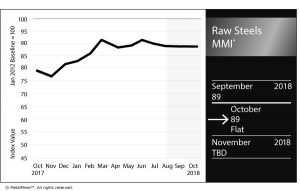

Raw Steels MMI: Subindex Holds at 89 For Third Straight Month

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

This marks the third consecutive month the index has held at 89 points. The current Raw Steels MMI is at May 2018 levels.

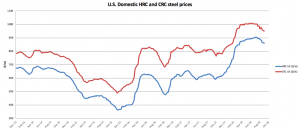

Domestic steel prices have decreased sharply and steel price momentum seems to have slowed. Prices traded lower in September and continued the downtrend in October. Buying organizations may want to remember that domestic steel prices have remained at more than seven-year highs this year.

All forms of steel fell in September. HRC, CRC and HDG showed weaker momentum. Meanwhile, plate prices held stronger in September. Plate prices had the support of low metal availability.

However, plate prices started to lose momentum and decrease at the end of the month.

The recent slowdown in steel prices comes down to historical steel price cyclicality. Domestic steel prices have remained in a sharp uptrend since January 2018. Prices have started to come off slightly but remain higher than last year’s average.

MetalMiner forecasts decreasing domestic steel prices until the budgeting season (November-December) starts. Prices may then find some support and increase.

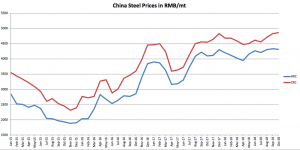

Chinese Steel Prices

So far in October, prices for most forms of Chinese steel have increased. HRC prices traded slightly lower in October, but prices increased sharply in September. It is still soon to talk about a downtrend. In fact, Chinese steel prices have been increasing since April and seem strong.

Strong Chinese domestic demand supports rising steel prices. China announced construction projects in several cities, such as Shenzhen, Suzhou and Changchun. These construction projects will focus on building 44 subway lines totaling up to 1,600 kilometers (or 1,000 miles). This means around 80 million tons of steel will be needed, or 10% of China’s current demand. Some of these steel products will include high-strength steel, reinforced steel and alloy steel sheet.

Chinese steel prices tend to drive U.S. domestic steel prices. Therefore, buying organizations may want to keep a close eye on pricing.

What This Means for Industrial Buyers

Since steel prices remain high, buying organizations may want to follow price movements closely to decide when to commit to mid- and long-term purchases.

Adapting the right buying strategy is crucial to reduce risks. Only the MetalMiner monthly outlooks provide a continually updated snapshot of the market from which buying organizations can determine when and how much to buy of the underlying metal.

For more information on how to mitigate price risk all year round, request a free trial to our Monthly Metal Buying Outlook.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Raw Steel Prices and Trends

The U.S. Midwest HRC 3-month futures price increased this month by 3.56%, moving to $813/st.

Chinese steel billet prices fell this month by 2.72%, while Chinese slab prices fell slightly, dropping 0.62% to $630/mt.

The U.S. shredded scrap price closed the month at $350/st, down from last month.

Leave a Reply