Iron Ore Defies the Odds: Prices Surge After Tariff Rollbacks

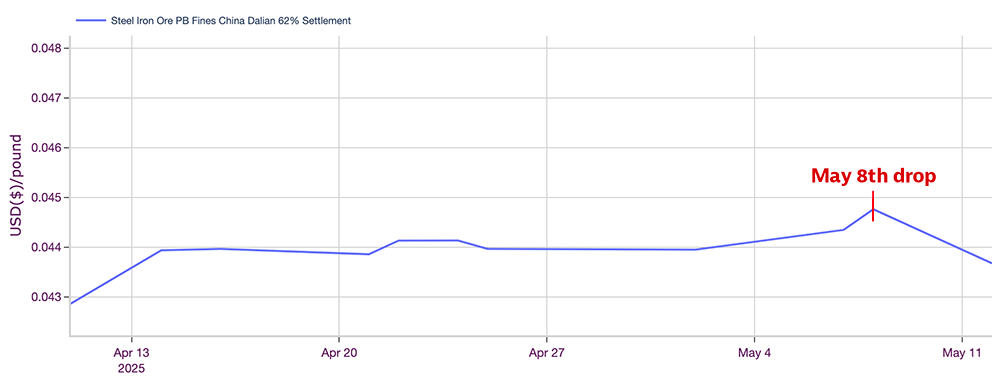

The past week or so has seen quite a yo-yo ride for global iron ore prices. Ore futures, including the most-active September contract on China’s Dalian Commodity Exchange (DCE), dropped by about 2% on May 8. The reasons for this were twofold: the likely consequences of the U.S.-China trade tariff war, and a demand slowdown in China.

The drop also coincided with an announcement by the People’s Bank of China cutting the seven-day reverse repurchase rate. The week ended tamely enough. But come Monday, May 12, iron ore futures bounced back after the U.S. and China announced a 90-day relief in the tariffs.

Make sense of shifting global trends, tariffs and economic pressures impacting steel and other metal prices by signing up for MetalMiner’s weekly newsletter.

Tariff Pause Sees Significant Price Changes

Following the announcement, the September contract on the DCE went up 7.185% to roughly US $99.2 (718.5 yuan) per ton. Coke and coking coal futures also saw gains, rising 0.75% and 0.68% to about $203 (1,471.5 yuan) and $123 (889.5 yuan) per ton, respectively.

Meanwhile, rebar and HRC futures on the Shanghai Futures Exchange climbed over 1.5%, reaching about $426 (3,082 yuan) and approximately $445 (3,220 yuan) per ton. Finally, wire rod rose 1.39% to about $474 (3,428 yuan), and stainless steel futures increased 1.34% to about $ 1781 (12,890 yuan) per ton.

Looking to track and predict industrial metal price trends? Subscribe to MetalMiner’s Monthly Metals Index Report and leverage it as a valuable resource for monitoring and forecasting price movements across 10 different metal industries, supporting your strategic sourcing efforts.

