Renewables/GOES MMI: Electricity consumption set to bounce back up in 2021

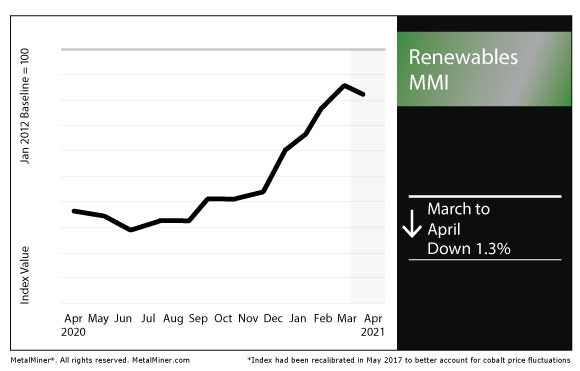

The Renewables Monthly Metals Index (MMI) dipped by 1.3% for this month’s reading, as the Energy Information Administration forecasts a jump in US electricity consumption this year.

(Editor’s note: This report also includes the MMI for grain-oriented electrical steel, or GOES.)

The MetalMiner Best Practice Library offers a wealth of knowledge and tips to help buyers stay on top of metals markets and buying strategies.

US electricity consumption to rise in 2021 after 2020 drop

In its most recent Short-Term Energy Outlook, the Energy Information Administration forecast US electricity consumption will rise by 2.1% in 2021.

This comes after electricity consumption fell by 3.8% in 2020.

“Much of the increased electricity consumption across the sectors reflects improving economic conditions in 2021,” the EIA said. “For 2022, we forecast that U.S. electricity consumption will grow by another 1.3%.”

As for renewable sources of energy, the EIA notes the US will add new wind and solar capacity in 2021.

Meanwhile, for 2020, the EIA estimated the US added 14.5 gigawatts of wind power. In 2021 and 2022, the EIA forecast wind power additions of 16.1 GW and 5.8 GW, respectively.

Furthermore, the EIA forecast new solar capacity of 15.8 GW and 14.9 GW in 2021 and 2022, respectively.

On the nonrenewables side, the EIA forecast the US’s share of electricity generation from natural gas will decline this year and in 2022. Furthermore, it forecast coal used to generate electricity will rise by 13% this year and by 4% next year.

Raw materials and the next industrial revolution

Earlier this month, MetalMiner’s Stuart Burns touched on the global race for raw materials as countries jockey to put themselves in the best position for the next industrial revolution.

The race for materials is only going to intensify as countries and corporations aim to meet their environmental targets.

In that regard, Europe and the US have a lot of catchup up to do, as China is ahead of the game.

“In the last four years, China Molybdenum has plowed into the Democratic Republic of Congo’s 350 kilometer copper belt,” Burns wrote. “The firm paid $2.6 billion (£2 billion) four years ago for the Tenke Fungurume mine from Freeport McMoRan.

“It then expanded its empire in December, paying another $550 million for Freeport’s nearby Kisanfu mine. The mine gave it access to a further 6.3 million metric tons of copper. In addition, the mine offers access to 3.1 million metric tons of cobalt.

“Chinese companies now dominate mining in the central African country that produces 70% of the world’s cobalt.”

Speaking of China Molybdenum and Kisanfu, Chinese lithium-ion battery maker CATL reportedly has bought a stake in the mine.

According to Reuters, CATL is taking a stake of $137.5 million in the copper-cobalt mine in the DRC.

Trafigura launches carbon trading desk

In other market news, multinational trading company Trafigura announced Friday it is opening a new carbon trading desk.

“Regulated and voluntary carbon offset markets will have an important role to play in the progression towards a carbon neutral world for industries with emissions that cannot otherwise be eliminated or reduced through investment and operational optimisation,” the company said. “Carbon offset markets provide the means for price discovery to drive the reduction of greenhouse gas emissions in existing supply chains and to encourage investment in carbon sequestration measures and technologies.”

GOES

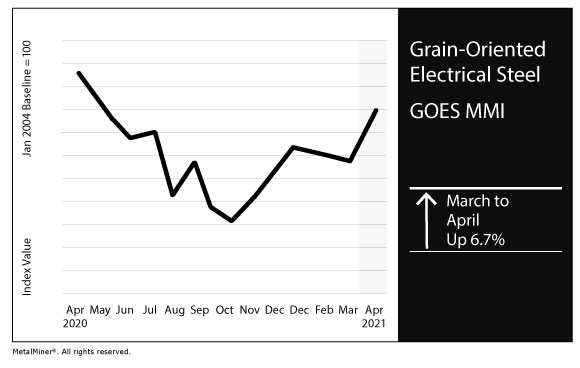

The MMI for grain-oriented electrical steel (GOES) rose by 6.7% this month.

The GOES price rose by 6.4% month over month to $2,414 per metric ton.

Actual metals prices and trends

US steel plate rose by 5.8% month over month to $1,142 per short ton as of April 1.

The Chinese steel plate price rose by 4.0% to $859 per metric ton. The Japanese steel plate price fell by 3.9% to $794 per metric ton. The Korean steel plate price rose by 3.0% to $731 per metric ton.

More MetalMiner is available on LinkedIn.

Leave a Reply