The Copper Monthly Metals Index (MMI) moved sideways, with the overall copper price falling 2.0% from October to November. While volatility remains a risk, copper prices traded in a tight range throughout October. In general, prices traded just above the low found in late September. Copper was also among multiple base metals who’s prices move […]

Category: Metal Prices

Renewables/GOES MMI: Political Factors Yank Renewable Energy in Different Directions

November’s Renewables MMI (Monthly MetalMiner Index) traded sideways for the first time since June. The index rose by 1.56% month-over-month. This primarily resulted from GOES (grain-oriented electrical steel) rising in price. Meanwhile, other renewable energy resources, like neodymium and Japanese steel plate, traded sideways. Silicon remains in particularly high demand, but supplies remain pinched along […]

Rare Earths MMI: The World Races to Find Alternatives to Chinese Rare Earths

The November Rare Earth MMI (Monthly MetalMiner Index) broke its short-term downward trend and traded sideways month-over-month. Altogether, the index dropped a modest 0.97%. Rare earths managed to hold their steady trend over most of 2022. This was due to high demand for EV’s, electronics, and rare earth magnets. Indeed, the global market for all […]

The Robust US Dollar Puts a Damper on the Gold Price Trends in India

October to December is always an interesting quarter in India, especially regarding gold and silver prices and their associated demand. For several reasons, this October is proving to be a less-than-ideal month for gold dealers around the subcontinent. So far, the gold price trend continues to decline when compared to the previous months. India is […]

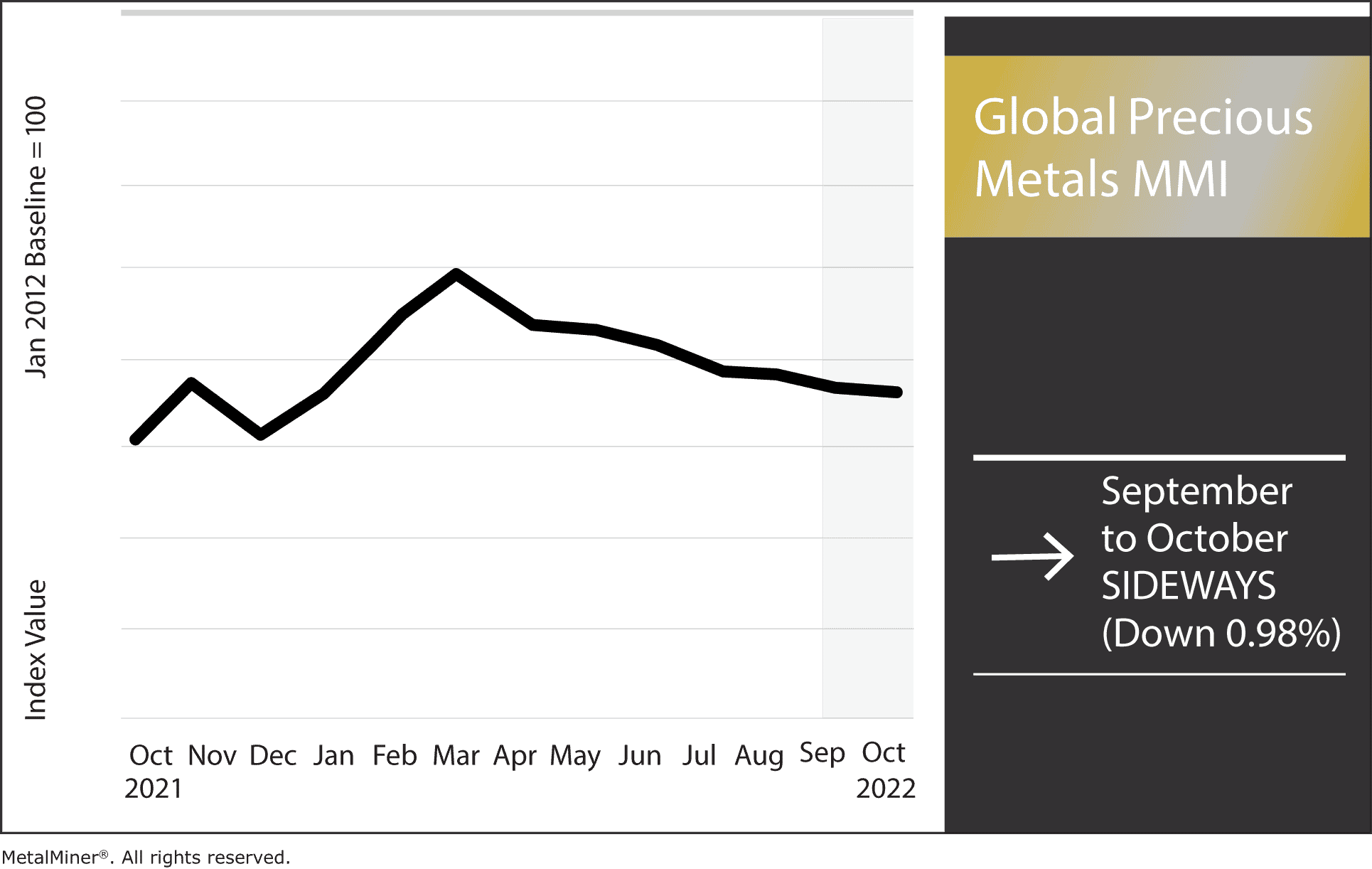

Global Precious Metals MMI – Are High Interest Rates Causing Precious Metal Investment Risks?

