As markets prepare for more bad steel news, ArcelorMittal plans to idle one of two blast furnaces at its Fos-sur-Mer site in southern France. The Luxembourg-headquartered group stated on November 4 that the move was a direct response to current market conditions. “In a sharply deteriorated macro-economic context, coupled with a major impact from soaring […]

Category: Supply & Demand

Potential Railroad Strike Threatens Metal Logistics

Roughly 1/3rd of all US exports rely on freight transport. Food, wood, coal and metal all move across the US’ 140,000 miles of freight routes. Because of this, many US goods providers are worried about the possibility of yet another major railway strike. In September, two of the 12 major US railway unions rejected negotiations, […]

Metal Price Trends: Tin May Rebound, While Zinc Could Experience Additional Declines

Since the beginning of 2022, tin prices have steadily declined. Indeed, such was the case for many metal prices after the March peak. However, it’s possible tin could see a reversal in the long term. As it begins to reach lower support ranges indicated by September 2020’s low, we could see tin start to push […]

Iron Ore Demand Remains Strong, But Will It Last?

Concern over China’s economy notwithstanding, iron ore remained relatively stable in September and October. This is of note because historically, these months are one of China’s highest peak demand periods. That said, whether the iron ore price will continue to weather the economic storm remains a point of intense debate. The Many Factors Affecting the […]

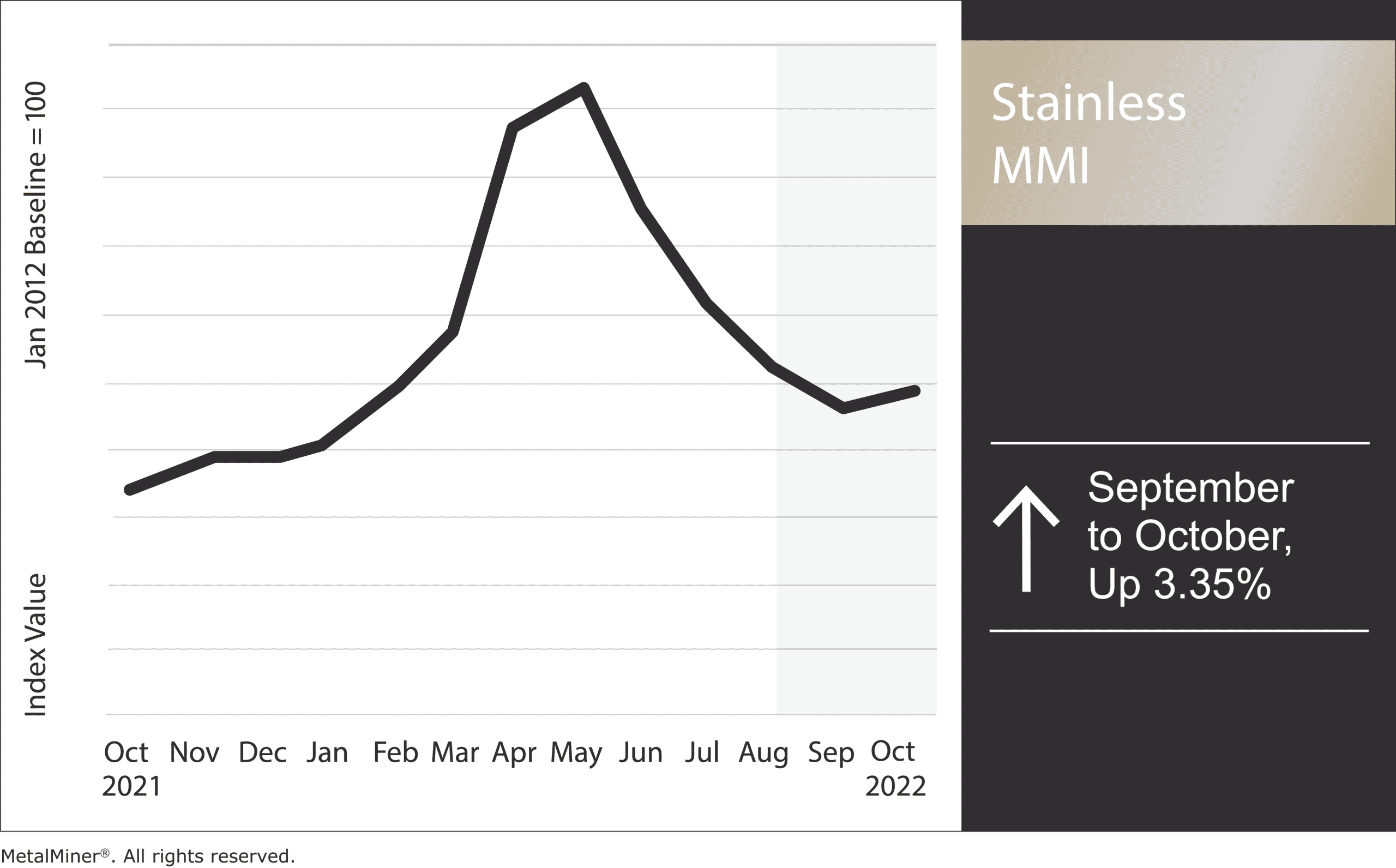

Stainless MMI: Nickel Prices Down After Bullish Month

By: Nichole Bastin and Katie Benchina Olsen The Stainless Steel Monthly Metals Index (MMI) rose 3.35% from September to October. Last month, nickel prices traded up with a strong rebound during the first three weeks. However, prices soon fell back within range. These declines continued until the opening days of October, with prices mainly remaining […]

Aluminum MMI: Aluminum Prices, Physical Delivery Premiums Decline

After substantial declines throughout September, this month’s aluminum prices appear strong compared to other metals. Aluminum prices hit a bottom in late September, but rebounded during the first week of October. Should prices continue to break out of range upward, it would indicate a halt of the downtrend amid building bullish sentiment. Despite the recent […]

Automotive MMI – Car Demand Growing, but Steel Supply Strained

The MetalMiner Automotive MMI (Monthly MetalMiner Index) dropped substantially in October, dipping by 9.08%. Manufacturing limitations due to energy shortages and smelter shutdowns remain the ongoing trend in car manufacturing. However, consumer demand for cars, especially in the US, still holds firm. This leaves many in the automotive industry trying to find a balance between […]

Recession Fears Ramp Up Pressure on Industrial Metals Market

Experts agree that a global recession is now a foregone conclusion. Though they continue to argue about the potential extent of the damage and which countries may evade repercussions, few see any way to avoid a downturn. As usual, one of the first markets to react to the growing concern is industrial metals. Back on […]

Aluminum Market After Another Fed Rate Hike

Aluminum supply continues to shrink thanks to smelter shutdowns caused by ongoing energy shortages. Aluminum prices enjoyed a brief rebound following the Fed’s latest rate hike of three-quarters of a point. However, in the short term, aluminum prices remain in a downward trend. Earlier this week, MetalMiner noted how smelter shutdowns in China and Europe […]

Aluminum Supply Suffers From Industrial Shut-Downs

Thing may appear better in China than they are, at least as far as the country’s metals and minerals markets are concerned. However, China still remains the go-to destination for European steel and aluminum supply. Energy-sensitive European factories and aluminum smelters remain stranded due to the ongoing Russian-Ukrainian war. Western Europe’s gas and electricity supplies […]