The Rare Earths MMI (Monthly Metals Index) rose considerably over the past month, climbing by a total of 7.05%. The primary factor influencing the rare earth price forecast over the past several months was zero-COVID. Now, the focus is on those restrictions being lifted. Currently, China reports that the country’s COVID cases are dropping. China’s […]

Category: Supply & Demand

Grain Oriented Electrical Steel Demand Expected to Keep Growing

No matter where in the world you go and what energy source you’re using, energy transfer requires transformers. Be it a nuclear power facility, a power plant running on natural gas, a wind field, or a plant running on hydropower. The energy generated in these facilities cannot light up homes, businesses, and schools without transformers. […]

Is the Face of the Steel Industry Changing?

After weathering a bumpy ride throughout 2022, one of the world’s most traded commodities still isn’t out of the woods just yet. Though steel prices rose across the board over the past few weeks, mills around the world remain shuttered, and demand continues to fluctuate. Zero-COVID and limited energy across places like Europe are just […]

China’s Reform Commission Threatens Crackdown on Iron Ore Hoarders

The global iron ore price may be in for a bit of a ride. Sector analysts foresee high price volatility in the first months of 2023, mainly due to the increasing number of coronavirus cases in China. Adding fuel to the fire is the fact that the government there has warned it will be “paying […]

