Automotive MMI: Increased U.S. auto sales restrained

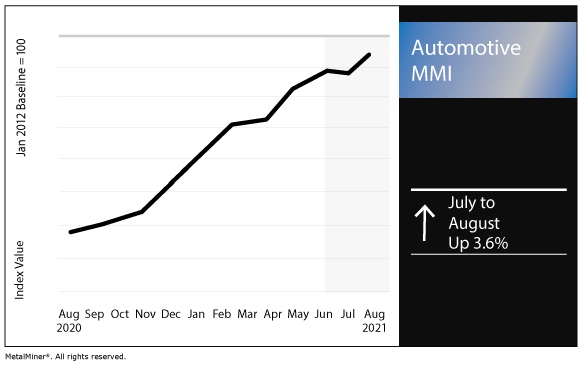

The Automotive Monthly Metals Index (MMI) rose by 3.6% for this month’s MMI reading, as U.S. auto sales rose in July.

All the metals intelligence you need in one user-friendly platform with unlimited usage. Request a MetalMiner Insights platform demo.

US auto sales

General Motors reported last month that its second-quarter sales rose by 40% year over year.

“The U.S. economy is accelerating, consumer spending is robust and jobs are plentiful,” said Elaine Buckberg, GM chief economist. “Consumer demand for vehicles is also strong, but constrained by very tight inventories. We expect continued high demand in the second half of this year and into 2022.”

In financial news, General Motors reported Q2 2021 net income of $2.8 billion. That compares with a loss of $800 million in Q2 2021. It also reported EBIT-adjusted of $4.1 billion, including warranty recall costs of $1.3 billion ($800 million of which was attributable to the Chevrolet Bolt EV).

Ford Motor Co. reported total U.S. sales of 120,053 vehicles in July. The July total marked a 31.8% drop compared with July 2020 sales.

Total Ford truck sales fell by 27.0%. SUV sales dropped by 27.3%, while car sales fell by 74.5%.

“Our newest products, including F-150 PowerBoost, Mustang Mach-E, Bronco and Bronco Sport, are conquesting at a rate that is almost 14 points higher than Ford overall,” said Andrew Frick, vice president for sales in the U.S. and Canada. “With our strong portfolio of new products, robust transaction pricing and a big order bank, we are perfectly positioned for significant growth as the semiconductor chip situation improves.”

Last month, Nissan reported a 68% year-over-year jump in its Q2 sales.

Meanwhile, FCA US reported a Q2 total sales jump of 32% year over year.

Total Honda sales in the U.S. rose by 8% in July, with sales reaching 135,542 vehicles “despite inventory constraints limiting key models,” the automaker said.

Inventory shortages cap sales

According to J.D. Power and LMC Automotive’s July 2021 automotive forecast, U.S. new-vehicle retail sales were projected to rise by 2.7% year over year.

However, auto sales fell by 12.4% compared with July 2019 sales.

“Inventory constraints, and its divergent effects on vehicle sales, continues to be the key theme for July,” said Thomas King, president of J.D. Power’s data and analytics division. “Too few vehicles in inventory mean the sales pace in July is well below the levels seen earlier this year. Conversely, the lack of inventory is driving the price of the vehicles to record highs as manufacturers and retailers continue to dial back discounts.”

BHP, Tesla enter nickel supply agreement

Meanwhile, in the world of electric vehicles, miner BHP announced it will supply EV maker Tesla with nickel.

BHP will supply the EV maker with nickel from its Nickel West operation in Western Australia. Nickel is used in the production of electric vehicle batteries.

“Demand for nickel in batteries is estimated to grow by over 500 per cent over the next decade, in large part to support the world’s rising demand for electric vehicles,” BHP Chief Commercial Officer Vandita Pant said.

The two firms will also “collaborate on ways to make the battery supply chain more sustainable, with a focus on end-to-end raw material traceability using blockchain.”

Actual metals prices and trends

The U.S. hot dipped galvanized price rose by 6.9% month over month to $2,145 per short ton as of Aug. 1. Meanwhile, the U.S. shredded scrap steel price ticked up 0.4% to $505 per short ton.

LME three-month copper jumped by 3.9% to $9,775 per metric ton.

The Korean 5052 aluminum coil premium fell by 0.8% to $3.92 per kilogram.

Get social with us. Follow MetalMiner on LinkedIn.

Leave a Reply