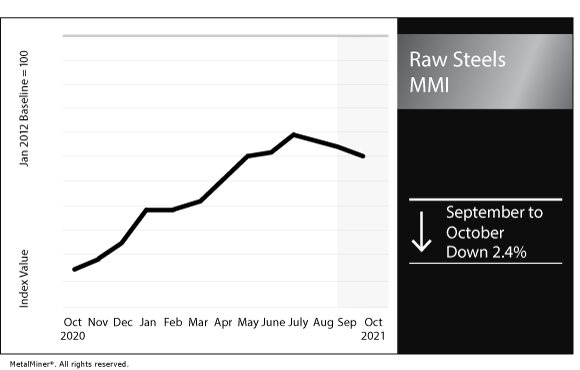

Raw Steels MMI: Steel prices settle going into the fourth quarter

The Raw Steels Monthly Metals Index (MMI) dropped by 2.4%, as most forms of steel around the world declined, despite coking coal prices being at all-time highs.

Do you know the five best practices of sourcing metals, including steel?

Global steel production

According to the World Steel Association, global steel production declined for the fourth consecutive month in August.

The 64 reporting countries to World Steel produced a total of 156.8 million tons (5.06 million tons per day) for August, compared to 171.3 million tons (5.71 million tons per day) in April, which was the highest monthly production of the year on a tons-per-day basis.

China continues as the world’s top producer by eight times more than the second-largest producer, India. Chinese production during August reached 83.2 million tons (2.68 million tons per day), over 50% of global production.

China, however, posted a fourth consecutive month of production declines on a tons-per-day basis. Since April, China’s daily steel production fell by 17.8%.

U.S. imports

Currently, the E.U. and U.S. continue to negotiate the replacement of the U.S.’s Section 232 import duties. A tariff-rate quota, similar to the existing E.U. safeguard, would mean duty-free allocation would be allowed, along with taxes payable once the volume has been reached.

So far, the main point of contention centers on the quota. The EU expects a quota based on pre-Section 232 volumes. However, the U.S. hopes for one based on more recent flows.

However, some market participants do not think the relaxation of the tariffs will encourage E.U. exports into the US. The U.S. is not a significant market for European mills despite U.S. domestic steel prices being higher than the current duties. Thus, E.U. imports have not spiked.

Moreover, Steel Import Monitoring and Analysis (SIMA) data seems to back up this trend.

Data suggests that steel import permit applications for the month of September totaled 2,865,000 net tons, or 8.8% higher compared to August. Meanwhile, import permit tonnage for finished steel in September also increased to 2,144,000 tons, up 1.7% from the final imports total of 2,108,000 in August.

However, most imports did not come from Europe but from South Korea (2,073,000 net tons during the first nine months), Japan (741,000 net tons) and Turkey (669,000 net tons).

Coking coal prices

While steel price increases seem to have started to slow, seaborne metallurgical coal prices remain at an all-time high amid global supply tightness and strong demand. However, market participants expect prices to correct during the last four months of the year as Chinese steel consumption decreases.

Supply tightness came partly as a result of China’s climate targets, which allowed coal inventories to dwindle. Additionally, China stopped imports of Australian coal amid a diplomatic row. This import shift shocked coal supply chains, as new buyers set their eyes on Australia and China built new relationships with Latin American, African and European suppliers.

As of Oct. 1, Chinese coking coal prices increased by 71% year over year to CNY 3,402 per metric ton.

Actual metals prices and trends

Chinese slab prices increased 1.7% month over month to $871 per metric ton as of Oct. 1. Meanwhile, the Chinese billet price jumped 3.9% to $804 per metric ton.

Chinese coking coal continued to increase substantially, rising by 8.0% to $527 per metric ton.

U.S. three-month HRC dropped 7.1% to $1,619 per short ton. Meanwhile, the spot price declined by 0.5% to $1,934 per short ton.

Lastly, U.S. shredded scrap steel declined by 3.3% to $467 per short ton.

MetalMiner should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.

Leave a Reply