Rare Earths MMI – End of Summer Rally: New U.S. Policy Moves and 40% Price Spikes

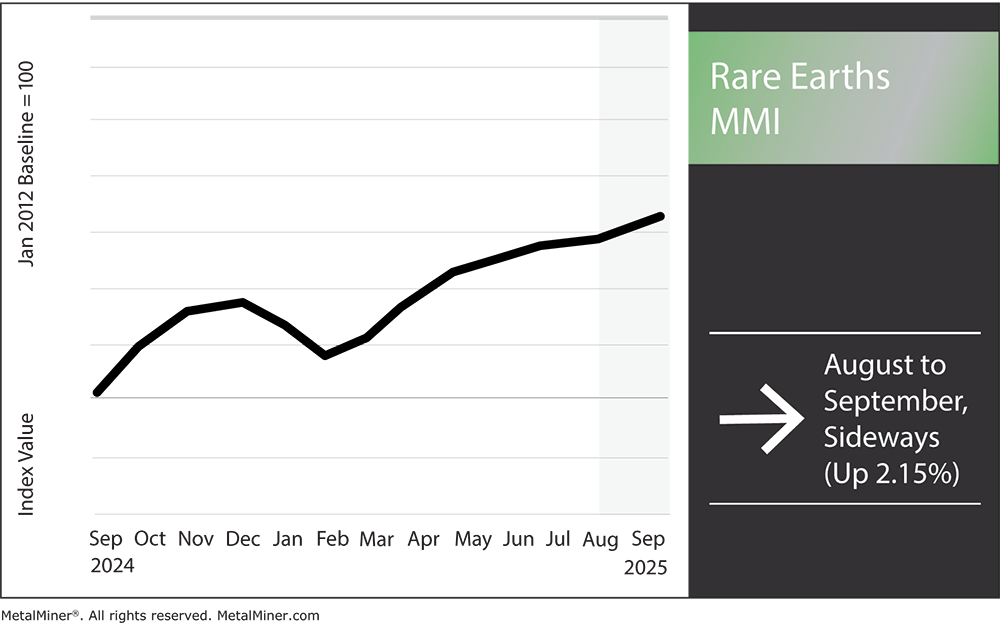

The Rare Earths MMI (Monthly Metals Index) moved sideways, but gained bullish momentum from the prior month, rising 2.15%. This comes as the rare earths market experienced numerous developments over the past 30 days, including discussions between Malaysia and China to develop new plans for rare earth processing. Notably, this would be limited strictly to Malaysian state-owned enterprises, potentially underscoring geopolitical cross-currents for U.S. sourcing.

Gain the knowledge required to navigate unpredictable metal markets and protect your bottom line by opting into MetalMiner’s weekly newsletter.

