Finally, gravity is reasserting itself on iron ore prices

Just as we were about to go to press with an article on the surprising resilience of seaborne iron ore and coking coal prices in Asia, the market in Asia closed yesterday with heavy falls – they beat us to it.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

Supply disruptions and what looks like an overly optimistic assessment of likely stimulus measures have supported iron ore and coking coal, despite the collapse of just about all other commodity prices.

Benchmark iron ore had remained above $90 per ton all quarter, falling just 1.1% from 2019 closing prices, Reuters reported. The Singapore Exchange’s Australian coking coal futures ended at $161.84 per ton on Wednesday, up 19% from the end of last year.

Prices were supported last year by weather-related disruptions – a cyclone in Australia and heavy rains in Brazil, underpinning a widely held (if probably misplaced) expectation that Beijing is going to unleash a tsunami of infrastructure projects, as it did after the 2008 financial crisis.

What has punctured the bubble is a growing realization that infrastructure investment is going to be targeted and likely on a much smaller scale than previously hoped. Meanwhile, demand in the rest of the world is falling off a cliff as the COVID-19 virus shuts down large parts of Europe and begins to impact the U.S.

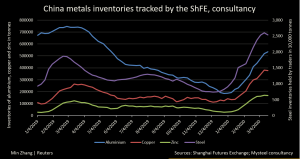

If domestic steel demand were strong or inventory were tight, there could be an argument for iron ore being different from the rest of the commodity sector, but steel inventories are climbing higher than any of the base metals, as the graph below from Reuters so graphically illustrates:

According to a Reuters report, Dalian iron ore prices fell 6% to hit the downside limit on Monday, as stricter measures to contain the coronavirus pandemic in Europe and the U.S. persuaded investors the Chinese economy could be in for a prolonged period of slow growth.

All steelmaking ingredients took a hit, with construction steel rebar on the Shanghai Futures Exchange falling 3.0%. Hot-rolled steel coil, used in cars and home appliances, shed 3.7% and stainless steel dropped 1.4%.

Other steelmaking ingredients also slumped, with coking coal down 1.6% while coke lost 1.8%.

Generate hard savings on your metal buys year-round; trial MetalMiner’s monthly outlook report

The cracks in the edifice supporting prices are appearing to widen daily.

Despite steel consumption picking up in China, inventory levels are extensive and steel production remains robust; oversupply seems more likely than shortages.

Iron ore and coking coal prices have more exposure on the downside than the up.

Leave a Reply