The Automotive MMI (Monthly Metals Index) continued its decline in June, this time falling by 3.28%. The aluminum and copper components of the index traded sideways. However, all other parts of the index dropped. Lead prices managed to trend more sideways in June than in May, but weak demand continues to impact lead and steel […]

Category: Automotive

Automotive MMI: Index Slides, High Car Costs Impede Buyers

The Automotive MMI (Monthly Metals Index) broke its sideways trend this past month, inching down 3.36%. Though all components of the index fell, hot-dipped galvanized steel experienced a particularly noticeable price drop, as did several other steel types.This could indicate a trend reversal. However, consumer purchasing must rise in order for a reversal to happen, […]

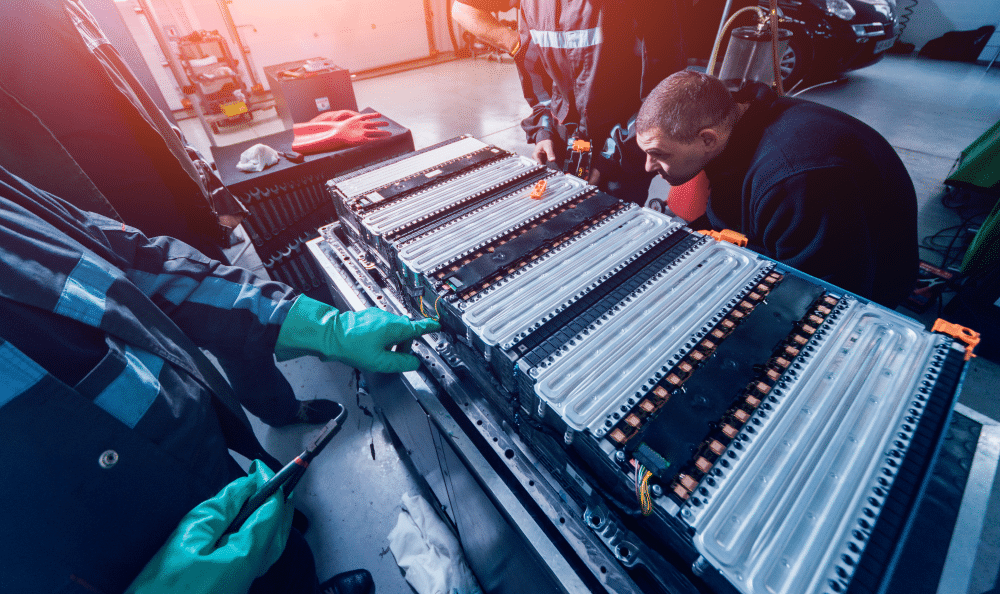

Experts Anticipate Long-Term Volatility in the Lithium Market

Lithium, a crucial component in electric vehicles (EVs), seems to be the metal of the season. Indeed, over the past month, the market has seen loads of fresh developments around lithium pricing. Lithium mining and lithium battery usage have also been effected. Moreover, sector experts anticipate that lithium prices will continue to be volatile over […]

Automotive MMI: Vehicle Sales Up, Steel Prices Dropping

April saw a welcome boost in sales within the U.S. automobile market. New vehicle inventories are now in healthy shape. However, interest rates are still high, as are new vehicle prices. Moreover, the Automotive MMI index still has several factors working against it. Steel prices, notable HDG traded not only sideways, but completely flat. In […]

Automotive MMI: HDG, Palladium and Shredded Scrap Steel Prices Jump

The Automotive MMI (Monthly Metals Index) rose significantly from March to April, jumping by 9.01%. This represents the highest rise the index has seen in over a year. Numerous drivers helped bring prices up, with every part of the index rising month-over-month, including: The steel parts of the index (in particular HDG) followed trend with […]

Rare Earths MMI: Prices Plunge, Flatten, Then Rise

The Rare Earths MMI (Monthly Metals Index) dropped drastically again this month, suffering a 15.5% decline. Despite this, downward price action began to slow down and flatten around March 16. As of March 30, prices began to rise again. Further adding to the confusion was the fact that some components in the index traded flat. […]

Automotive MMI: are Lithium Supplies Threatened by Supply Shortages?

