Aluminum MMI: Midwest Premium Finds a Peak

The Aluminum Monthly Metals Index (MMI) moved sideways as the global price of aluminum ticked modestly higher. Overall, the index rose 0.73% from May to June. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing.

Aluminum Midwest Premium Finds A Peak

The Midwest Premium found a peak in mid-June. Following successive tariff-induced spikes throughout the year’s first half, the premium hit a new all-time high at $0.615/lb on June 9. This marked a staggering 161% rise since the start of 2025. However, in a relief to markets, the premium has since started to fall.

While declines have proven modest thus far, the bias has shifted to the downside. The spot premium has fallen by over 3%, while the three-month futures contract suggests further declines. Futures now sit almost 14% lower than their respective peak as the reaction to tariffs appears to be over. Markets now seem to be pricing in the impact of considerably higher aluminum prices in the U.S., potentially out of concern over demand destruction in the months ahead.

Demand Destruction, Tariff Deals Drag Market Sentiment

U.S. aluminum tariffs, which now sit at 50%, have significantly increased the price of aluminum in the United States. However, those costs are now weighing heavily on the demand outlook. While tariffs raise the floor for aluminum prices, they do not mean the market has reached a bottom just yet. Higher prices kill higher prices, and now, manufacturers appear to be buckling under the weight of the sharp material increases seen since the start of the year.

Prior to the spikes, the market appeared largely sideways. Suppliers characterized demand as steady, albeit not as high as what would be considered healthy. Over recent years, the U.S. manufacturing sector has mostly trended in contraction, and the Institute for Supply Management’s Manufacturing PMI continues to trend at weak levels. Throughout May, the PMI fell for the third consecutive month, dropping to 48.5. A reading below the 50 mark suggests an overall contraction in the U.S. manufacturing sector.

UAE, Canada Reportedly Close to Deals on Tariffs

Demand conditions have appeared to wane in the aftermath of tariff announcements. Now, markets are awaiting the outcome of trade negotiations, which could pull the premium much lower.

So far, the UK has received a temporary exemption from the additional 25% increase on aluminum duties. Ongoing negotiations have hinted that this could result in a quota, like what occurred under the Biden administration. However, the recent trade deal with the UK did not address steel and aluminum, both of which could be adjusted pending a Commerce Department review.

Don’t panic! Learn how to manage tariff threats with MetalMiner’s free steel and aluminum tariff guide.

While the UK is not a significant aluminum supplier to the U.S., the recent deal indicates a path toward lower duties for other countries. At the beginning of June, the UAE agreed to start negotiations that would put aluminum imports in sharper focus. The UAE stood as the second-largest aluminum exporter to the U.S. in 2024, which would make a potential deal much more consequential to the aluminum market. The largest supplier, Canada, is also reportedly weeks away from an agreement.

LME Aluminum Prices Stable

Exchange prices remain relatively stable, offering some relief to markets. While LME aluminum prices have risen since their early-April low, those gains appear relatively modest. Despite volatility witnessed across the base metal category throughout the year, LME prices stand 1.30% lower than where they closed 2024. While tariffs offered strong support to U.S. premiums, they have also suppressed global demand expectations for aluminum.

Overall, the global market remains oversupplied. While it is close, China has yet to reach its 45 million ton cap on aluminum output, which continues to place a cap on exchange prices. Meanwhile, the U.S. awaits the opening of SDI’s Aluminum Dynamics facility, which is due to come online this summer. This will provide an additional 650,000 metric tons of secondary aluminum to the market, offering further relief for the price of aluminum.

Biggest Moves in the Price of Aluminum

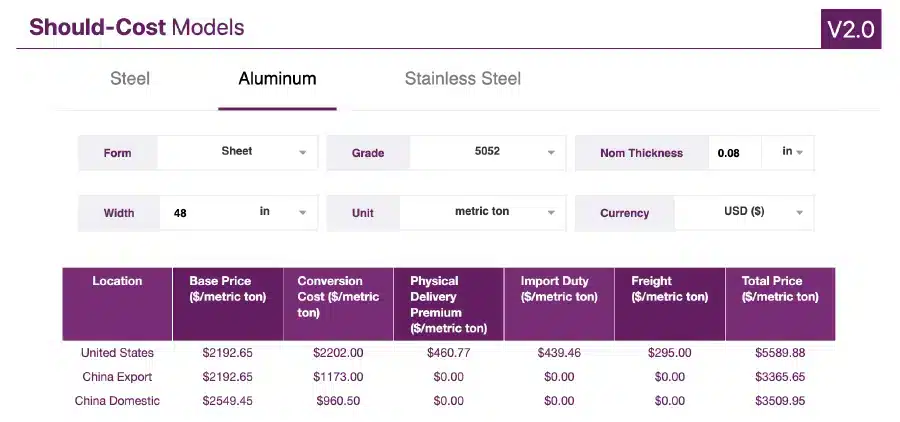

MetalMiner aluminum should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.

- Chinese primary cash aluminum prices witnessed the largest increase of the overall index, with a 3.22% rise to $2,823 per metric ton as of June 1.

- Chinese aluminum billet prices moved sideways, increasing 2.6% to $3,042 per metric ton.

- LME primary three-month aluminum prices rose by 1.48% to $2,468 per metric ton.

- Meanwhile, European commercial 1050 sheet prices fell by 2.88% to $3,119 per metric ton.

- European 5083 aluminum plate prices appeared bearish, experiencing a 4.79% decline to $4,353 per metric ton.