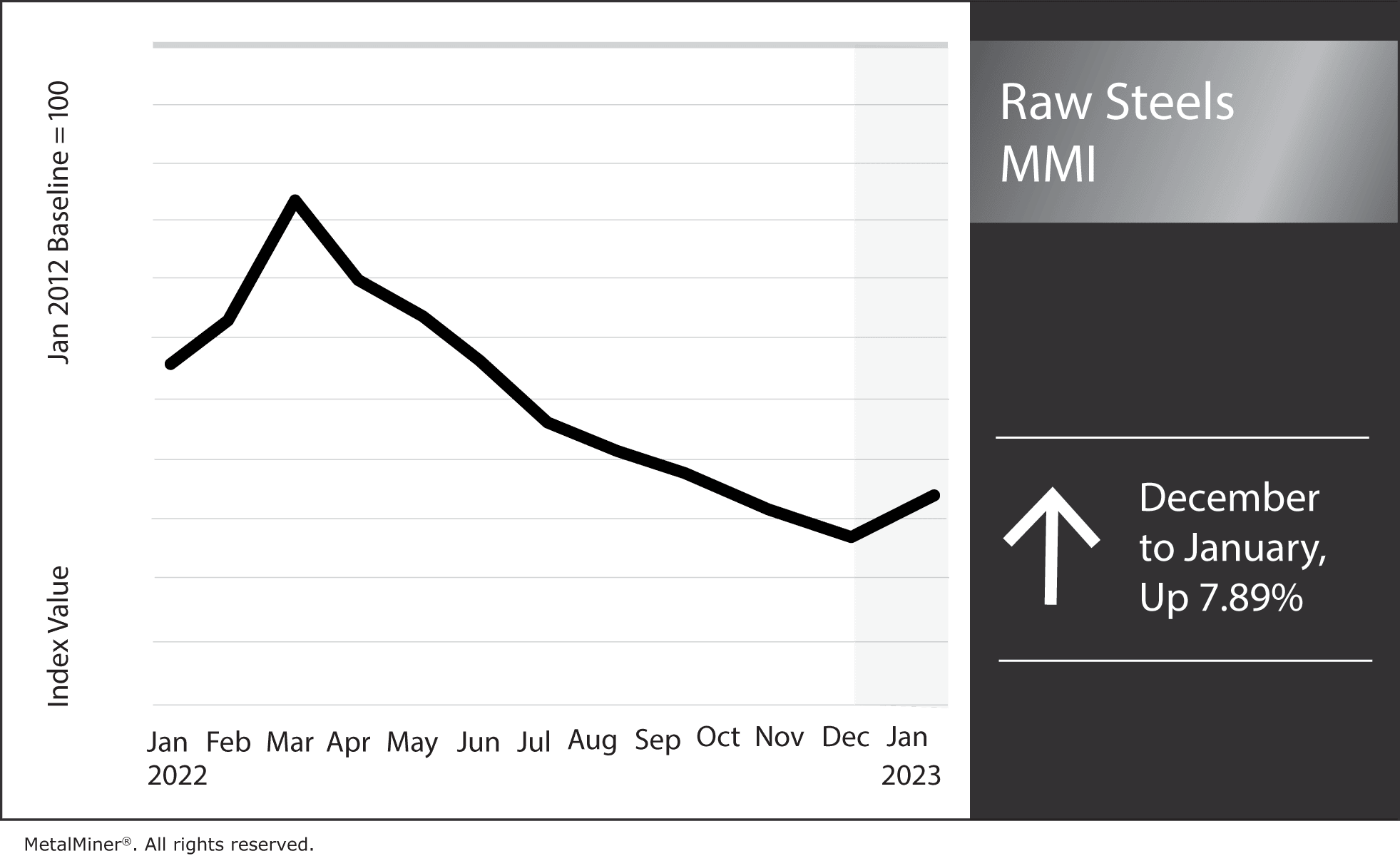

Raw Steels MMI: U.S. Steel Prices Find Bottom, Begin Rising

U.S. steel prices hit a bottom at the beginning of December, then began to climb. Hot rolled coil prices rose over 8% from their December low. Meanwhile, plate prices traded down for the first time since September. Overall, the Raw Steels Monthly Metals Index (MMI) rose by 7.98% from December to January. MetalMiner’s free weekly […]

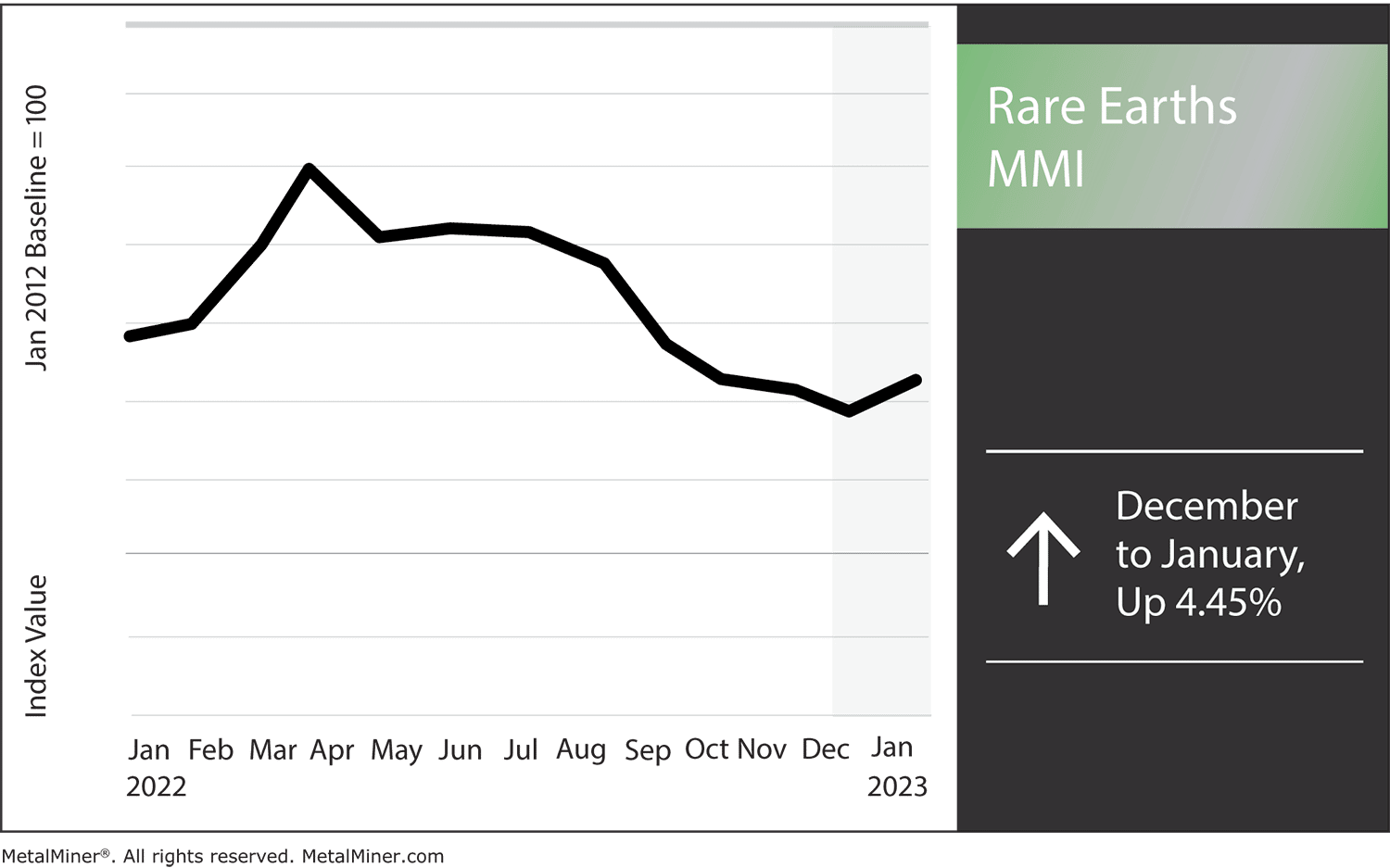

Rare Earths MMI: Surge in China’s COVID Cases Impact Prices

The Rare Earths MMI (Monthly MetalMiner Index) jumped slightly more than in the past six months, rising 4.45%. All month, geopolitical factors, mostly involving China, significantly impacted the index. For instance, production still proved low in the wake of zero-COVID. Then, once zero-COVID restrictions were lifted, the spike in cases across China kept the drag […]

