Renewables/GOES MMI: Lynas records quarterly jump in neodymium-praseodymium output

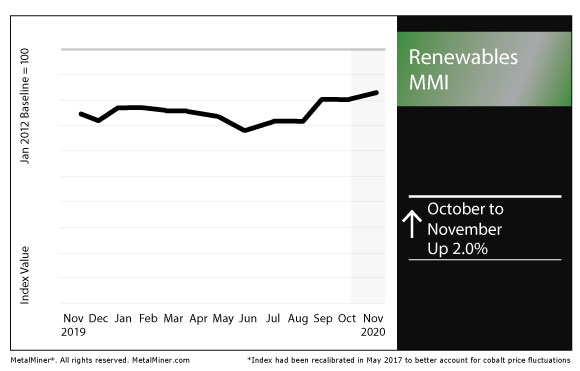

The Renewables Monthly Metals Index (MMI) rose 2.0% for this month’s index value, as Lynas Corporation reported a rise in neodymium-praseodymium output during the most recent quarter. (Editor’s Note: This report also includes coverage of grain-oriented electrical steel, or GOES.)

The MetalMiner 2021 Annual Outlook consolidates our 12-month view and provides buying organizations with a complete understanding of the fundamental factors driving prices and a detailed forecast that can be used when sourcing metals for 2021 — including expected average prices, support and resistance levels.

Lynas Corp. posts rise in quarterly neodymium-praseodymium output

Lynas Corp., the largest rare earths company outside of China, recorded neodymium-praseodymium (NdPr) output in the quarter ended Sept. 30 of 1,342 tonnes.

The quarterly total marked an increase from neodymium-praseodymium output of 775 tonnes the previous quarter.

Neodymium is a key component in permanent magnets in a wide variety of electronic devices.

“Following the temporary shutdowns in both Malaysia and Mt Weld as a result of the COVID-19 Movement Control Order (MCO) issued by the Malaysian government, production of NdPr was at 75% of Lynas NEXT production rates during the quarter (equivalent to original nameplate production rates),” Lynas reported in its quarterly activity report. “This is currently sufficient to meet demand from our customers while COVID-19 uncertainty remains.”

Fortescue to invest in renewable energy

Australian iron ore mining giant Fortescue Metals Group plans to take a big step into the renewable energy sector.

According to the Australian Financial Review, Fortescue Metals Group chairman Andrew Forrest said during the company’s annual general meeting this week that the company would move toward becoming a “renewables and resources” company.

Fortescue shares are up nearly 60% in the year to date.

GOES

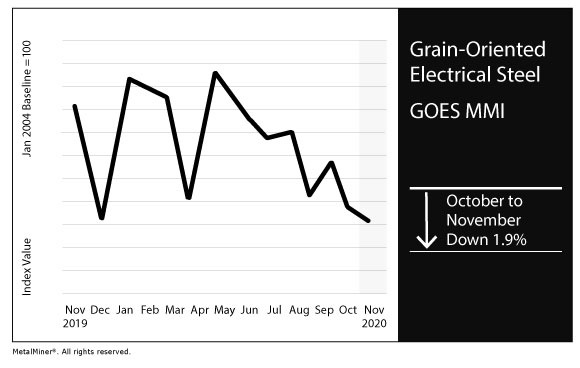

Meanwhile, the index for grain-oriented electrical steel, the GOES MMI, fell 1.9% for this month’s index value.

In May, the U.S. Department of Commerce initiated a Section 232 investigation covering imports of laminations and wound cores for incorporation into transformers, electrical transformers, and transformer regulators.

“The Department of Commerce will conduct a thorough, fair, and transparent review to determine the effects on the national security from imports of laminations for stacked cores for incorporation into transformers, stacked and wound cores for incorporation into transformers, electrical transformers, and transformer regulators,” Secretary of Commerce Wilbur Ross said in a prepared statement in May.

AK Steel, a subsidiary of Cleveland-Cliffs, is the only remaining domestic producer of GOES.

Last week, the United States Trade Representative (USTR) announced an agreement with Mexico related to the transshipment of GOES from outside North America into the U.S.

“Mexico and the United States have successfully concluded consultations held pursuant to their Joint Statement of May 17, 2019 to address the transshipment of grain-oriented electrical steel (GOES) from outside the North American region into the United States through GOES-containing downstream products,” the USTR said in a statement.

Mexico will establish a “strict monitoring regime for exports of electrical transformer laminations and cores made of non-North American GOES.”

Forthcoming Section 232 GOES action?

Meanwhile, in a Nov. 2 press release, Cleveland-Cliffs applauded what it said would be forthcoming action by the Trump administration.

“President Trump’s Administration will be moving forward with a Section 232 action implementing a remedy covering imported laminations and cores of Grain Oriented Electrical Steel (GOES),” Cleveland-Cliffs said in a release.

However, the Department of Commerce has yet to make any formal announcement of action in the case.

Actual metals prices and trends

Japanese steel plate gained 0.8% month over month to $841.40 per metric ton. Meanwhile, Korean steel plate rose 4.1% to $567.57 per metric ton.

Chinese steel plate jumped 3.7% to $646.97 per metric ton.

In addition, U.S. steel plate rose 5.3% to $657 per short ton.

Lastly, The U.S. GOES price dipped slightly to $2,087 per metric ton.

You want more MetalMiner on your terms. Sign up for weekly email updates today.

Leave a Reply