Conflicting Reports Signal Chinese Aluminum Supply Uncertainty

Conflicting reports continue to emerge from China regarding aluminum supply, demand, and production. Some information notes that the downturn in the country’s economy is largely due to the ongoing real estate crisis. As demand wanes, this poses questions regarding the internal pickup of aluminum and other base metals.

However, other reports talk of the country setting new aluminum production records. Even Fitch Ratings agency recently predicted that aluminum demand in China would continue to increase in 2024. The lack of clear information makes it difficult for global analysts to nail down the current situation with aluminum supply and demand. This, in turn, makes forecasting difficult.

Take this report, for instance. It discusses Golden World Innovation Aluminum, a private aluminum operator in Guangdong, the southern manufacturing hub of China. According to the article, the company recently asked its workforce to go on a five-month furlong with reduced salaries, underlining the rising unemployment in the world’s second-largest economy.

Meanwhile, employees choosing to stay with Golden World Innovation will receive only 80% of the Foshan labor laws’ minimum monthly salary, which is about U.S. $266, or 1,900 yuan. This represents a third or less of their usual income, with the pay cut lasting until the beginning of April.

Interested in accurate long-term and short-term aluminum price forecasting to save money on COGS? See a preview of MetalMiner’s comprehensive 12 month report, the 2024 Annual Metals Outlook.

Aluminum Supply and China’s Unemployment Problem

Is Golden World an isolated case? Most analysts agree that 2023 has not been ideal for Chinese workers. The country’s economy continues to face hiccups, requiring an occasional boost from the government to kick start it. Yet, the economy and employment are still not as healthy as many experts expect, seemingly in defiance of various support measures.

According to some reports, employment looks to have stabilized in the last few months. In fact, unemployment hovered around the 5% mark for three consecutive months, just within the government’s own target of 5.5%. However, much of the employment-related news coming out of the country seems to paint a more grim picture.

This report from WIO News says the decline in the housing sector triggered a ripple effect, impacting industries beyond aluminum production. For example, Yaxin Iron and Steel Group in Henan recently declared a production stop, while another piling company sent much of its staff on unpaid leave.

Moreover, frequent disruptions in funding across industries created significant cash flow problems. The article quotes analysts as calling for stabilizing manufacturing as well as additional policy support to breathe more life in domestic demand. Yet, despite such challenges, the report maintains that China is still on track to achieve its growth target for 2023.

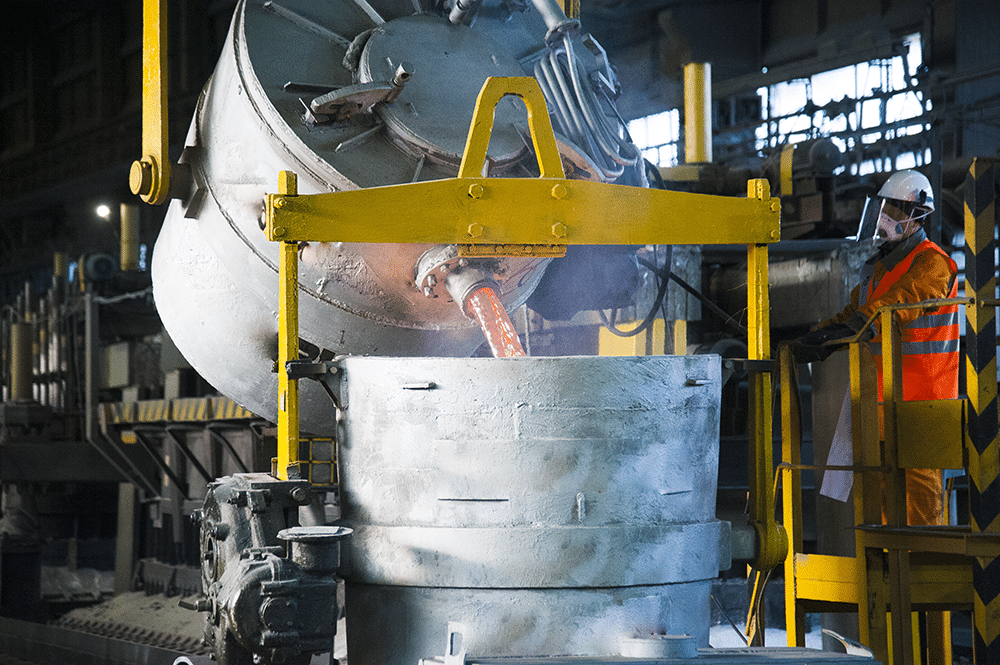

Primary Aluminum Production Increased in November

Amid such pessimistic data comes a new report saying China’s primary aluminum production increased by 4.8% in November compared to the same period last year. Apparently, a surge in demand for the lightweight metal prompted major producing regions to expand their capacity.

Indeed, the National Bureau of Statistics (NBS) reported that the world’s largest aluminum producer generated 3.54 million metric tons of primary aluminum last month. In November, industry consultancy Aladdiny reported that Inner Mongolia, China’s second-largest producing region, augmented its capacity by approximately 100,000 tons.

Calculations by Reuters revealed that the average daily aluminum output in November reached 118,000 tons, indicating an increase from October’s daily average of 116,774 tons. What’s more, up through November this year, China produced 38 MT of aluminum. This represents a 3.9% increase from the same period last year.

Check if your service center is providing you with price transparency for your aluminum spend.

Chinese Aluminum Output Exceeding Expectations

The news of the expanding aluminum supply came on the heels of a reports that the International Aluminum Institute recently revised China’s production through the first half of the year significantly higher. The IAI initially projected an annualized decline of 118,000 metric tons for the first seven months of 2023. However, the latest estimate indicates that national output actually increased by 1.3 million metric tons.

Meanwhile, Fitch Ratings now says that the ongoing stimulus measures in China and an industrial rebound in developed nations will bolster the demand for base metals and steelmaking raw materials in 2024. “Our neutral sector outlook is also influenced by government spending initiatives in China, Europe, and the U.S., aimed at supporting the energy transition and infrastructure projects that necessitate metal resources,” the firm said in a press note.

Finally, predictions of global aluminum consumption recovering in 2024 may work in favor of China’s aluminum sector next year.

Weekly market intel is key to knowing aluminum price forecasts. Don’t miss out on MetalMiner’s expert analysis and up-to-date information, subscribe to MetalMiner’s free weekly newsletter.