October’s Global Precious Metals MMI (Monthly MetalMiner Index) traded sideways, falling slightly by 0.98%. The index held higher than other October MMI’s (a majority of which fell in price) due to high interest rates, recession fears, and slowing economic activity. Due to these the current economic climate, investors sought out precious metals for investment reasons […]

Copper MMI: Copper Prices Move Sideways in Tight Range

The October Copper Monthly Metals Index (MMI) fell 5.59% from September to October, with all components experiencing declines. Still, future copper prices face a wide range of challenges. Copper prices continue to show signs of short-term consolidation following a brief rebound that stalled in late August. Meanwhile, the bottom found in mid-July and the peak of […]

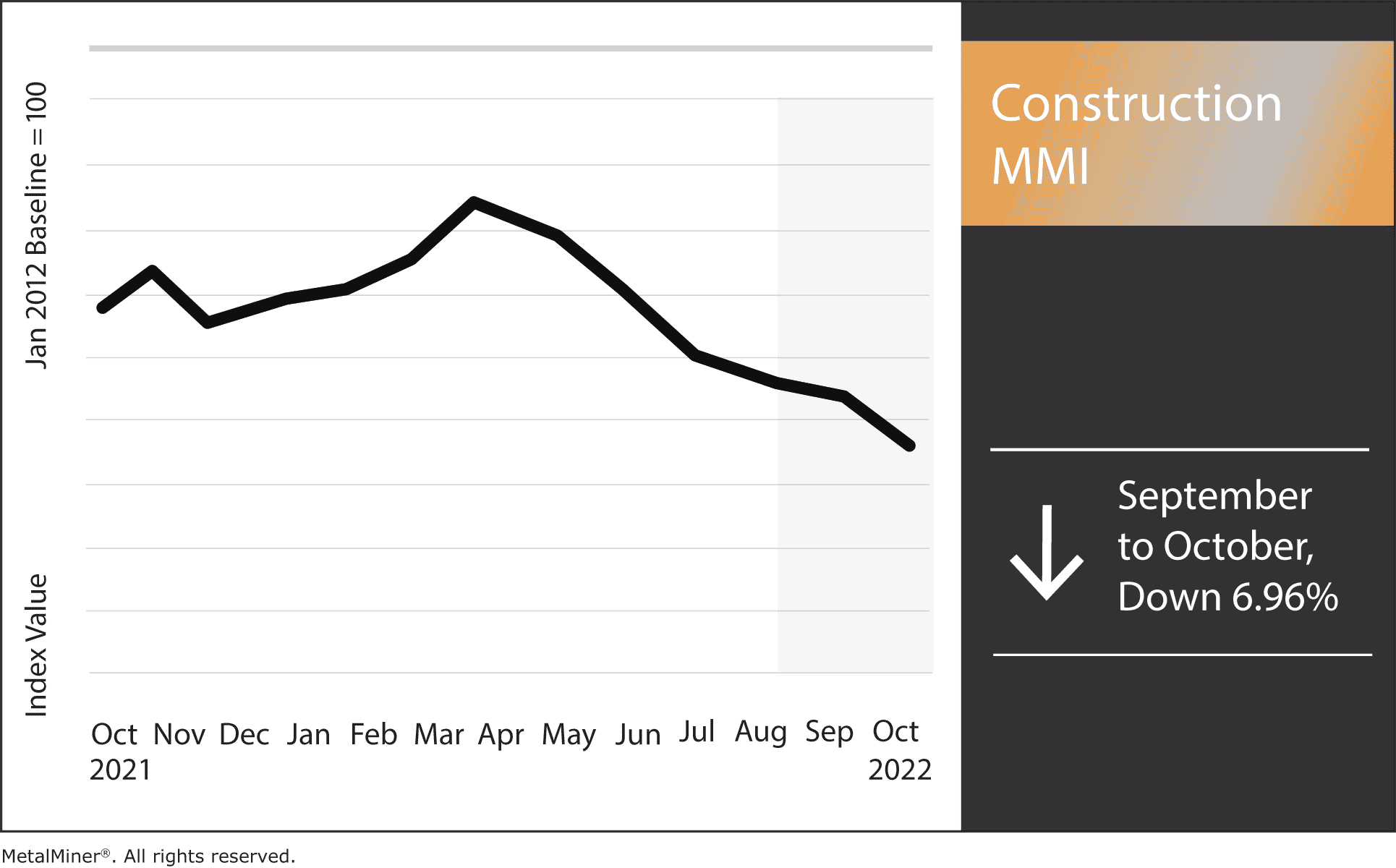

