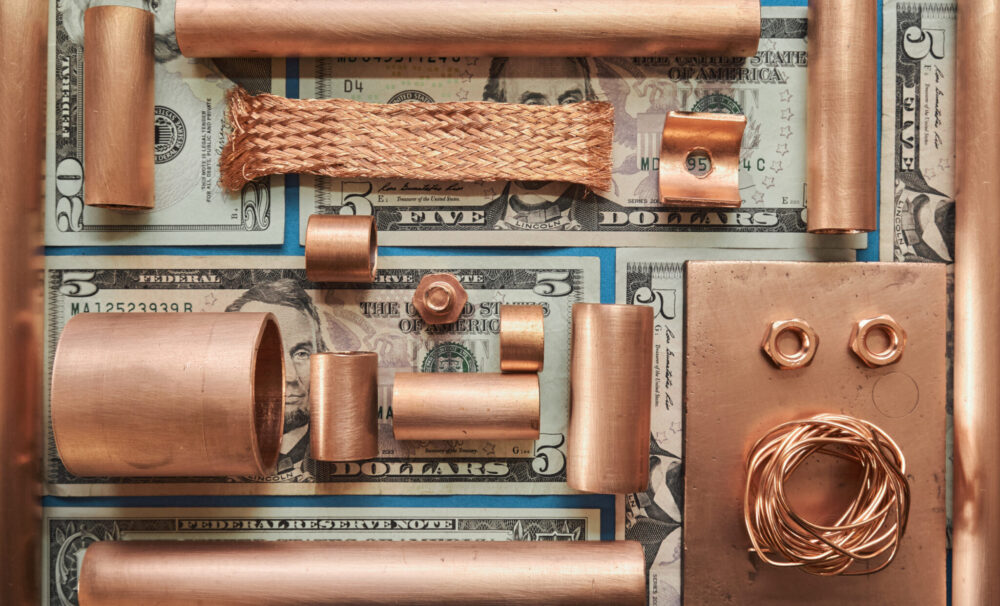

Is Copper About to Spark a Global Commodities Rally?

Copper was touted as the hottest commodity of 2025, as covered in MetalMiner’s weekly newsletter. Capped by April’s tariff-driven turbulence, the last quarter only reinforced that view. Now it seems copper prices are poised to lead other metals in the short term. Many experts believe copper has reached an inflection point. As such, they expect its coming price moves to ripple through other raw commodity futures and even stock and financial markets.

Copper Prices Were Tumultuous for Most of Q1

Since February, global copper prices have swung wildly, experiencing both plunges and spikes. These rapid fluctuations have, in turn, kept the entire sector on edge. That said, everything might have stabilized if not for the tariff war that erupted in April.

Shortly after, the copper futures (HGK25) market turned into a seesaw, rising from a record high of $5.2770 per pound in March before tumbling to a three-month low of $4.03 in early April. Much of March’s surge stemmed from traders stockpiling copper to hedge against the looming tariff hikes. But by mid-April, copper prices rebounded.

Why invest precious procurement dollars into unnecessary metal price data when you only need a few metal price points? MetalMiner Select allows you to purchase just the metal price data you require.

Copper Currently Faces a Crossroads

Some copper analysts now see the market at a tipping point. An analysis on MSN.com noted that if May copper futures break above the $5.00-per-pound resistance level, it would signal that copper has likely found a price floor and may resume its upward trajectory. That same move could also suggest that major U.S. and global stock indexes have bottomed out and may soon rise as well.

Conversely, if prices dip below the April low of $4.03 per pound, it could signal trouble. Specifically, it might indicate that the global economy is sliding into recession. If that occurs, stock markets would likely fall, risk aversion would increase and investors might retreat to safe-haven assets like gold and silver, driving prices even higher.

Some Breaks for the Red Metal

Downstream copper inventories have taken a hit due to a series of geopolitical risks, particularly the ongoing trade war, which has left copper prices particularly vulnerable. In China, one of the world’s largest copper consumers, officials have started rolling out measures to manage rising demand from both traditional and emerging industries. Meanwhile, Chinese lithium battery material companies have ramped up R&D to address supply imbalances and price swings.

Recent reports revealed that China’s copper output rose in March 2025 despite shrinking profit margins. According to Bloomberg, the increase was also driven by higher sales of byproducts like sulphuric acid. Interestingly, Chinese smelters can extract gold from copper ore and either refine it in-house or outsource the process, a strategy that lets them profit from gold’s recent price surge.

Prices for by-products like gold and sulphuric acid have climbed sharply in recent weeks, with sulphuric acid up about 50%, the highest since March 2022. Meanwhile, data from the National Bureau of Statistics showed that China produced 1.25 million tons of refined copper in March, marking an 8.6% year-over-year increase. First-quarter refined copper output totaled 3.54 MT, up 5% from the same period last year.

Russia Looks to Expand Copper Output

While China pushes ahead with its copper strategy, Russian media outlets report that state development bank VEB plans to invest over one trillion rubles ($13.40 billion) to develop the Baimskaya copper-gold deposit in Chukotka, a mountainous region in Russia’s far east.

Reuters reports that once fully operational, the mine would increase Russia’s copper output by 25% and gold production by 4%. Part of the deposit lies within the Arctic Circle, which is now central to Russia’s economic development plans as it shifts focus following European sanctions.

Struggling to align your copper strategy with current market conditions? MetalMiner helps you match your exact metal types, forms and gauges with actionable market intelligence. View our full metal catalog.