Hedging Copper Prices and Smoothing Volatility in H2 2025

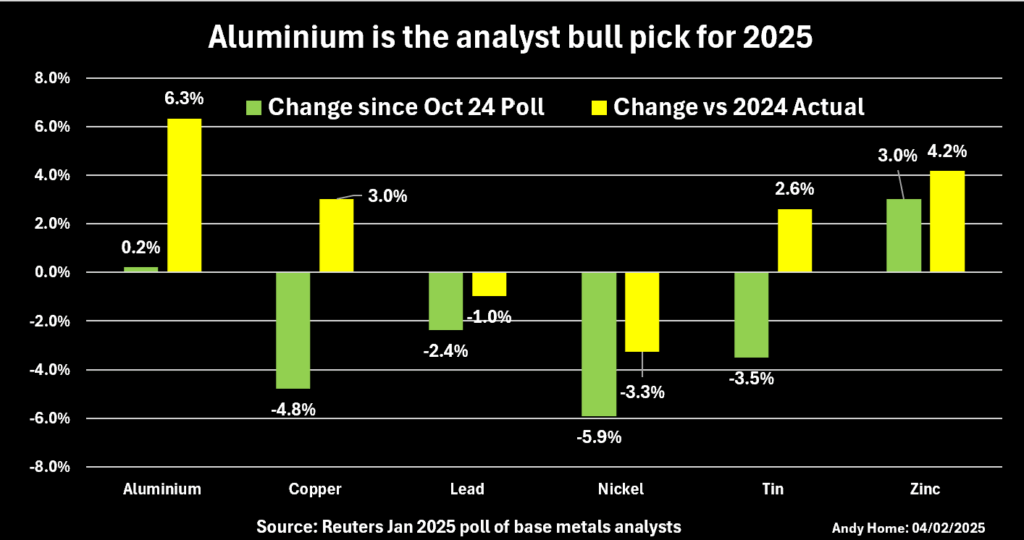

There are many hedge fund strategies organizations can employ to generate returns and manage risk. Now, metal buyers are looking to apply these same concepts to certain metals. Base metals like copper have seen notable swings so far in 2025. According to the CME group, copper oscillated in a roughly $4.55–$4.80 per pound range throughout May as Chinese demand steadied and trade tensions eased. In contrast, aluminum has been much stronger. Analysts now predict that LME aluminum will average about $2,574/tonne in 2025 (up ~6% from 2024) on expected supply deficits.

In short, base-metal prices remain volatile entering the second half of 2025. Emerging supply constraints (Chinese smelters pledging capacity cuts) and strong “energy transition” demand globally remain counterbalanced by weaker growth and trade skirmishes. Amid this uncertainty, metal buyers cannot rely on “benign” markets.

Effective hedging, which involves using a mix of financial and operational tools, is essential to stabilize costs. As one risk manager put it, commodity hedging “provides a level of price predictability” to aid in both budgeting and planning.

These hedge fund strategies are just the beginning. You can cut through the noise and get clear, expert-backed insights on where metal prices are headed when you sign up for MetalMiner’s weekly newsletter.

Key Hedging Strategies for Base Metals

Practical hedging involves locking in prices or managing exposure. One common strategy is buying metal futures on exchanges like the CME or LME. Forward contracts can also fix purchase costs. For example, a cable manufacturer might buy COMEX copper futures equal to its planned purchase, so any spot price rise is offset by gains on futures. In other words, if the physical price jumps later on, the hedged futures position gains an equivalent amount. According to the CME group, this “back-to-back” hedging lets a producer or consumer offset price risk.

Options give the right, but not the obligation, to transact at a set price. For instance, buying a call option lets you lock in a maximum purchase price (for a premium) while retaining upside if prices fall. Conversely, a put option can guarantee a minimum sale price for stored metal. See the details about the pros and cons of call and put options in MetalMiner’s free guide 5 Best Practices of Metal Based Sourcing.

The LME notes that a buyer pays a known premium for “unlimited potential upside,” effectively capping the cost at the strike price. For example, a copper buyer might buy calls struck near current levels. If market prices spike, the call payoff compensates for the higher cost. To reduce premiums, companies can use collars (buying a put and selling a call) to set both floor and ceiling prices. In practice, options are best for insuring against rare extreme moves, whereas futures lock in cheaper prices when a move is expected.

