Lithium Ion Battery Use Could be “Playing with Fire”

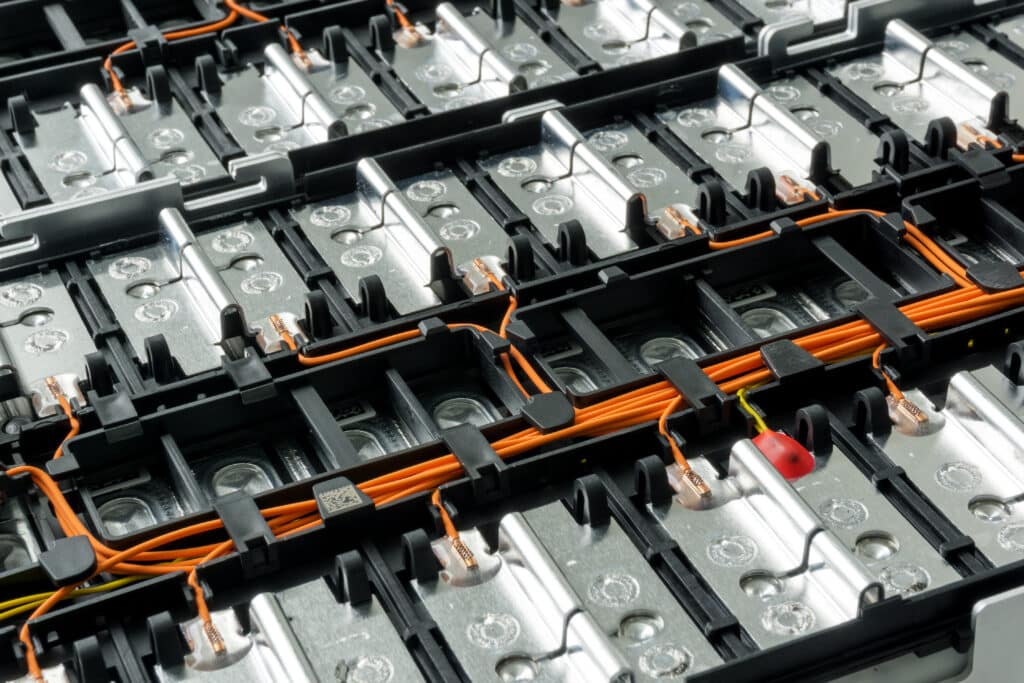

Lithium-ion is having a bad day – or year. In fact, depending on the source, “years” might be more appropriate. Lithium-ion (Li-ion) has powered batteries for portable consumable electronics, electric vehicles (EVs), and other products for over two decades. But now, with Tesla cars and millions of other products using the technology, the potential hazards are much more apparent. So while the surging lithium price remains problematic, countries like the U.S. also see the batteries as a major fire risk.

Almost every day, there’s a report of an electric vehicle catching fire somewhere around the world. Given the company’s designation as a market leader, fires involving Teslas often make the front pages. For instance, in California, spontaneous battery combustion recently caused a car to catch fire. According to firefighters, the vehicle needed almost 6,000 gallons of water to put out.

A few days ago, Ford Motor Co. suspended production and halted shipments of its F-150 Lightning electric pickup. The move came after a battery caught fire during a test drive in Michigan. Ford continues to investigate the cause of the blaze. However, until they get to the bottom of things, F-150 Lightning production will remain offline.

Track metal price movements as well as news affecting other metal commodities. Sign up for MetalMiner’s weekly newsletter.

Lithium Price Now Part of a Bigger Problem for Automakers

The car industry has long been aware of the problems concerning lithium-ion batteries. However, industry leaders mainly focused on high costs, limited cycle count, and aging-related issues. Now they need to add spontaneous combustion to that list.

