Stainless MMI: Suppliers Note Weak Q2 Despite Firm Stainless Prices

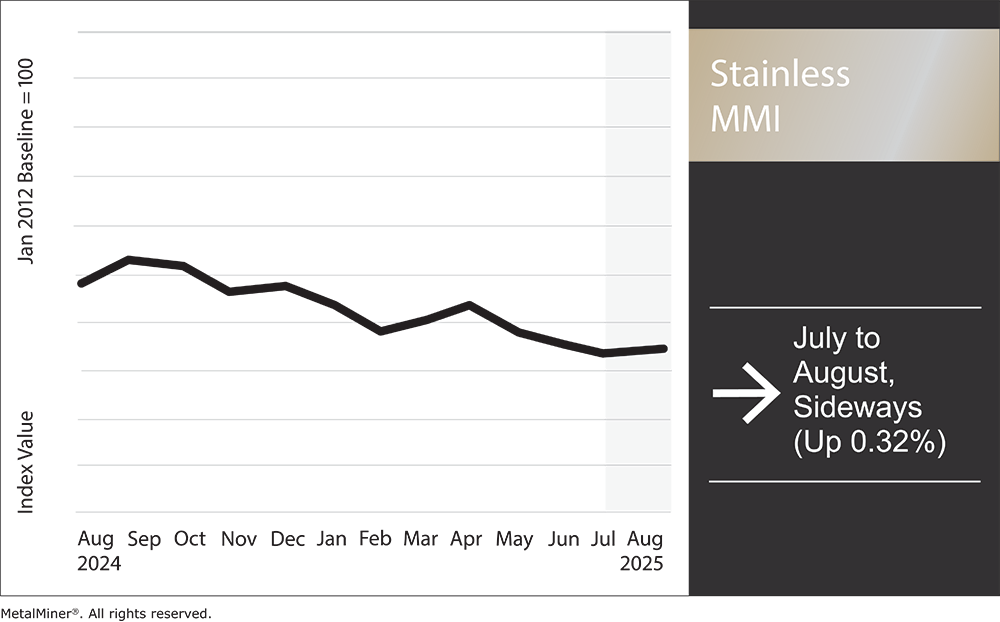

The Stainless Monthly Metals Index (MMI) moved sideways, with a modest 0.32% increase from July to August. Though it also remained flat for the month, the nickel price continued on an overall downtrend.

Stainless Mills Note Weak Demand

Despite a round of price hikes in recent months, the stainless market remains weak, with no evidence of a turnaround. Supplier financial results from Q2 indicate that while tariffs improved pricing conditions for mills, U.S. service centers struggled amid lackluster market conditions.

For example, Acerinox saw its EBITDA increase 10% from Q1 to Q2. This was largely supported by U.S. tariff policy, which helped insulate the mill from competitive global prices. The firm noted the “poor performance of the European market,” while “the order book in the United States remained stable.”

Outkumpu, whose results are more heavily influenced by conditions in Europe, saw EBIDTA decrease 17% during the same period. That firm noted that Europe’s “stainless steel industry faces persistent challenges, including subdued demand, low-priced imports from Asia and elevated energy costs.” Outokumpu called for increased safeguard measures through the Carbon Border Adjustment Mechanism to support the industry, particularly as U.S. tariffs have shifted stainless trade flows to other regions like Europe.

Trying to lower your stainless COGS more, but unsure what else you can do? MetalMiner helps you identify cost-saving opportunities hidden in your current buying habits. Explore our full metal catalog.

U.S. Deliveries Increase, But Demand Yet to Recover

In the U.S., Outokumpu’s stainless deliveries increased 7%, a fact that the mill attributed to “higher demand for domestically produced stainless steel.” While Acerinox saw U.S. capacity increase at North American Stainless, its global output fell 2.34% quarter over quarter.

Meanwhile, Outokupmu’s Q3 outlook showed little optimism, noting “group stainless steel deliveries in the third quarter are expected to decrease by 5–15% compared to the second quarter, mainly in business area Europe, due to seasonality and market weakness.” While Q2 saw efforts among U.S. manufacturers to nearshore supply, the U.S. showed no “signs of demand recovery yet.” This may serve to temper results during the third quarter relative to the first half.