Struggling to stay updated on metal price trends affecting metal industries? Download MetalMiner’s Monthly Metals Index Report to receive the latest price trends, market intelligence, and outlooks for 10 different metal industries, aiding your strategic planning.

Still Rolling the Dice on Metal Prices?

Over‐the‐counter fixed‐price swaps or long-term supply agreements can also hedge budgets. In a swap, the buyer and bank agree on a fixed forward price. Monthly cash settlements then pay out any difference between the market average and that strike. For instance, a manufacturer could enter a 3-month swap on LME aluminum. If the monthly average LME price exceeds the swap price, the bank pays the company the difference (and vice versa). This ensures the company effectively “locks in” its spend.

Forward Contracts

Similarly, forward contracts with smelters or traders can fix quantities at agreed prices. If available, swap-based commodity funds or structured notes from banks (akin to swaps) are another option. This strategy is regularly covered in MetalMiner’s Monthly Metals Outlook report for copper and other major base metal industries. These instruments allow hedging even when exchange liquidity is thin on certain tenors. Buyers can also negotiate contract terms with suppliers. A straightforward approach is a fixed-price agreement (tied to a metal index) for a set volume over a period.

Price Caps

Alternatively, adding price caps or collars to contracts effectively shares risk. For example, the contract might allow price increases only up to a capped percentage or tie index adjustments to an agreed maximum. LME commentators note that collars “define the maximum and minimum prices,” thus avoiding extreme swings. This way, if the market soars, the buyer only pays up to the cap. If prices fall, the supplier still gets at least the floor. Variations of this particular strategy include escalator clauses (prices rise only with a commodity index up to a limit) or step-up pricing.

Hedge Fund Strategies: Reducing Risk Exposure

Holding extra metal inventory can act as a de facto hedge against shortages or sudden price jumps, but it also carries a cost. For instance, large buyers sometimes build safety stock when prices are low. However, as the LME warns, “holding additional inventory exposes a company to the risk of a financial loss if its value falls.”

For this reason, firms must balance carrying costs and capital lock-up against the premium paid for availability. In practice, companies might combine small buffer stocks with active financial hedges. Meanwhile, real-time monitoring of stock levels and contracts like prepaid forward deals (e.g., consignment stock or “pay-as-you-go” structures) can provide flexibility.

Purchase Diversity

Spreading purchases across multiple suppliers or regions can mitigate supply shocks or localized price spikes. For example, a U.S. buyer might source aluminum from both North America and Europe, or qualify alternate mines for copper. This reduces exposure to any one producer’s outage or one government’s policy.

Procurement experts caution that multiple sourcing “loses price leverage on volume commitment,” but note it limits counterpart risk. Relatedly, companies are exploring near-shoring and regional alliances to avoid tariffs or geopolitical risks.

Why invest in unnecessary metal price data when you only need a few price points? MetalMiner Select allows you to purchase just the metal price data you require.

Buying Partnerships

Forming strategic partnerships (e.g., joint buying consortia) can also lock in volumes and get better terms. Regardless of the tools chosen, rigorous risk management is essential. Establish clear policies (what percent of exposure to hedge, for how long), and use scenario planning to quantify potential losses without hedges.

Track key indicators (inventory levels, exchange stocks, macro drivers) and adjust hedge ratios dynamically. As one banker advised, hedging should align with the company’s risk tolerance. It’s “not a way to win a market bet; the goal is to mitigate risk, increase certainty.” In other words, companies should use hedges to stabilize budgets, not to gamble on prices.

Hedging Strategies Moving into H2 2025

Global growth and trade jitters have cooled demand expectations, even as supply-side shifts (China policy, decarbonization) keep markets tight in spots. In this environment, proactive hedging is critical. By employing a mix of hedge fund strategies like futures, options, swaps and smart contract terms, procurement teams can lock in most of their costs and avoid budget-busting surprises. As experts note, robust hedging brings “price predictability” and protects margins.

Discover how MetalMiner Insights empowers you to optimize metal sourcing for maximum cost savings and ROI. Learn more.