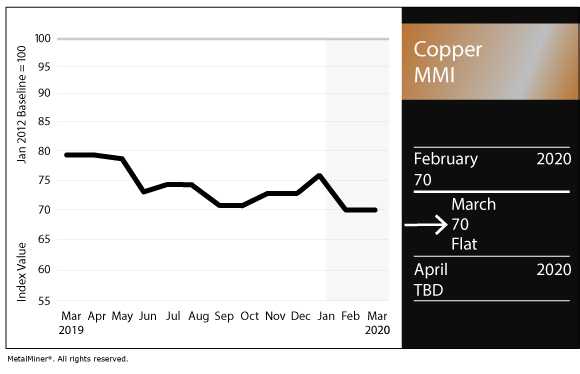

Copper MMI: Mixed price movements hold index sideways

The Copper Monthly Metals Index (MMI) held at a value of 70 this month based on a mix of mild price changes globally.

All the metals intelligence you need in one user-friendly platform with unlimited usage – Request a MetalMiner Insights platform demo

LME copper prices traded sideways during most of February, following late January’s precipitous price drop. However, the price weakened again in early March.

Markets generally moved down March 9 as Saudi Arabia’s oil price surprise shook markets globally. Copper looked most impacted of all industrial metals, but the price still managed to hang onto the $5,500/mt level.

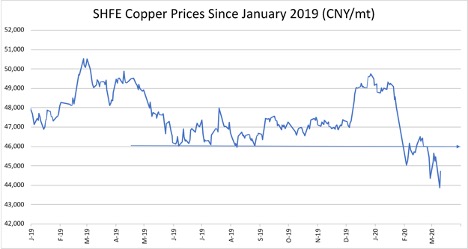

SHFE copper prices drop steeply

SHFE prices continued to drift away from 2019 support levels as February came to a close, after still looking set to trade around the CNY 46,000 level earlier in the month.

The price just recently dropped to a three-year low.

The price is now trading at a critical long-term point. From a technical perspective, a drop from here could look more like a price free fall.

The International Copper Study Group (ICSG) previously forecast growth for 2020 at 1.7%. This growth rate may be hard to reach now, with some analysts tentatively expecting a permanent copper demand reduction for Q1 2020 roughly in the range of 15-20%.

Additionally, global demand growth could drop to 0% this year, with forecasts of deficits for 2020 shifting to small surpluses following from the impact of the novel coronavirus, COVID-19, on markets.

However, absence of demand growth alone may not shift prices lower.

If oil prices remain lower for an extended period, this could ultimately have a negative effect on copper prices, as lower energy costs could result in some producers cutting prices as production costs fall.

However, further price declines only seem likely in the context of a challenging demand environment undergoing significant copper demand contraction (at least for the short term).

We could be in the middle of such an event now, or the impact could still prove mild enough to mitigate any potential recession.

Hindalco: Global copper demand increased marginally in 2019

According to Hindalco Industries Limited, global refined copper consumption in 2019 dropped by 0.3%. In 2018, global consumption increased by 3.1%.

Consumption growth ex-China dropped 1.7% in 2019 after growing by 1.3% in 2018.

Demand grew by 1% in China during 2019, down from a 5% demand growth rate during 2018.

Global concentrate consumption grew by 1% during 2019 to 16.7 million tons.

The global copper concentrate market deficit totaled 142,000 tons in 2019, compared to a surplus of 95,000 tons during 2018.

The benchmark TC/RC for 2020 dropped by 23% compared to 2019, now at $62/mt ($0.159/pound).

Freeport-McMoRan plans to grow copper production volume by 30% during 2020

Freeport-McMoRan plans to focus on increasing volume from underground mines in the Papua province of Indonesia.

The Lone Star project will also start operations in 2020, assuming the timely completion of the commissioning process.

Additionally, the costs of production will drop by around 25% to $1.30/pound. The company expects productivity improvements to more than double cash flows by 2021 compared to 2019.

Mitsubishi Materials Corporation announces acquisition of 30% stake in Chilean copper mine

Mitsubishi Materials of Japan will buy a 30% stake in Chile’s Mantoverde copper mine for $236 million to ensure concentrate availability for existing smelter operations.

As part of the agreement, the company will receive 30% of annual offtake, in line with its ownership share.

The transaction is expected to be complete by October 2020.

What this means for industrial buyers

Copper prices continue to trade lower, but a return of renewed economic momentum could turn prices back around quickly.

Metal prices fluctuate. Key is knowing when and how much to buy with MetalMiner Outlook. Request a free trial.

Actual copper prices and trends

Copper prices moved sideways during February, with index values making only minor moves.

Japan’s primary cash price increased 1.4% to $5,914/mt.

U.S. producer copper grades 110 and grade 122 increased by 0.9%, resulting in a $0.03/pound increase for both to $3.34/pound. U.S. producer copper grade 102 increased by 0.8% to $3.56/pound, compared to $3.53/pound last month.

Indian copper cash prices fell by 1.5% to $5.89/kilogram.

Korean copper strip fell by 1.4% to $8/kilogram.

China’s copper prices all dropped by 1.1% to $6,425/mt.

Leave a Reply