Automotive MMI: General Motors posts strong Q4 in U.S. sales

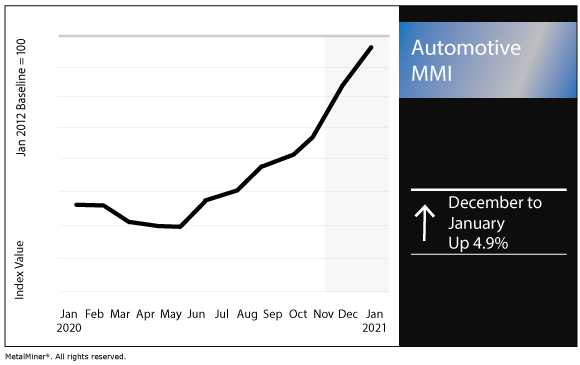

The Automotive Monthly Metals Index (MMI) jumped 4.9% for this month’s index reading, as General Motors posted a strong Q4 in the U.S. market.

Become part of the MetalMiner LinkedIn group and stay connected to trends we’re watching and interesting metal facts.

General Motors posts strong Q4

In the U.S., General Motors reported Q4 sales of 771,323 vehicles, up 5% year over year.

The automaker said the quarter marked its best fourth-quarter retail sales since 2007.

“GM outperformed the industry in the quarter and the full year by a significant margin because our manufacturing and supply chain teams and dealers helped keep people safe at work and our launches on track,” said Steve Carlisle, executive vice president and president of GM North America. “Extraordinary teamwork has set up everyone to succeed in 2021 as the economy continues to recover and we further ramp up truck and SUV production.”

Furthermore, average transaction prices set fourth-quarter and full-year records, GM reported, at $41,886 and $39,229, respectively.

Meanwhile, Fiat Chrysler reported Q4 U.S. sales of 499,431 vehicles, or down 8% year over year. The automaker’s full-year sales in 2020 declined by 17% compared with the previous year.

“The work undertaken by our dealers was nothing less than heroic given the challenges they faced this year,” U.S. Head of Sales Jeff Kommor said. “The fourth quarter provided a strong springboard heading into 2021. Looking ahead, we anticipate an exciting year that will include a variety of new vehicles. Just in the first quarter alone, we will be offering the Ram 1500 TRX, Jeep Wrangler 4xe, Jeep Wrangler Rubicon 392, the refreshed Dodge Durango and the refreshed Chrysler Pacifica.”

Nissan reported Q4 sales of 243,133 vehicles, down 19.3% year over year. The automaker’s full-year sales, meanwhile, declined by 33.2% year over year.

Honda’s December sales were about flat on a year-over-year basis (down 0.1%), while its full-year sales fell 16.3%.

J.D. Power, LMC Automotive release December data

Per a jointly released forecast by J.D. Power and LMC Automotive, U.S. new-vehicle retail sales were forecast to rise in December on a year-over-year basis.

The uptick marked a positive end to what was a challenging year for the sector. The challenges were at their peak in Q2, when automakers suspended production for two months and the U.S. began its first round of coronavirus-related restrictions.

When adjusted for selling days, December sales were forecast to rise 1.0% year over year. Meanwhile, full-year new-vehicle retail sales were forecast to drop by 9.5%.

“December’s performance closes the year on multiple positive notes,” said Thomas King, president of the data and analytics division at J.D. Power. “Retail sales are up, transaction prices are at record levels and retailer profits are at all-time highs.”

General Motors announces U.S. plant investments

In other General Motors news, the automaker announced plans to invest $76 million in two of its U.S. manufacturing plants.

General Motors plans to invest $70 million into its Tonawanda, New York engine plant. In addition, it plans to invest more than $6 million into its metal stamping plant in Parma, Ohio.

“The Tonawanda investment will be used to increase capacity on the engine block machining line and the Parma investment will be used to construct four new metal assembly cells to support increased truck production volumes,” the company said in its announcement.

Actual metals price and trends

The U.S. HDG price rose 13.7% month over month to $1,167 per short ton as of Jan. 1.

The LME three-month copper price rose 1.0% to $7,757 per metric ton. U.S. shredded scrap surged 38.3% to $401 per short ton.

The Korean 5052 aluminum coil premium rose 4.8% to $3.49 per kilogram.

Cut-to-length adders. Width and gauge adders. Coatings. Feel confident in knowing what you should be paying for metal with MetalMiner should-cost models.

Leave a Reply