It would not be far-fetched to say li-ion batteries are losing popularity due to these fires. However, in reality, it’s just “one more thing” automakers have to deal with. High costs remain the major issue, as lithium – also known as “white gold” – continues to enjoy sky-high prices due to surging EV sales. Indeed, Elon Musk personally raised concerns over rising lithium costs just a few months ago.

Costs aside, automakers have had to contend with the environmental impact of lithium-ion for years now. It seems the more they position their product as green, the faster people point out the potential problems of li-ion battery disposal. The fact that these batteries are now getting a reputation for overheating and causing fires is only the icing on the cake for EV critics.

Just a few days ago, the New York Fire Department sounded the alarm on the dangers of Li-ion batteries. This came after the city saw as many as 22 fires in the first two months of 2023. The department even posted a video of a fire started by an electric skateboard. Elsewhere, other fire departments are grappling with the same issue. Many do not even have standard procedures for putting out such fires. After all, most experts say li-ion battery fires are still too new for there to be a consensus on the fastest way to deal with them.

Not sure if MetalMiner can help you with your specific metal purchases? Check out our full metal catalog.

That Was the Ugly: Now the Good and Bad From China

As if that weren’t enough of a headache, new developments from China will cause even more worries for lithium buyers. The global lithium supply is about to experience a new disruption due to shutdowns in Yichun City. The city lies in China’s Jiangxi province, which accounts for around a 10th of the world’s lithium supply. Unfortunately, it currently faces sweeping closures due to an environmental investigation.

According to the Yicai newspaper, the Chinese government has ordered that lithium ore-processing operations in Yichun shut down amid a probe for alleged environmental violations. The investigation adds uncertainty to a lithium market where prices have just begun petering off. So those companies hoping for a price break may not want to celebrate just yet.

Adding to the issue is the fact that the battery industry in China is on the cusp of a price war. According to a news report in 36Kr, CATL was actively considering a battery price reduction plan for key car companies, though this did not include Tesla. CATL even proposed a price reduction requirement of about 10% to its raw material suppliers. The report stated that the plan would come into play in the 3rd quarter once all the agreements were in place.

CATL’s move targeted only important customers like Li Auto, NIO, Huawei, and Zeekr. It set the proposed price of lithium carbonate at 200,000 yuan ($29,053) per metric ton. However, the car companies that sign the agreement must agree to purchase about 80% of their battery volume from CATL. The current price per ton of battery-grade lithium carbonate is about 470,000 yuan. Therefore, this represents a huge opportunity for those companies that sign on.

Every metal buying organization should utilize A.I. to forecast prices and save money. Click here to learn more!

New Research Could Improve Lithium Battery Potential

Amidst all the doom and gloom comes a slightly more optimistic development. U.S. researchers recently announced they had developed a lithium-air battery with a solid electrolyte. The researchers claimed they could potentially increase the battery’s energy density fourfold over today’s lithium-ion batteries. Moreover, during tests, the prototype achieved an impressive 1,000 charge and discharge cycles.

Leading the project were the Illinois Institute of Technology and the U.S. Department of Energy’s Argonne National Laboratory. According to a release on the project’s findings, the new battery utilizes a solid electrolyte made of a ceramic polymer material, carrying “relatively inexpensive elements in nano-particle form.” Meanwhile, a lithium anode and a cathode with an air-permeable structure complete the cell structure. The researchers claim the battery is suitable for use in electric cars, trucks, and planes. The development should bring cheer to the Biden administration, which has a policy to strengthen domestic supplies of critical elements, including lithium.

Back in the 1970s, the U.S. was a leading lithium producer. Not long after, however, processing moved overseas. Fortunately, the U.S. still has the fourth largest global lithium reserves, although the country only mines and processes around 1% of global lithium. It’s hoped that the government’s policy on critical elements will soon add more domestic production capacity to fuel the clean energy transition.

MetalMiner Insights offers a full suite of battery metal prices, forecasted price movements and correlation analyses. Schedule a demo.

Leave a Reply