Construction MMI: High Interest Rates Haunt US Construction

The October Construction MMI (MetalMiner Monthly Index) dropped 6.96%. Not only did the construction cost index fall recently, but high interest rates have seriously impacted the US housing construction sector. Billings are on the rise in both the US commercial construction sector and on the consumer end. Meanwhile, new housing construction continues to cool due […]

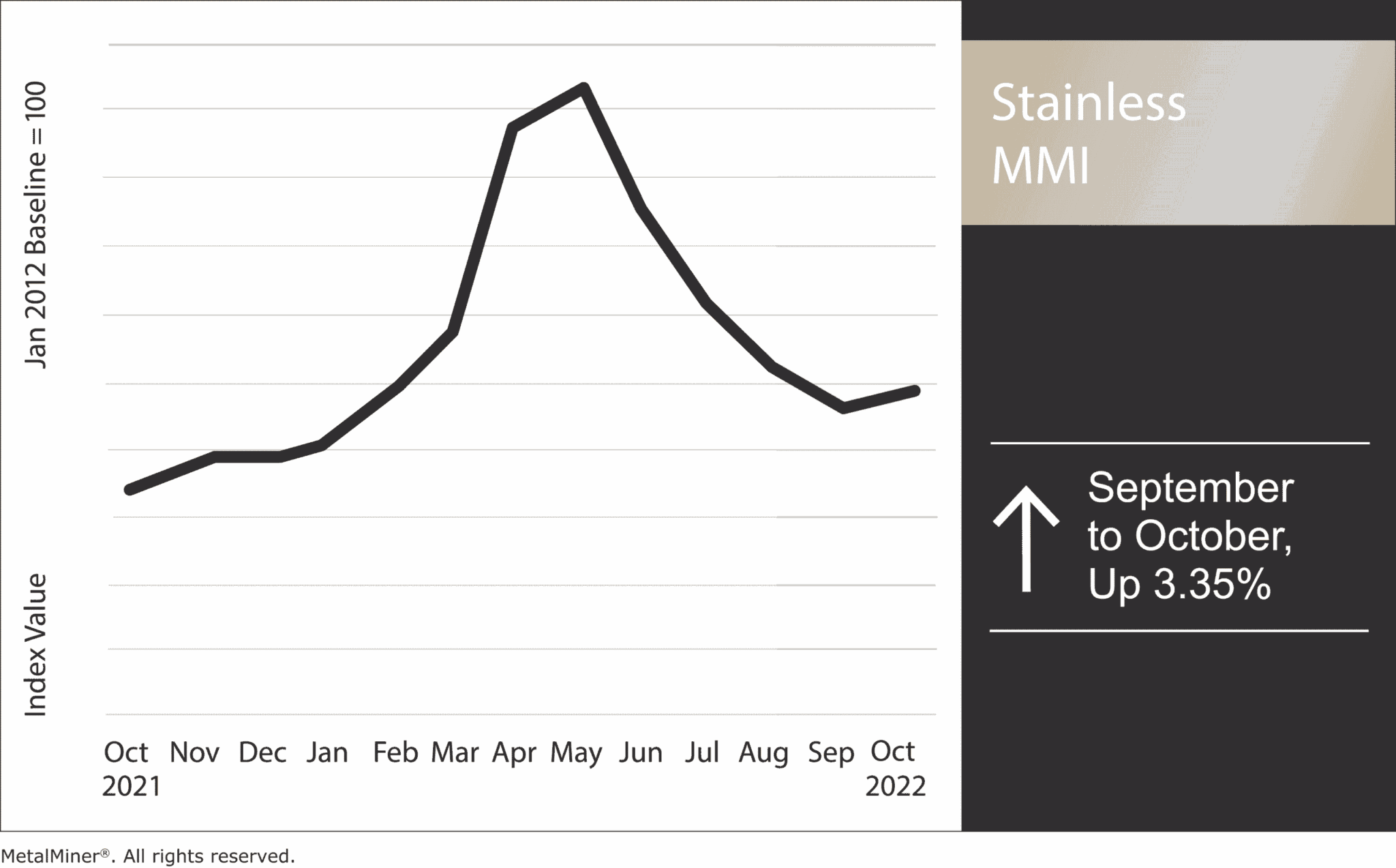

Stainless MMI: Nickel Prices Down After Bullish Month

By: Nichole Bastin and Katie Benchina Olsen The Stainless Steel Monthly Metals Index (MMI) rose 3.35% from September to October. Last month, nickel prices traded up with a strong rebound during the first three weeks. However, prices soon fell back within range. These declines continued until the opening days of October, with prices mainly remaining […]

