.

Leave a Reply