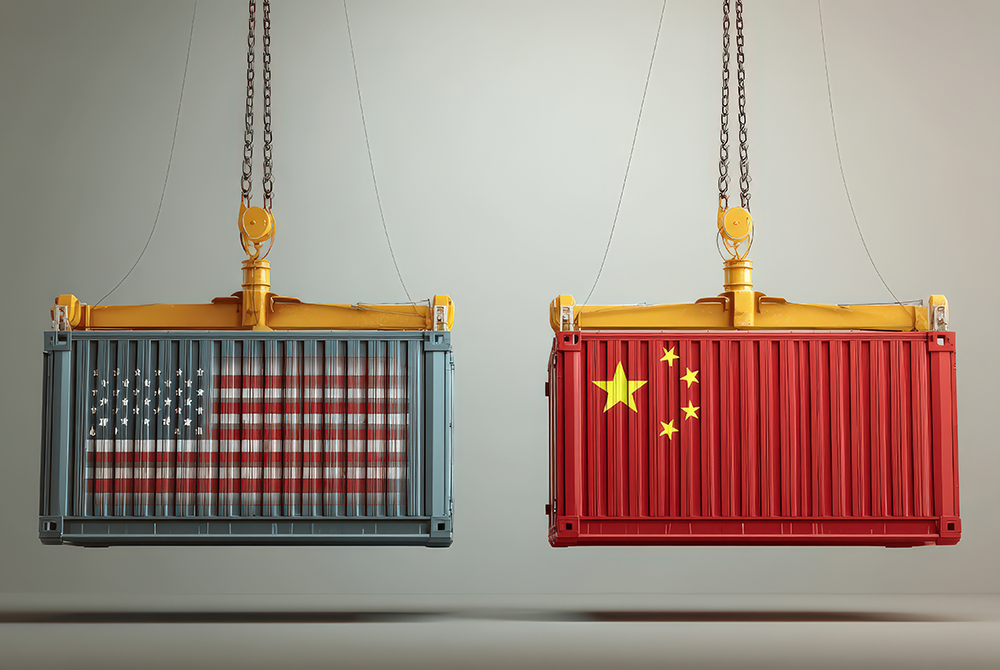

Details and Effects of the Tariff Pause

Both the U.S. and China have agreed to temporarily roll back tariffs on each other’s goods. For the first 90 days, the U.S. will cut tariffs on Chinese imports from 145% to 30%. In its response, China has agreed to reduce duties on U.S. goods from 125% to 10%. According to some reports, traders at the DCE were actively selling following the development, with a slight uptick in speculative activity. Meanwhile, steel mills stayed cautious, buying only as necessary and generally taking a “wait-and-see” approach.

This surge in ore futures prices caught some by surprise, as many had anticipated a price climbdown after the announcement of the reduced tariffs, similar to what happened to gold futures. The latter index dipped after the 90-day reduced tariffs were announced, increasing risk-on sentiment in markets. Altogether, continuous gold futures on the New York Mercantile Exchange fell 3.75% to US $3,218.70 a troy ounce in European morning trading.

Iron Ore: A Different Story

As reported by MetalMiner a few days ago, iron ore prices have remained surprisingly steady amid a season of tariffs and countermeasures. So far, the critical raw material has largely resisted the market volatility affecting other sectors.

Despite the ongoing threat of tit-for-tat trade duties, futures prices on some exchanges have even edged up recently, defying expectations in the face of mounting tariff pressures. So, where historic records show that a reduction in tariffs might seem like it should lead to lower prices, in the case of iron ore, the current-period market dynamics are so complex that futures prices actually went up.

Are you on the hook for communicating your company’s steel performance to the executive team? See what should be in that report!

What’s Behind the Resilience in Iron Ore Prices?

Some analysts believe investor sentiment could be a key reason for the surprising shift in iron ore prices. They argue that the market not only reacted to the tariff cut itself, but also to the broader implications of such a move.

Since tariffs between the U.S. and China were a major source of uncertainty, reducing them signals greater stability in global trade. This has led to a bullish outlook among traders, who anticipate higher demand as steel production picks up.

Additionally, lower tariffs reduce costs for steelmakers, which may encourage them to purchase more iron ore to ramp up production. The combination of positive sentiment and improved demand expectations is keeping iron ore futures on an upward trajectory.

All Eyes on China for the Time Being

Compared to most other commodities, iron ore has held its own despite the geopolitical volatility of the past quarter, often trading in a narrow band. As this website reported, iron ore futures on the Singapore Exchange were trading at US $99.35 per metric ton in May 2025, rebounding from a seven-month low of US $96.20 on May 1. Since October 2024, prices have held within a steady range of US $96.20 to US $110.55, defying forecasts of significant volatility.

Adding to the stability is the fact that China’s steel production data continues to show strength rather than decline. Iron ore import data for the first quarter of 2025 totaled 285.31 MT, down 7.8% year-over-year. Analysts attribute some of this to supply issues rather than weakening demand. This includes factors like bad weather in Australia, a top supplier.

Encouragingly, signs of recovery are beginning to surface. Kpler data indicates April imports are on track to reach around 101.4 MT, up from 93.97 million tons in March. This rebound is consistent with seasonal trends, as Chinese buyers typically restock ahead of the summer construction season.

Want to identify which parts of your metal buy are most affected by tariffs? Insights SV pinpoints the components with the highest tariff exposure, guiding your profits.