Price of Copper Braces for H2 2025: Are Demand Jitters on the Way?

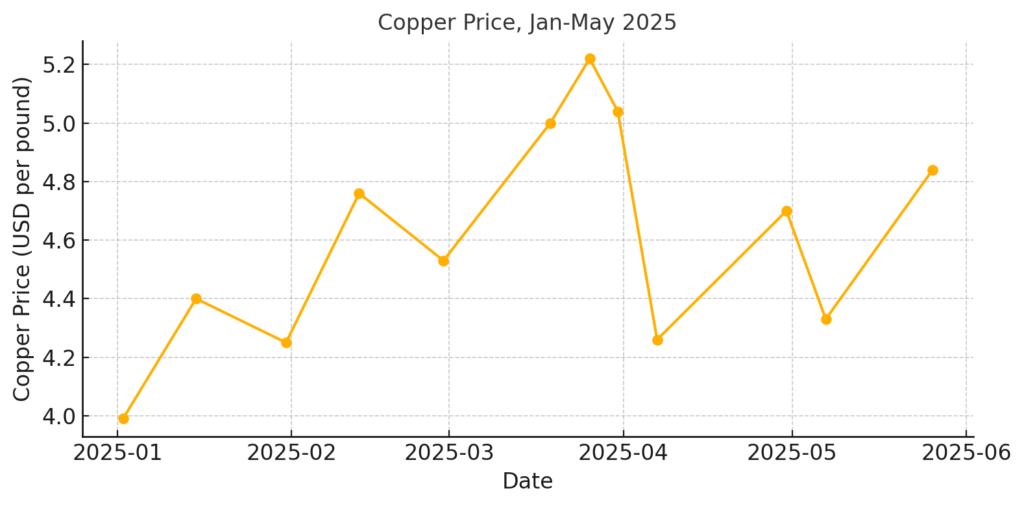

Copper prices are entering the second half of 2025 on a knife’s edge. After a roller-coaster first half that included soaring to record highs in March only to plunge weeks later, the outlook for the price of copper remains clouded by dueling forces. On the one hand, robust long-term demand drivers like electrification and EVs promise support.

On the other hand, immediate headwinds from an escalating U.S.–China trade war and a potential surplus threaten to cap gains. C-suite procurement executives sourcing copper face a pivotal question: Will copper prices climb again or stay grounded through year-end?

Copper briefly hit an all-time high, fueled by bullish sentiment and traders rushing to buy ahead of anticipated U.S. import tariffs. However, optimism quickly gave way to anxiety. By early April, prices had cratered below $4.30 per pound, erasing gains as tariff threats became more concrete. The dramatic whipsaw underscored just how sensitive this market is to geopolitical news.

Conquer copper price unpredictability with a steady stream of price risk alerts and cost-saving strategies by signing up for MetalMiner’s weekly newsletter.

Price of Copper: Tariffs Drive Volatility, Regional Price Gaps

A major storyline for the second half of 2025 will likely be U.S. trade policy. President Donald Trump’s renewed push for tariffs on copper imports has already shaken the market. According to Goldman Sachs, U.S. copper prices jumped to a $756-per-metric-ton premium over London prices this spring as buyers scrambled to bring in supply ahead of potential tariffs. Meanwhile, Reuters reports that U.S. net copper imports nearly doubled in recent months, leading to a buildup in domestic inventories.

This front-loading of supplies has tightened availability elsewhere. “Likely excess inventory builds in the U.S. ahead of a tariff leave the rest of the world shorter of copper,” JP Morgan observed. The organization added that this sets the stage for a “bullish push” in global prices over H2 2025 toward $10,400 per metric ton (approximately $4.70 per pound). In other words, if the U.S. siphons off copper, overseas markets could feel a pinch as the price of copper rises.

Concerned about volatile copper markets affecting your earnings? Stay informed with MetalMiner’s Monthly Metals Index Report, offering monthly price insights across ten metal industries.

Some Argue We’ve Already Seen the Peak

Nevertheless, a lot depends on the timing of the policies. Goldman Sachs analysts caution that if Washington delays tariffs until late 2025, disrupted trade flows could prolong tight supply outside the U.S., especially in China. Conversely, if tariffs hit sooner and demand softens, some heat could come off prices.

Chile’s state copper commission (Cochilco) has argued that base metal prices “have peaked in 2025” due to the U.S.–China trade rift. It expects copper to average above $4 per pound, but believes the price of copper will not reach new highs under current conditions. This view implies that unless trade tensions ease, copper may have already seen its high-water mark for the year.

Demand: Resilient, But Not Bulletproofde

So far, underlying copper demand has held up better than some feared. Despite China’s real estate woes, the world’s top consumer has continued on a robust buying spree throughout 2025, aided by strong exports and stimulus measures. That said, global manufacturing activity continues to flash warning signs.

Meanwhile, purchasing managers’ indices are languishing in the low-50s or below (with 50 being neutral), indicating only modest growth at best in key regions. Should industrial demand outside of China stay sluggish, it will be hard for copper usage to surprise to the upside. Looking ahead, most forecasts see demand growth slowing as 2025 progresses.

The International Copper Study Group (ICSG) revised this year’s refined usage growth down to just 2.4%, citing the chilling effect of trade uncertainty, versus 2.8% growth last year. JP Morgan likewise predicts only a “modest deceleration” in worldwide demand (3.2% growth in 2024, easing to 2.9% in 2025). In short, copper demand isn’t collapsing, nor is it booming enough to overpower the current headwinds.

Not sure if MetalMiner can help you with your specific metal purchases? Check out our full metal catalog.

Will the EV Boom Drain Copper Supplies?

The global energy transition remains a crucial bullish undertone. The drive for electrification, from EVs to renewable energy infrastructure, continues to underpin a strong long-term need for copper. Goldman Sachs maintains that robust electrification demand, combined with China’s pro-growth policies, will contribute to a global supply deficit of about 180,000 tons in 2025. They went on to say that they expect this deficit to really bite in the second half of the year.

That contrasts with the ICSG’s more conservative view of a surplus. For copper buyers, this means keeping an eye on sectors like automotive, tech and construction. Any pickup in those industries in H2 could tighten the market unexpectedly. Conversely, if high interest rates and recession fears curb industrial activity, copper’s demand might sag, tempering prices. When it comes to the price of copper in 2025, everything relies on a delicate balance.

Need to audit your pricing for tariff compliance and other prominent price drivers? Insights SV acts as a smart audit partner, highlighting discrepancies and ensuring accuracy.