Nickel Market Volatility Leaves Buyers Confused

November marked a rocky roller coaster for many metal prices, and the nickel price index was no exception. After the sharp rally at the beginning of the month, nickel prices eventually bounced back down. At the time, MetalMiner noted that the rally would prove short-term at best and didn’t indicate a true reversal.

The LME’s decision about whether or not to place sanctions on Russian metal also weighed heavily on the long-term nickel price outlook. Just Wednesday, the LME announced it would scrutinize nickel trading more tightly after the sharp price drop which occurred this past week, bringing an end to the sudden rally.

Given the price plummet, an oncoming nickel squeeze appears more and more likely.

Need advice about when to purchase nickel/stainless steel and when to hold off? Trial MetalMiner’s Monthly Outlook report. Get in-depth, expert advice about how to avoid margin erosion in 2023.

Nickel Price: Where Does the Market Currently Sit?

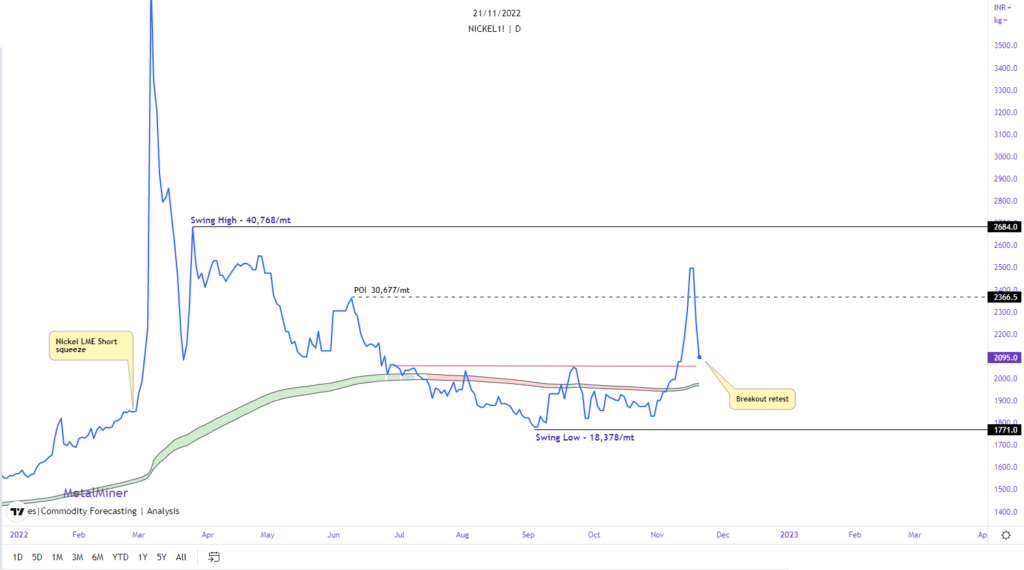

The big question during early November’s price rally was whether or not the nickel price rally was a true reversal. Indeed, many saw the surge as another result of volatile market conditions, which ended up proving true. Over the past week, nickel prices dropped again sharply and then retested, as indicated below:

The LME nickel price action was indicative of several factors. The first being that LME nickel shifted its short-term market structure to bullish after it hit its pre-LME nickel squeeze levels. This is evident in the sharp rally at the beginning of November. Nickel also managed to break through prior highs, which kept prices within a tighter range. In fact, this subsequently melded the index’s long-term resistance and support zones. Lastly, LME nickel began setting up a retracement retest for prices to reintroduce demand at breakout levels.

Now, the nickel price index has nearly returned to where it was before the sharp rally. Over several days, analysts have watched as it came back down and moved toward its prior resistance threshold.

Know how to communicate nickel’s current, volatile market conditions with your executive team so they have the information they need to make critical decisions. Read What Every Executive Team Wants from Procurement.

Fears of Another Nickel Squeeze and Indonesian Nickel Crackdown

After the LME nickel squeeze in March, nickel buyers remain wary of another LME nickel debacle. Indeed, Argus noted this past week that buyers remain uncertain and even confused about where nickel prices might go. In fact, the past month’s volatility shows pretty clear evidence of this.

Adding to the chaos is the fact that Indonesia, a major player in the global nickel market, recently began cracking down on its nickel output and exports. The Indonesian government even proposed creating an organization similar to OPEC in order to monitor Indonesian nickel output. Things like this, along with fears of another LME nickel squeeze, continue to create volatile market conditions in the nickel price index which have yet to solidify.

Do you know the best practices for sourcing stainless and nickel products? Join MetalMiner’s Interactive Fireside Chat – 5 Best Practices: Metal Sourcing Strategies. Click and register for free on LinkedIn or Zoom.

Leave a Reply