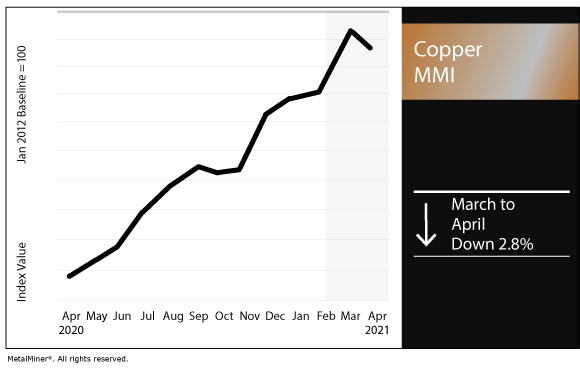

Copper MMI: Copper price stabilizes in March

The Copper Monthly Metals Index (MMI) fell by 2.8% for this month’s reading.

Sign up today for Gunpowder, MetalMiner’s free, biweekly e-newsletter featuring news, analysis and more.

Copper stabilizes after late February, early March drop

The LME three-month copper price surged to a peak of $9,560 in late February.

However, like nickel, the red metal cooled at the end of February and early March. The three-month price fell to $8,757 per metric ton as of March 4.

“This is a classic overbought market in which traders sought to take some profits,” MetalMiner CEO Lisa Reisman explained last month. “With the exception of tin, all of the non-ferrous metals traded down. And though nickel looks weaker (as does lead), most of the non-ferrous metals remain in their uptrend, as does the ferrous metals complex.”

Since then, copper has stabilized. The price has mostly traded between $8,900-$9,000 per metric ton. The three-month price closed Tuesday at $8,893 per metric ton, or down 1.59% from the previous month.

Copper market shift

Elsewhere, Stuart Burns recently delved into the shift in the global copper market as a result of China’s relaxation of scrap import regulations.

“China’s relaxation of copper scrap imports has created a significant — some may say seismic shift — in the copper market,” he explained. “That shift has taken the heat out of the refined metal market and supercharged the scrap market.

“Current higher LME prices will generate more scrap and, given 6-12 months, improve scrap supply. As such, there is not much ground for copper price weakness in a globally recovering market. However, there is also less probability of a supercycle bull story taking hold again.”

Vedanta looks to try again in India

Three years ago, the local government in India’s Tamil Nadu forced Vedanta to close its copper smelter. The closure came on the heels of protests that turned deadly, as police fired on locals protesting pollution levels from the plant. The facility was just one of two copper smelters in India.

Now, Vedanta is looking to start a new copper smelter in the country, Sohrab Darabshaw explained. The proposed smelter will have an annual capacity of 500,000 tons per year.

“As per the details spelled out in the expression of interest, the proposed multimillion dollar project has an investment potential of about US $2 billion (Rs 10,000 crore),” Darabshaw wrote. “The project, it said, would also provide direct and indirect employment to 10,000 people. In addition, it would require around 1,000 acres near a port along with logistics connectivity to handle 5 million tons per annum of material movement.”

GlobalData: Chile copper output to rise 3.7% in 2021

Meanwhile, in top copper producer Chile, GlobalData forecast the country’s copper production to rise by 3.7% in 2021.

The increase follows what GlobalData estimates to be a decline of 0.7% in 2020.

“Chile’s copper production is estimated to have declined by 0.7% in 2020,” said Vinneth Bajaj, associate project manager at GlobalData. “While the country’s mining sector avoided a full-scale lockdown as seen in neighboring Peru, operational restrictions and rising cases impacted the progress of various developments. For example, Codelco had to halt on-site construction activities at Chuquicamata and El Teniente, with rising cases leading to mounting pressure from workers and the temporary shutdown of Chuquicamata at the end of June 2020.”

Actual metals prices and trends

The Chinese copper scrap price fell by 1.2% to $5,856 per metric ton as of April 1. Meanwhile, the Chinese primary cash price dropped by 4.3% to $10,016 per metric ton.

The LME three-month copper price fell by 3.0% to $8,846 per metric ton.

Copper producer grades 110 and 122 fell by 1.8% to $4.83 per pound. Producer grade 102 fell by 1.8% to $5.05 per pound.

Find more insight on MetalMiner’s LinkedIn.

Leave a Reply