Service Centers Showed Softer Results

Amid soft demand, U.S. service centers did not witness the same benefits as mills. Ryerson’s quarterly results showed average selling prices for stainless steel decreased 2% quarter over quarter. This suggests the firm was forced to offer discounts to move material, which came at the expense of its margins. Stainless steel shipments fell 1.6% during the same period, a tell-tale sign that buyers continue to hold back from the market.

Meanwhile, Reliance showed a 0.7% decline in stainless steel tonnage sold as well as a 2.8% drop in overall sales. Like Ryerson, lower stainless steel prices dragged the company’s results for the category. However, Reliance suggested that stainless steel prices may improve in Q3 due to recent mill base price increases. The firm’s optimism will likely face headwinds as reports from service centers throughout July indicated no such improvement during the month, with buying activity remaining soft.

Get monthly, expert tricks of stainless steel sourcing that can result in significant cost downs, savings and cost avoidance in MetalMiner’s Monthly Outlook. See a free sample copy.

Tariffs Support Base Prices

As recently covered in MetalMiner’s weekly newsletter, tariffs have allowed mills to increase capacity in the U.S. This has translated into tighter conditions for the ferritics category as mills continue to prioritize more common grades like 304. Mill price hikes throughout Q2 have largely held stable, despite soft overall demand conditions. Moreover, cold rolled stainless steel imports into the U.S. appear notably slow throughout 2025 compared to 2024, which has helped mills gain market share over foreign competitors.

For now, steel tariffs are being held at 50%. However, trade deals with some countries, including the UK and EU, suggested that quota arrangements could come to fruition in the months to come, though none have been announced as of yet. Meanwhile, in mid-August, Trump told the press that the U.S. may face another tariff disruption.

Don’t miss out on valuable stainless market insights. Subscribe to MetalMiner’s Monthly Metals Index Report and gain a competitive edge with comprehensive analysis across stainless and 7 other metal sectors, ensuring you’re always informed.

More Tariffs to Come?

On August 15, President Trump stated, “I’ll be setting tariffs next week and the week after on steel and on, I would say, chips. Chips and semiconductors…we’ll be setting sometime next week, week after.” While the president offered no ballpark as to how high or broad the upcoming tariffs would be, he suggested implementation may be gradual, continuing, “I haven’t set some of the tariffs yet. The rate will be low in the beginning. That gives them a chance to come in and build…a very high rate after a certain period of time.”

The president’s comments appeared notably vague. Therefore, it remains unclear whether tariff rates will increase or whether he plans to expand the list of derivative products impacted by tariffs. This may or may not result in higher duties for the stainless steel category.

While part of Trump’s overall tariff strategy has been to support domestic metal producers, manufacturing conditions remain notably weak, which may see him exercise caution with regard to tariff adjustments. Higher tariffs are unlikely to shift demand conditions. Instead, they could translate to demand destruction. This comes as manufacturers are already witnessing compressed margins as they struggle to pass along the full cost of the existing tariff hikes.

Nickel Prices Unlikely to Mount Recovery

While base prices remain firm for now, nickel prices overall remain soft, which has helped tether the stainless steel surcharge. And while nickel prices have held sideways over recent months, the multi-year trend points to the downside.

Meanwhile, nickel stocks remain exceptionally high. Indonesia continued to boast strong output, with nickel surpassing coal as Indonesia’s leading export in 2025. That said, Indonesia’s nickel demand has reportedly reached a peak. This has forced certain smelters to idle as nickel prices languished.

While a slowdown from Indonesia could serve to support prices, the overall global nickel supply glut remains exceptionally high. As such, smelters would need to curtail output for an extended period of time before it would significantly impact prices.

Biggest Stainless Steel and Nickel Price Moves

We know what you should be paying for metals. MetalMiner should-cost models are the ultimate savings hack, showing you the “should-cost” price for gauge, width, polish and finish adders. Explore what value they can add for your organization.

- Chinese ferromolybdenum prices witnessed a significant jump, rising 10.95% to $35,924 per metric ton as of August 1.

- The Allegheny Ludlum Surcharge for 316L cold rolled stainless coil prices increased 3.57% to $1.45 per pound.

- Meanwhile, Chinese primary nickel prices fell 1.16% to $16,756 per metric ton.

- LME primary three-month nickel prices slid 1.13% to $15,025 per metric ton.

- Indian primary nickel prices experienced the largest decline of the overall index, falling by a modest 1.56% to $15.20 per kilogram.