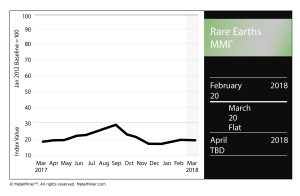

The Rare Earths MMI (Monthly Metals Index) held steady, notching a reading of 20 for our March MMI.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Chinese yttrium dropped slightly, while terbium metal picked up in price.

Europium oxide also dropped slightly, while dysprosium oxide picked up an extra dollar per kilogram.

New Toyota Magnet Not Dependent on Some Rare-Earth Minerals

According to a report by Ars Technica, a new magnet developed by automaker Toyota will not be dependent on some key rare-earth minerals.

Toyota announced it had invented a magnet — for application in electric vehicles — that uses much less of the rare-earth mineral neodymium. According to Toyota, it had developed “the world’s first neodymium-reduced, heat-resistant magnet.”

Of course, cost is a major restraining factor when it comes to electric vehicle (EV) growth. Materials needed for EV batteries, like neodymium, are costly, and many battery makers have sought to reconfigure the percentages of metals used in their batteries to phase out more cost-prohibitive materials (like cobalt, for example).

In addition to reducing the use of neodymium, the new magnet also completely phases out two other rare earth minerals.

“The newly developed magnet uses no terbium (Tb) or dysprosium (Dy), which are rare earths that are also categorized as critical materials necessary for highly heat-resistant neodymium magnets,” according to the Toyota statement. “A portion of the neodymium has been replaced with lanthanum (La) and cerium (Ce), which are low-cost rare earths, reducing the amount of neodymium used in the magnet.”

According to the announcement, the new magnet reduces the amount of neodymium used by as much as 50%.

Europium Market to Hit $308.9M by 2025

The global europium market is set to hit a value of $308.9 million by 2025, according to a recent report by Reportbuyer.

According to the report, consumer electronics, automotive, semiconductors, and energy and mining are the sectors leading the charge in the growth of europium.

Want to see an Aluminum Price forecast? Take a free trial!