Copper Price Trends: 2022 Review

Looking at 2022 copper price trends, the market was nearly as volatile as metals like nickel and aluminum. Currently, copper prices are attempting to break prior highs but have yet to get there. As copper taps into short-term resistance levels, the possibility of a pullback in price appears more and more likely. Meanwhile, the copper […]

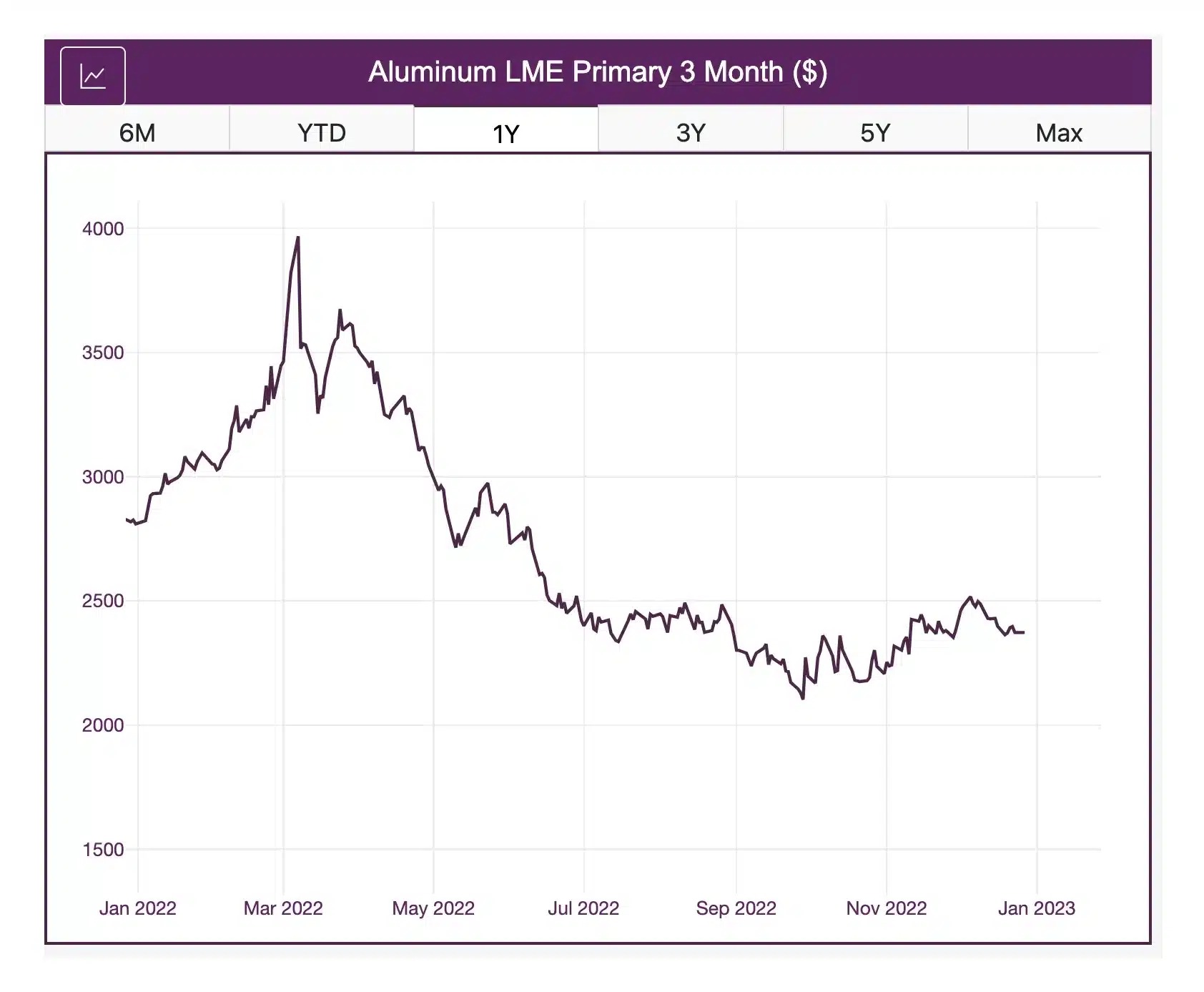

Aluminum Prices and Global Market: a 2022 Review

Aluminum prices reached a high price of almost $4,000 per metric ton on the LME primary 3-month in 2022. However, there were plenty of sales for roughly half that amount, attesting to the wide range of the 2022 index. When March’s rally ended, prices began a decline that resulted in them hitting a yearly low […]

