Rare earth oxide prices drop as China loosens production quotas

China’s rare earth (RE) oxides market is a controlled market — or at least it is today.

There was a time it was the mining equivalent of the wild west with multiple operators. There were once zero controls and, as a result, the sector’s operations led to massive environmental damage.

The authorities stepped in, consolidated the operators and enforced licences.

Become part of the MetalMiner LinkedIn group and stay connected to trends we’re watching and interesting metal facts.

Managing the rare earth oxides market

Today, Beijing’s Ministry of Industry and Information Technology (MIIT) with the Ministry of Natural Resources sets quotas every half year for how much can be produced.

Market prices remain volatile, though. A half yearly quota set by government officials is not the optimal system to match supply, demand and prices. As the economy bounced back last year, the rare earths market was caught on the hop and prices rose strongly.

Some light rare earths, like praseodymium-neodymium (PrNd) oxide, reached multiyear highs.

As a result, the MIIT relaxed quotas this year. It raised the quota from 66,000 tons in the second half of 2020 to 84,000 tons in the first half of 2021. Prices continued to rise as global demand roared back. China’s exports are also controlled (the country still produces something like 90% of global supply). Grateful producers elsewhere have made up the shortfall.

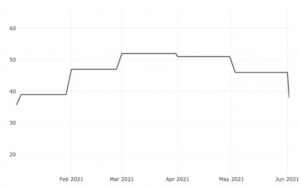

MetalMiner tracks Chinese rare earths prices on a daily basis and produces a rare earths Monthly Metals Index (MMI) displayed above. After rising strongly in Q1, the index took an unexpected reversal in April and again in May, as my colleague Fouad Egbaria posted at the time.

The index has dropped again for the start of June. This suggests the MIIT’s loosening of production limits has had the desired impact and availability is proving sufficient to meet demand.

Last year, rare earth element refiners operated at just 45% of capacity, the Global Times reported. Even with higher output this year, there is still substantial spare capacity. With exports likewise controlled, producers’ enjoyment of higher output permits look like they will be mitigated by lower prices.

Each month, MetalMiner hosts a webinar on a specific metals topic. Explore the upcoming webinars and sign up for each on the MetalMiner Events page.

Leave a Reply