Stainless MMI: Nickel prices trade down but remain elevated amid lower LME volumes

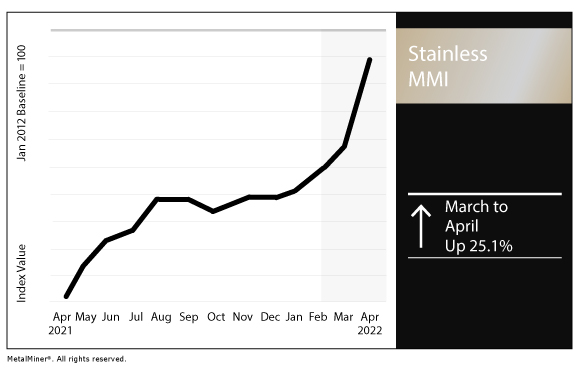

The Stainless Monthly Metals Index (MMI) jumped by 25.07% from March to April, as nickel prices remained elevated.

Nickel prices continue to trade slightly downward. However, nickel prices remain elevated from pre-invasion levels.

Volume flow fluctuated among exchanges in recent days due to distrust of the LME, while nickel prices began to trade within an increasingly narrow range. A sudden change in overall price direction remains unlikely in the coming weeks, however, as LME volumes remain limited.

Risk aversion, margin calls cause trading exodus

Nickel trading finally resumed last month following the historic short squeeze that saw nickel prices spike by more than 90% within hours.

In order to restore stability to the disorderly market, the LME retroactively canceled trades. The LME implemented new rules, including price limits, “to minimise the potential for future disorderly price moves.”

The volatility and overall market uncertainty, in part due to current geopolitical tensions, prompted exchanges and brokers to request higher down payments for certain commodities, known as margins. The new requirements hindered trading, even in regions not connected to Russia or Ukraine. Furthermore, the requirements fueled recent price swings as trades were unwound to avoid the cost of holding positions.

Between the difficulty to finance trade and compounding market risks, volumes upon the resumption of trading remained uncharacteristically low on both the LME and SHFE. Further, open interest on the LME hit a nine-year low, Reuters reported. Meanwhile, open interest on the SHFE nickel contract fell to its lowest level since 2015 as position holders retreated from the market.

What could low volume and liquidity mean for nickel prices?

Likely, an increased risk for volatility.

An illiquid market means there will be fewer orders to absorb buy and sell orders. Thus, buy and sell orders have a larger likelihood to affect price movement.

Since trading resumed, the LME’s implementation of daily price limits appears to have been effective. Nickel prices began to trade within increasingly narrow ranges. It remains to be seen, however, when and if traders will return and nickel trading will normalize.

The best way to track monthly nickel prices is to sign up for the MetalMiner Monthly Metals Index report.

UK regulators to review nickel debacle

As the dust continues to settle, markets have yet to hear the last of the nickel squeeze.

Announced April 4, the LME’s primary regulators, the Financial Conduct Authority (FCA) and the Bank of England, will launch a review of the LME’s approach in order “to determine what lessons might be learned in relation to the LME’s governance and market oversight arrangements.”

“The FCA and the Bank will consider these reports in determining whether further action should be taken and will announce next steps in due course,” the statement continued.

The LME also intends to initiate its own independent probe of the March 8 incident.

As the exchange prepares to examine the activity of all market participants, LME CEO Matthew Chamberlain stated, “we’re absolutely not sitting here saying abuse has taken place but it is…right that we review all of the activity and make sure we are absolutely satisfied we account for everything that’s happened.”

MetalMiner’s free weekly newsletter provides up-to-date metal price intelligence.

NAS’ stainless fuel surcharge jumps, nickel spike disregarded

North American Stainless (NAS) increased its fuel surcharge effective April 1. The surcharge jumped 47% for stainless flat and long products.

Meanwhile, the producer disregarded nickel closing prices during the days of disrupted trading to calculate the nickel portion of its April surcharge. NAS used closing prices from Feb. 21-March 18. However, it excluded prices from March 8-15. According to the company, “this move is essential to provide the stainless steel supply chain clear direction on April pricing, and to protect the integrity of our industry until the situation normalizes.”

The value of those dates averaged $12.60/lb, or $27,777.88/mt.

See the impact on stainless steel prices. Check out MetalMiner’s stainless steel should cost models by scheduling a demo of the MetalMiner Insights platform.

Actual metals prices and trends

The Allegheny Ludlum 304 stainless surcharge jumped by 22.3% to $1.70 per pound as of April 1. Meanwhile, the Allegheny Ludlum 316 surcharge rose by 18.97% to $2.32 per pound.

Chinese primary nickel increased by 23.54% to $35,170 per metric ton.

LME three-month nickel rose by 34.75% to $33,350 per metric ton.

Indian primary nickel increased by 29.02% to $31.74 per kilogram.

Leave a Reply