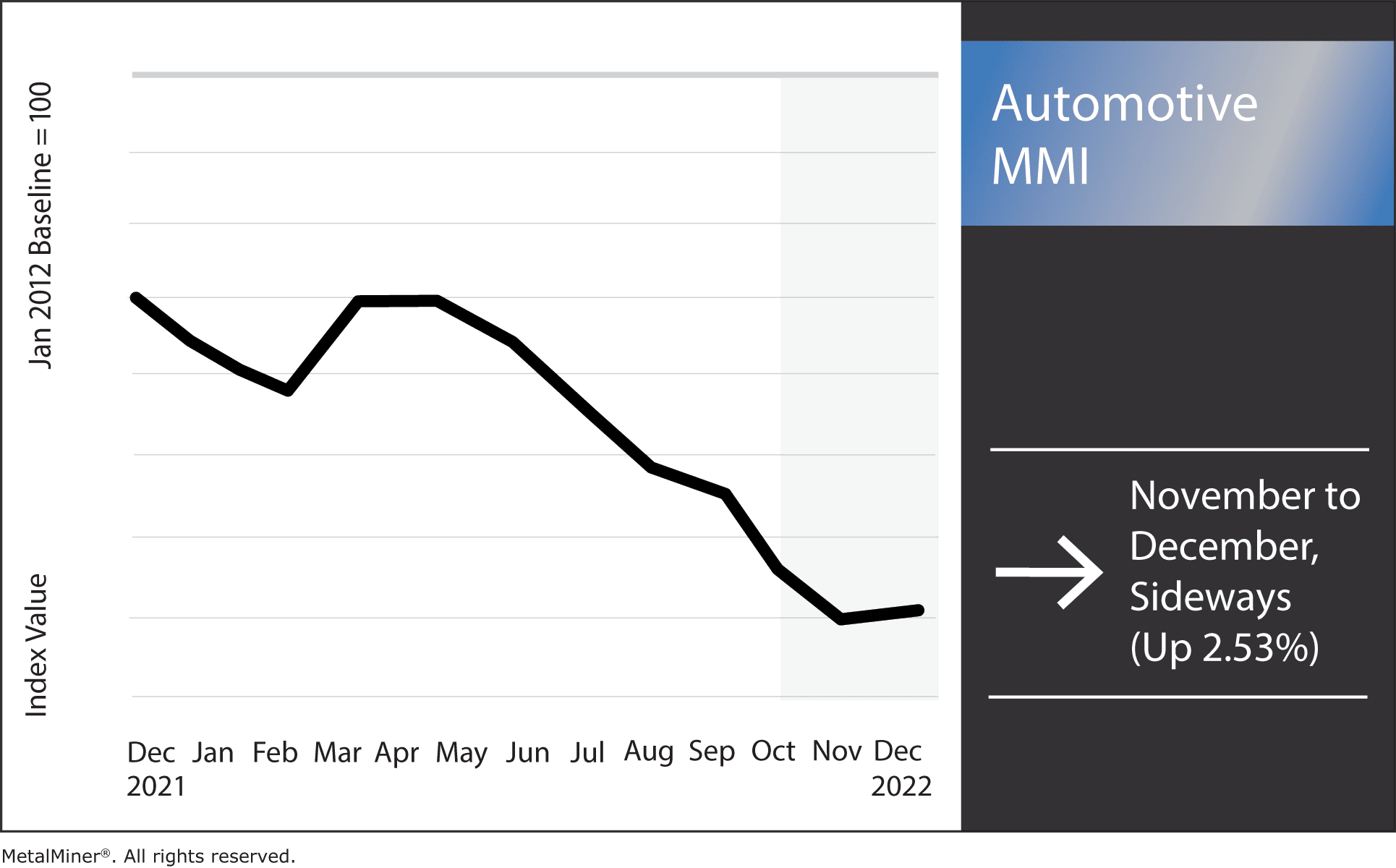

Automotive MMI: Interest Rates Move Up, Consumer Demand Moves Down

The Automotive MMI (Monthly MetalMiner Index) finally broke its downward trend and traded sideways, inching up by 2.53%. Meanwhile, myriad factors continue to pressure metal prices. The demand for vehicles among consumers remains strong. However, low inventories throughout most of 2022 placed a huge strain on the index. Without parts, the manufacturing of new vehicles […]

