Steel Manufacturing: Uncertainty Looms as Liberty Steel Ostrava Workers Delay Return

Workers at flats producer Liberty Steel Ostrava in the Czech Republic did not return to work on January 16, despite local media reports stating that workers agreed to resume working on this date. The Daily Denik noted that there were a couple of other “return dates” set for the steel manufacturing plant, including January 3 and January 9.

“Employees at Liberty Ostrava continue to overcome so-called other obstacles by the employer until January 22, when we will inform them of further developments in the situation,” the publication quoted plant spokeswoman Kateřina Zajíčková as saying. Zajíčková was unavailable for comment, despite several attempts by MetalMiner (these updates and more in MetalMiner’s weekly newsletter).

The Ostrava plant stopped all operations back in December. On December 21, energy supplier Tameh suspended supplies to the plant after declaring bankruptcy, citing the lack of payments from the steelmaker. On January 12, local media reported that a regional court in Ostrava recently ordered Liberty to pay Kč 500 million ($21.9 million) in outstanding debts to Tameh. Howeever, that order only came after a court declared a three-month moratorium on all of Ostrava’s debt payments and appointed a restructuring trustee.

Blast Furnace Shutdown Raises Concerns Over Europe’s Steel Manufacturing

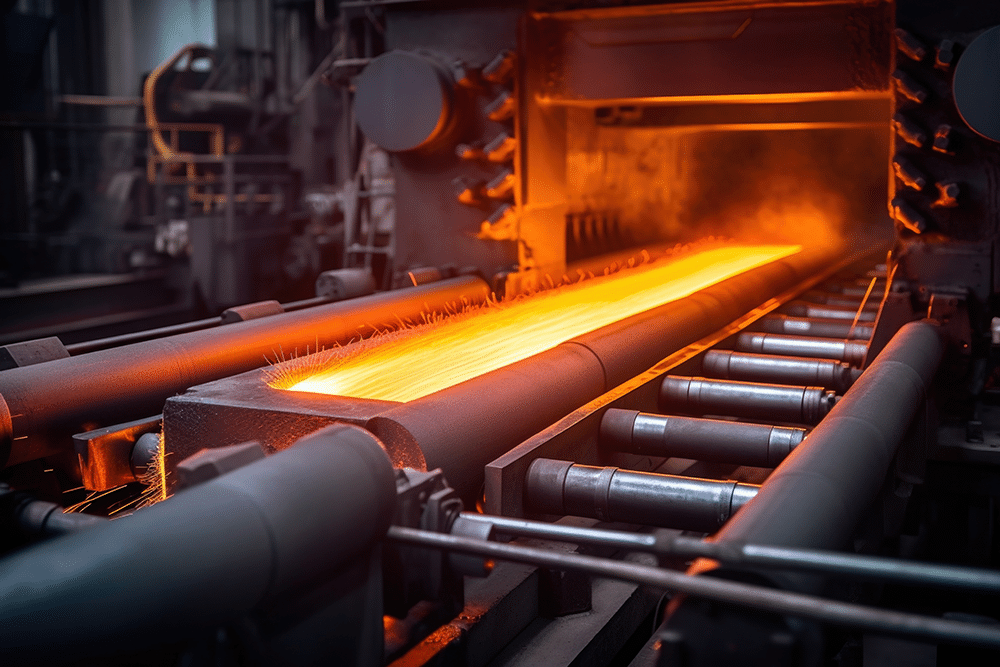

Weak steel demand in Europe prompted Liberty Steel Ostrava to take its single operating blast furnace off-stream in October. At the time, the facility cited high gas prices and poor economic circumstances within Europe as causes for the shutdown. Plant managers initially scheduled the stoppage for two weeks. However, as of mid-January 2024, it did not restart, painting a somewhat grim picture of the Czech steel manufacturing hub’s future.

The plant at Ostrava can produce up to 3.5 million metric tons of crude steel per year, which it casts into slab, square billet and round billet. These are then used for rolling into hot rolled coil, merchant bar, and seamless tubes. In addition, the site posesses a pipe mill for the production of spiral-welded, welded tube, and OCTG-grade pipes.

Liberty Steel Ostrava’s Connection to ArcelorMittal

ArcelorMittal owns a 50% stake in the Ostrava plant’s energy products, Tameh, which is a joint venture with Polish energy company Tauron. A Singapore court recently granted ArcelorMittal a €150 million ($163 million) freeze order against Liberty for the outstanding balance on the sales of Ostrava, including Romanian steelmaker Galati. A Singapore court against also granted ArcelorMittal a €150 million ($163 million) freeze order against Liberty for the outstanding balance on the sales in 2018 of Ostrava as well as of Romanian steelmaker Galati, in Romania.

Liberty Steel agreed to acquire Ostrava from ArcelorMittal in 2018. This was mainly because European regulators previously required the Luxembourg-headquartered group to sell the plant as part of its acquisition of Italian steelmaker Ilva, now known as Acciaierie d’Italia (ADI). Incidentally, ArcelorMittal now holds 62% of that company.

However, a January 15 report by Reuters stated that an Italian court recently gave the green light to energy companies to cut gas supplies to ADI. Similar to the Czech Republic, higher gas prices and poor economic circumstances all across Europe continue to impact steel demand and the Ostrava plant.

Curious about how changes in global steel manufacturing like this will impact your bottom line? Subscribe to the Monthly Metals Outlook report and watch your ROI soar. Grab a free sample.

ADI Steel Manufacturing Increasing

ADI’s main plant at Taranto, in southern Italy, rolls plate and hot rolled coil via six basic oxygen converters. The site also has a tube and pipe mill, which produces welded and spiral-welded tubes. Further downstream, Taranto also produces cold rolled, hot dipped, and electrolytic galvanized coil.

Reports noted that ADI plans to produce up to 5 million metric tons of crude steel in 2024 (read the five best practices of sourcing steel, both in and outside of Europe). This would represent a two-thirds increase from the 3 million metric tons it poured in 2022. That said, the Reuters report noted that the company currently has €200 million ($217 million) in outstanding payments to state-owned gas grid supplier Snam. Meanwhile, debts to energy provider Eni were €104 million at the end of H1 2023.