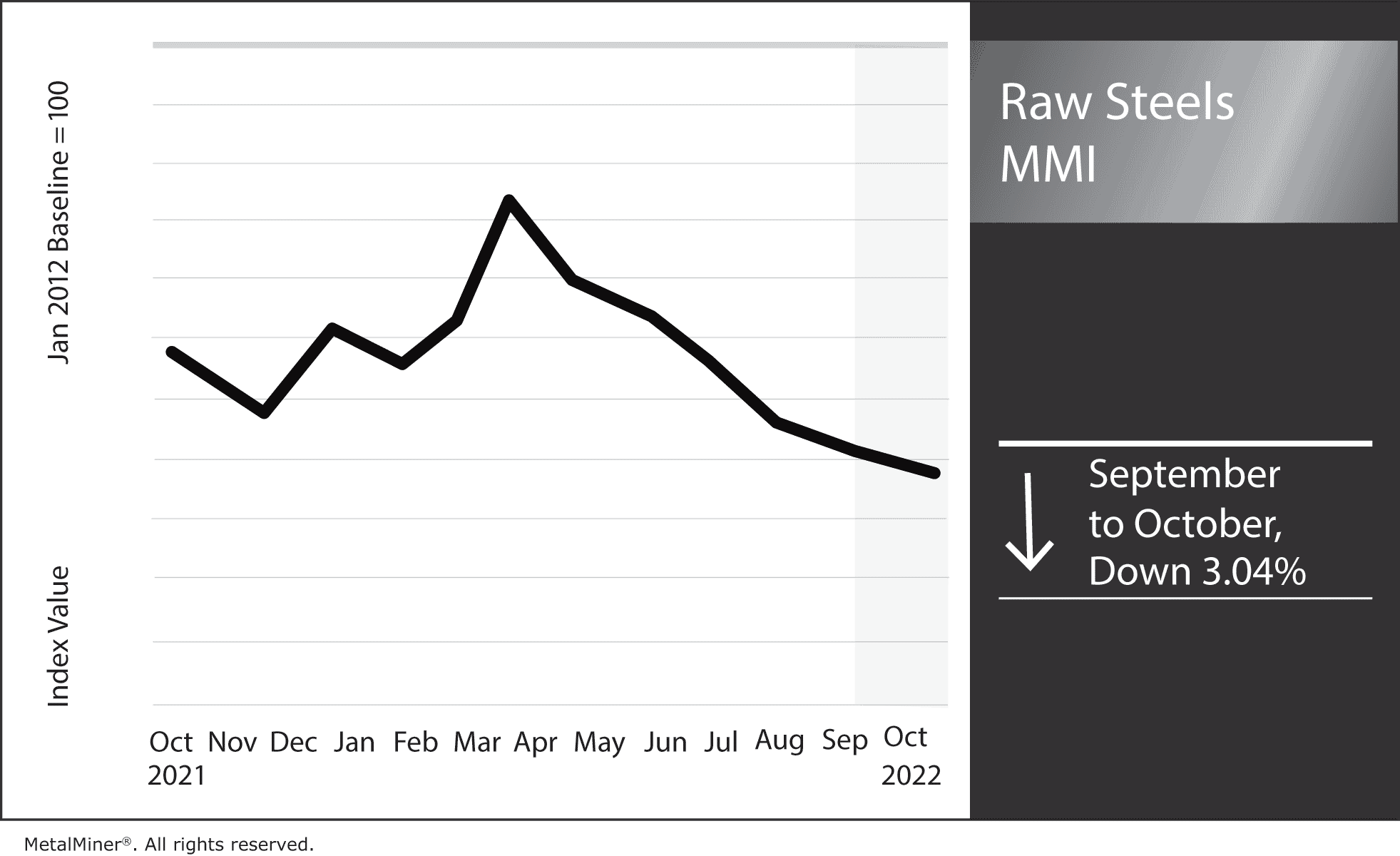

Raw Steels MMI: Steel Prices Flatten, Slowly Edge Downward

The Raw Steels Monthly Metals Index (MMI) fell by 3.04% from September to October. U.S. steel prices continued to drop throughout September. However, declines for both hot rolled coil prices and cold rolled coil prices slowed to a sideways trend. Plate prices, which have shown the most strength of steel prices, traded down for the […]

Recession Fears Ramp Up Pressure on Industrial Metals Market

Experts agree that a global recession is now a foregone conclusion. Though they continue to argue about the potential extent of the damage and which countries may evade repercussions, few see any way to avoid a downturn. As usual, one of the first markets to react to the growing concern is industrial metals. Back on […]