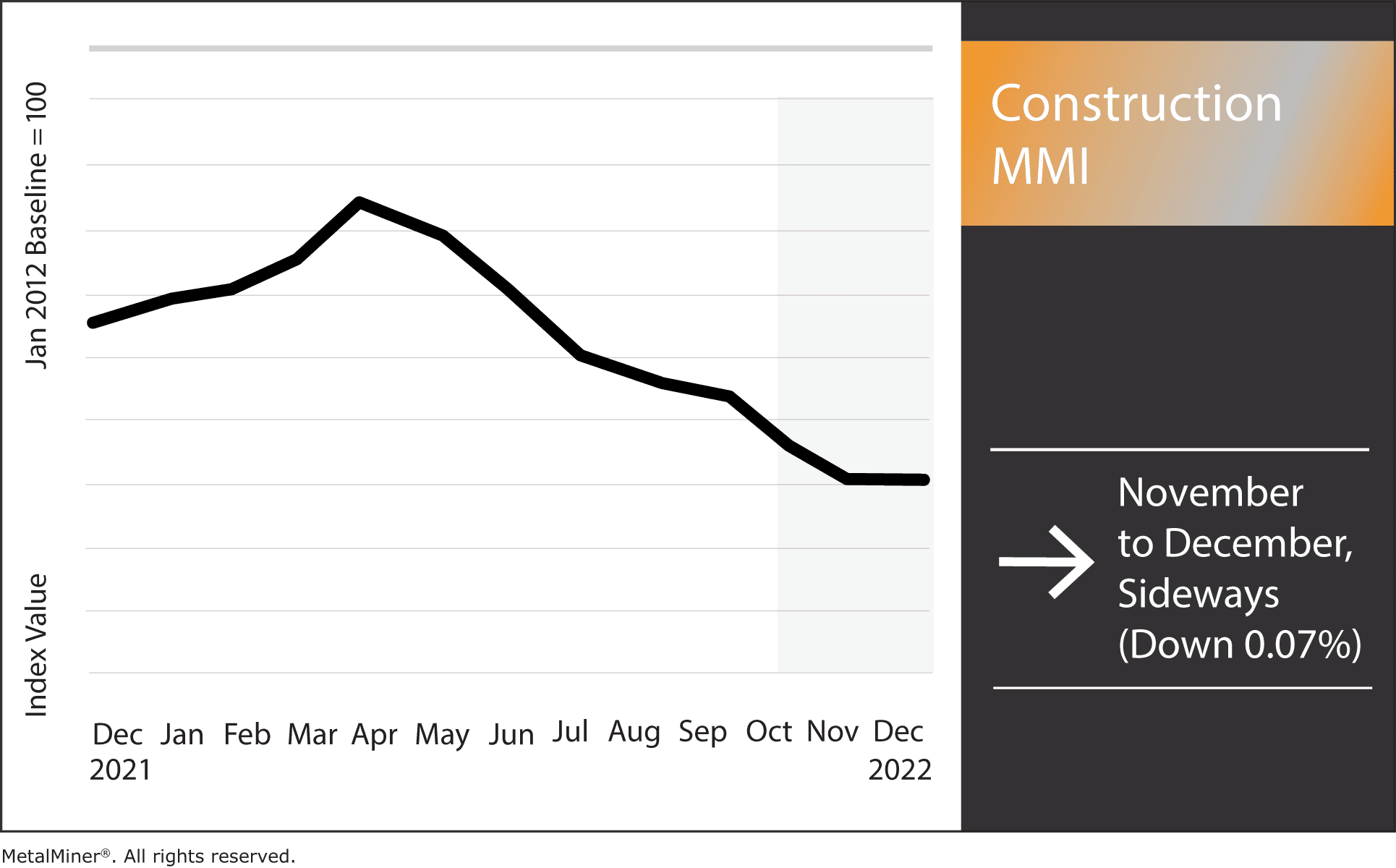

Construction MMI: Aluminum Plate and Steel Rebar Reverse

The Construction MMI (Monthly MetalMiner Index) flatlined sideways, moving downward by a meager 0.07%. The overall volatility of metal prices remains a primary challenge to the index. The near-stationary index contrasts starkly with the downward 2022 trend. Aside from fluctuating metal prices, the industry also had its integrity tested by several other problems. These included […]