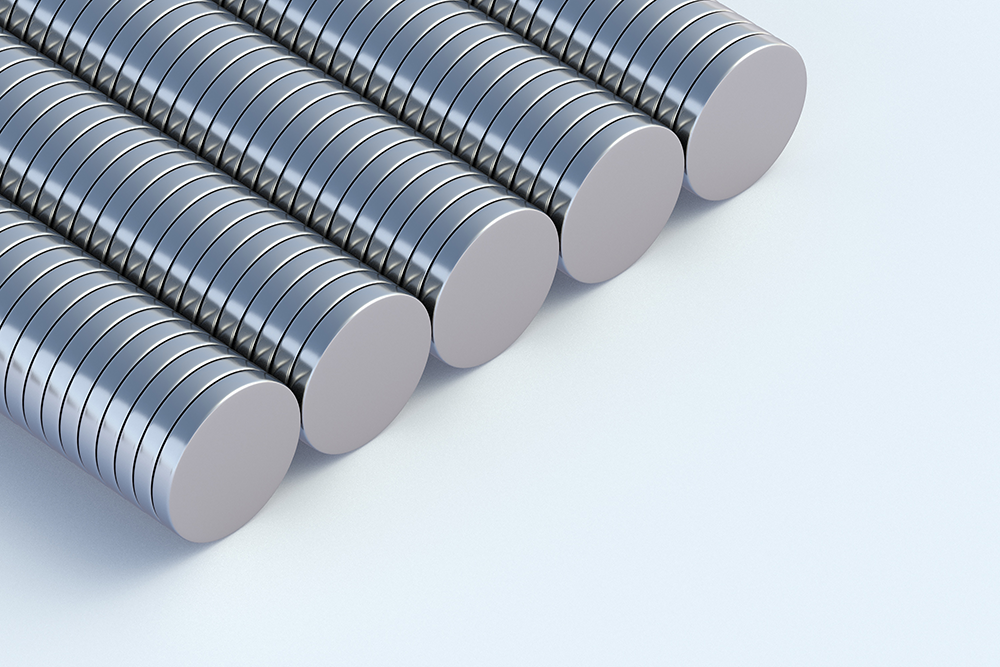

Neodymium-Praseodymium Magnet Metal Prices Spike

After peaking in late August, NdPr oxide prices eased slightly this week as some traders took profits. According to SMM, Chinese prices pulled back to the ¥600,000–¥608,000/ton range (~$84/kg) amid a brief wave of selling.

That said, current levels remain far above the summer’s start. For U.S. and European OEMs, this price whipsaw raises some financial red flags. Notably, neodymium-iron-boron magnets, which rely on NdPr, are required to power everything from EV motors to wind turbines and fighter jet actuators. Reuters reported that a sustained cost surge would squeeze margins for manufacturers. If producers prove unable to absorb the hit, it could eventually flow through to higher costs for end-products.

All of this means that contingency plans (such as dual sourcing and stockpiling critical magnet inputs) are back on the agenda, and companies are leveraging affordable market intelligence platforms like MetalMiner Select to strategically monitor price drivers and time purchases. Staying ahead of such volatility with data-driven forecasts can help OEMs avoid overpaying or getting caught short on key materials. The U.S. government’s recent deal with MP Materials to support a $110/kg NdPr price floor is also telling, as it effectively establishes a new higher baseline for Western producers.

Australia’s Lynas Raises Funds but Flags Texas Plant Doubts

Australia’s Lynas Rare Earths, the largest non-Chinese rare earths producer, recently sounded the alarms over its planned heavy rare earths separation facility in Seadrift, Texas. According to Rare Earth Exchanges, CEO Amanda Lacaze cautioned on an earnings call last week that construction “might not proceed” unless acceptable off-take agreements are secured with the U.S. Department of Defense,

The Texas plant, which is backed by a DoD contract, was slated to start up in 2026 to produce separated heavy rare earth oxides, notably dysprosium (Dy) and terbium (Tb). These are critical for high-temperature magnets in EV drivetrains and defense systems. Lynas’s warning underscores how uncertain the project’s economics remain despite U.S. support. Any delay or cancellation of the Texas heavy REE plant would represent a significant setback for U.S. supply chains. Dysprosium and terbium are, in many ways, the Achilles’ heel of the magnet industry.

