Market sources report that hot rolled coil steel prices in northern and southern Europe continued to decline in recent weeks due to slowing economies in Europe as well as overcapacity. “I’m a little scared about Germany,” one trader told MetalMiner, referring to that country’s current economic situation. Germany’s economy is the largest in the European […]

Category: Metal Pricing

Copper MMI: Copper Prices Rise to Highest Level Since April Amid Supply Concern

By mid-March, copper prices hit their highest level since April 2023. Prices previously found a bottom in early February before strong upside momentum saw them topple previous peaks within their long-term sideways trend. While prices clocked a moderate1.74% month-over-month decline throughout February, they rose 4.12% during the first two weeks of March. Overall, the Copper […]

Global Precious Metals MMI: Gold Sees a Strong Rally

Once again, the Global Precious Metals MMI (Monthly Metals Index) failed to exhibit strong bearish or bullish pressure. The index remained sideways throughout February, budging down a mere 0.65%. Despite this, some bullish pressure did seep into precious metal prices at the beginning of March, when numerous precious metals began to rally. Gold prices, in […]

Raw Steels MMI: Mills Lob Price Hikes at Bearish Steel Prices

The Raw Steels Monthly Metals Index (MMI) moved sideways amid bearish steel prices, with a modest 1.75% increase from February to March. U.S. flat rolled steel prices stayed bearish over the past few weeks. Meanwhile, HRC prices remained 22% beneath their peak at the close of 2023 as they search for a new bottom. However, […]

Construction MMI: Potential Manufacturing Boom Could Impact Steel Prices

Month-over-month, the index experienced little movement. Overall, the Construction MMI (Monthly Metals Index) moved sideways, inching down just 1.2%. Steel prices moving downward placed some bearish pressure on the index. However, several significant factors continue to press on construction from both a bearish and bullish standpoint, including the Fed holding off on adjusting interest rates, […]

Automotive MMI: Automotive Market Improves, but Bears Show Up for Steel Prices

Month-over-month, the Automotive MMI (Monthly Metals Index) dropped by 3.03%. While the automotive market continued to improve overall, bearish pressure on certain steel prices like hot-dipped galvanized steel, ultimately forced the index down. Experts anticipate this bearish pressure to continue impacting both steel prices and automotive manufacturing in the short term. Despite this, the automotive […]

Rare Earths MMI: Is China Moving Down the Rare Earths Totem Poll?

The Rare Earths MMI (Monthly Metals Index) experienced a pretty significant drop month-on-month, falling 24.73%. Save for cerium oxide, all components of the index either fell or moved sideways. Weaker than anticipated downstream demand ended up hitting certain metals related to rare earth magnets particularly hard, causing a plummet in the index. Another significant factor […]

Aluminum MMI: Aluminum Prices Sideways After U.S. Smelter Closure

Following a 4.7% month-over-month decline during January, aluminum prices fell an additional 1.9% throughout the first half of February. Despite these declines, aluminum prices continued to trade in their long-term sideways range. Meanwhile, the Midwest Premium also remains consolidated, with prices retracing to the downside following a short-lived bounce at the end of January. Overall, […]

Global Precious Metals MMI: Precious Metal Prices Edge Further Down Month-on-Month

After almost a year of sideways movement, the Global Precious Metals MMI (Monthly Metals Index) broke its trend, declining by 4.71%. Despite the break in sideways movement for precious metal prices as a whole, most individual commodities still lack strong bullish or bearish movement as they move through Q1. Most gold and other precious metals […]

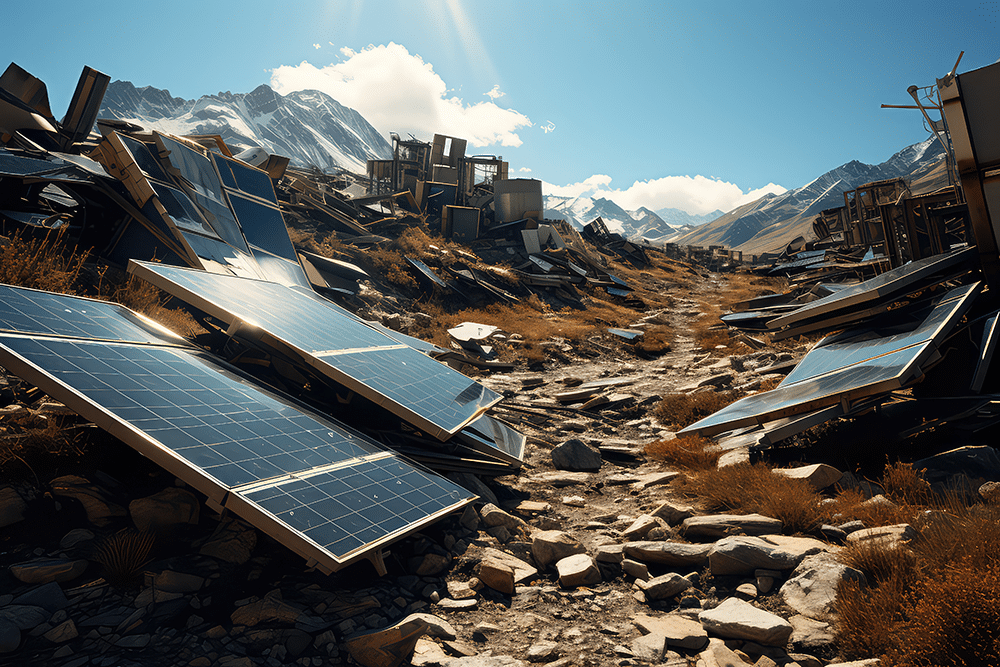

Renewables/GOES MMI: The “Dirty” Business of Disposing of Solar Panels

Numerous factors continue to pull at the Renewables MMI (Monthly Metals Index) as it moves through Q1. This past month, the index largely moved sideways, only exhibiting a slight upward movement of 1.66%. Meanwhile, renewable energy news indicated that metals like cobalt and silicon could remain in oversupply for some time. Moreover, expanding mining operations […]