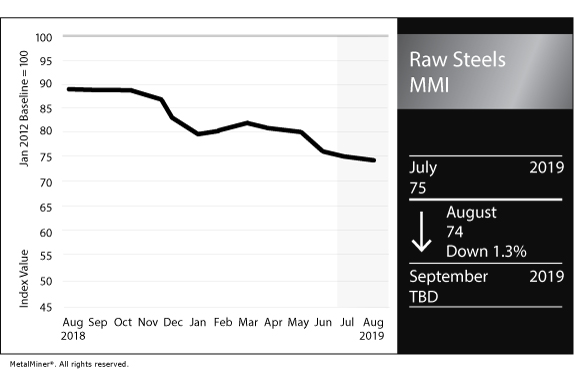

Raw Steels MMI: Mixed Price Movements Lead to One-Point Index Drop

The Raw Steels Monthly Metals Index (MMI) fell one point this month for an August reading of 74.

Small price increases for some metals did not outweigh a few steeper price drops, bringing the index down for the month.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

U.S. steel prices seemed to find a bottom recently (at least for HRC, CRC and HDG). Plate prices stopped dropping and moved sideways with the most recent price changes.

Chinese HRC and CRC Prices Move Sideways

Chinese HRC and CRC prices continued to move sideways this month. However, CRC prices showed more strength, with another modest increase in early August, while HRC prices declined slightly as August started, reversing the recent mild uptick that occurred in July.

U.S. HRC and Chinese HRC Prices Start to Diverge Again

Since peaking in mid-2018, the spread between U.S. and Chinese HRC prices began to narrow. The spread hit its narrowest point in about 1.5 years last month when it dropped to a difference of around $37/st — the third-lowest value since January 2014.

The recent increase in U.S. prices increased the spread once more, but it remains low at just $70/st. This does not yet reflect the recent devaluation of China’s currency back to the range of CNY 7-to-1, which should further increase the steel price spread (unless Chinese prices start to rise to a greater extent than U.S. prices).

Chinese and U.S. CRC prices moved more similarly, overall, with both prices increasing again of late.

Similar to HRC, the spread between prices closed quite a bit, but a larger spread remains for CRC. The spread between the two CRC prices currently measures $158/st, up slightly from around $149/st last month — the lowest values seen since late 2017.

What This Means for Industrial Buyers

The global steel prices tracked by the index once again showed mixed performance this month.

The U.S. Midwest HRC futures spot price increased slightly, turning around after last month’s decline. The U.S. Midwest HRC futures 3-month price increased once again this month. China saw mixed price signals, with some prices up and others down.

With prices giving sustained mixed signals, industrial buying organizations seeking more pricing guidance should try a free two-month trial of our Monthly Metal Buying Outlook report.

Buying organizations will want to read more about longer-term steel price trends can do so with the Annual Outlook.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Raw Steel Prices and Trends

Prices in the index showed mixed performance this month.

Korean prices showed a clear drop. Korean standard scrap steel prices dropped by 8.3% to $122/st and pig iron prices fell by 2.6% to $332/st.

Chinese price movements remain mixed. Chinese steel slab prices increased the most (by 3.2% to $489/st). Chinese HRC prices increased by 1.3% to $479/st.

Chinese steel billet decreased by 2.7% to $470/st and coking coal prices dropped by 1.1% to $278/mt. Chinese iron ore prices edged down slightly, by less than 0.5%.

U.S. shredded scrap prices fell by 6.2% to $257/st, while U.S. Midwest futures 3-month price increased by 3.2% to $619/st.

MetalMiner’s Annual Outlook provides 2019 buying strategies for carbon steel

LME billet 3-month prices dropped 2.7% $268/mt.

Leave a Reply