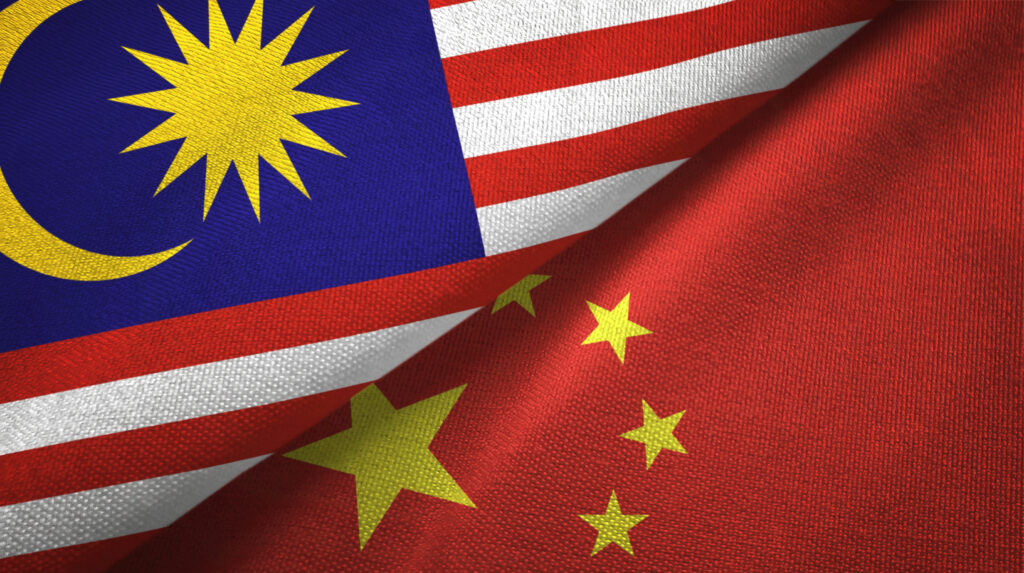

Malaysia Weighs China-Only Rare Earths Processing Partnership

In a move with significant geopolitical overtones, Reuters reported a recently disclosed offer from China to help develop Malaysia’s rare earth processing capabilities, but only via partnerships with Malaysian state-owned enterprises. According to Malaysia’s Natural Resources Minister, President Xi Jinping himself conveyed Beijing’s willingness to provide rare earth processing technology during a visit to Kuala Lumpur, on the condition that collaboration be restricted to government-linked companies (excluding any private or foreign firms).

This “SOEs-only” stipulation is seen as China’s way of ring-fencing its tech and IP from Western access. In effect, China is dangling support to help Malaysia build a downstream rare earths industry, but with strings attached. For starters, Chinese state entities would likely co-own or control any new facilities, ensuring Beijing’s standards and influence carry over.

Struggling to align your sourcing strategies with the right market data? MetalMiner helps you match your exact metal types, forms and gauges with actionable market intelligence. View our full metal catalog.

What Would Malaysia Get?

For Malaysia, the offer presents both opportunity and risk. The country is currently estimated to sit on 16 million tonnes of rare earth deposits, which could potentially be worth $170+ billion. The government is also eager to move up the value chain. According to Rare Earths Exchange, it already hosts Lynase’s major light rare earth refinery in Kuantan, and it notably just became the first place outside China to produce terbium oxide.

Malaysia has also proactively banned the export of unprocessed rare earths to prevent the exploitation of its resources. Again, the geopolitical implications are substantial as China is aggressively working to maintain its dominance by exporting its technology on its own terms.

U.S. Backs Brazil’s Heavy Rare Earth Project, with a “Mine-to-Magnet” Vision

In a bid to cultivate new non-Chinese supply, the U.S. International Development Finance Corp just committed $5 million to Aclara Resources’ Carina rare earth project in Brazil. Announced on September 1, mining.com reports that funding will accelerate Carina’s feasibility study (due Q1 2026) and marks an early-stage vote of confidence in a significant heavy rare earth deposit.

The Carina project, which is located in Goiás state, is an ionic clay deposit rich in dysprosium and terbium, exactly the type of heavy rare earth source the West badly needs to offset China’s near-monopoly. In essence, Carina could become one of the largest single sources of heavy magnet metals outside China. The strategic twist is where that material would be separated and processed. For now, Aclara is pursuing a novel “mine-to-magnet” approach that spans multiple continents.

For metal procurement professionals, Aclara’s progress is a welcome bright spot on the horizon, albeit a longer-term one. That means relief in the form of new heavy rare earth supply is still a few years off. However, in time, Aclara’s U.S.-linked output could offer American and European magnet manufacturers a new, stable option for Dy/Tb outside the China-Myanmar supply loop.

Rare Earths MMI: Noteworthy Price Shifts

Want to enhance your RE market intelligence? Subscribe to MetalMiner’s free Monthly Metals Index Report to gain a deep understanding of the dynamics affecting RE markets, along with nine other metal industries.

- Neodymium prices rose by 26.87% to $87,214 per metric ton.

- Praseodymium-neodymium oxide prices rose by 15.45% to $72,256.87 per metric ton.

- Praseodymium oxide prices rose by 26.26% to $73,417.65 per metric ton.

- Lastly, europium oxide prices moved sideways, rising a slight 1.36% to $44.17 per kilogram.