Similar to the past six months, the Automotive MMI for March was again pulled in multiple directions. Hot dipped galvanized prices rose again, following the same trend as HRC and CRC. However, Chinese lead prices dropped significantly, pulling the index down. This was mainly due to car sales shrinking within China (the world’s top market). […]

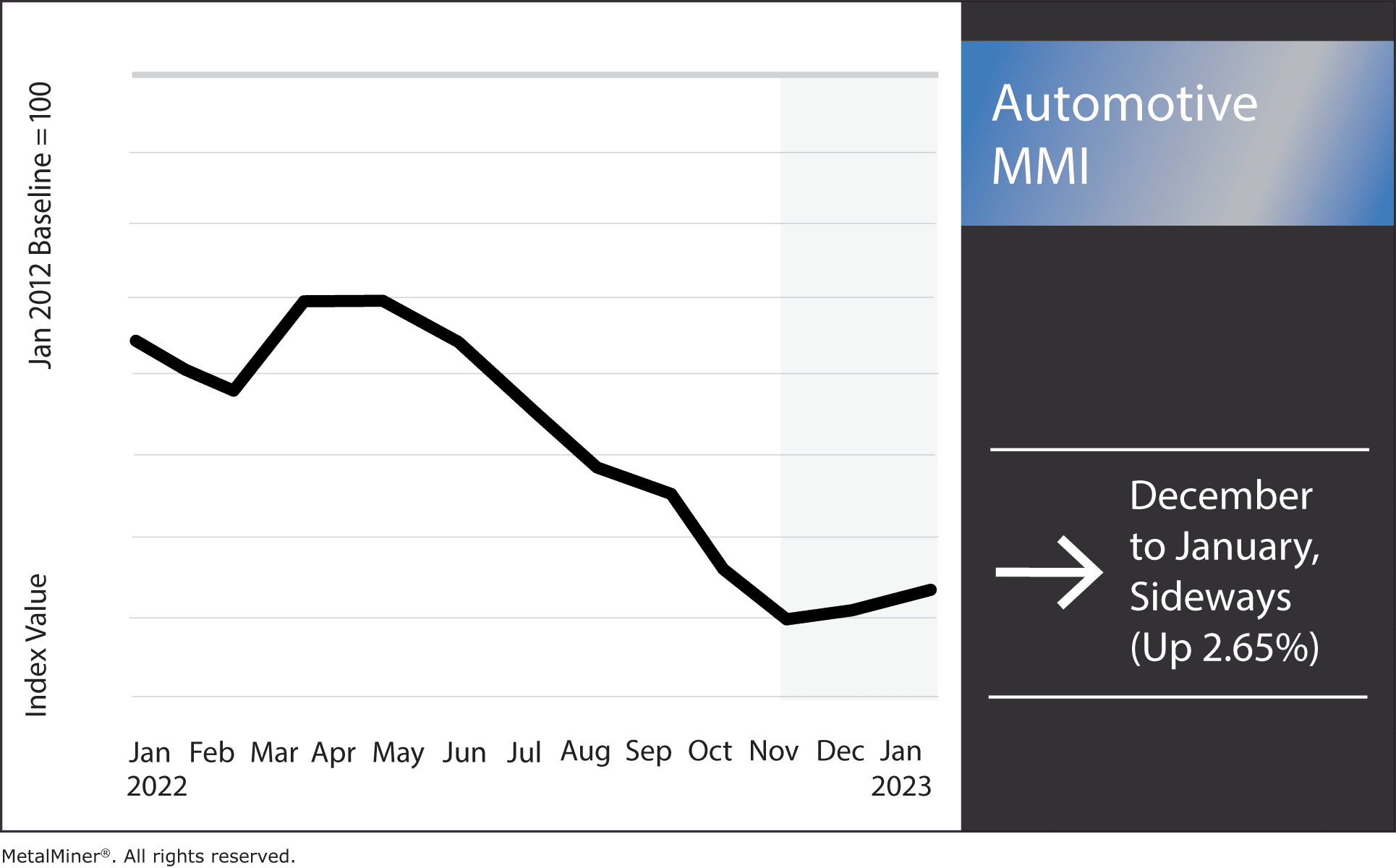

Automotive MMI: 2023 Could Bring More Car Parts Shortages

The Automotive MMI (Monthly MetalMiner Index) traded sideways for the second month in a row, rising by just 2.65%. The automotive index was impacted heavily by China rescinding zero-COVID restrictions, which caused a spike in cases. However, Chinese-sourced lead and HDG steel prices rose significantly, pulling the index upward. The overall volatility in metals used […]

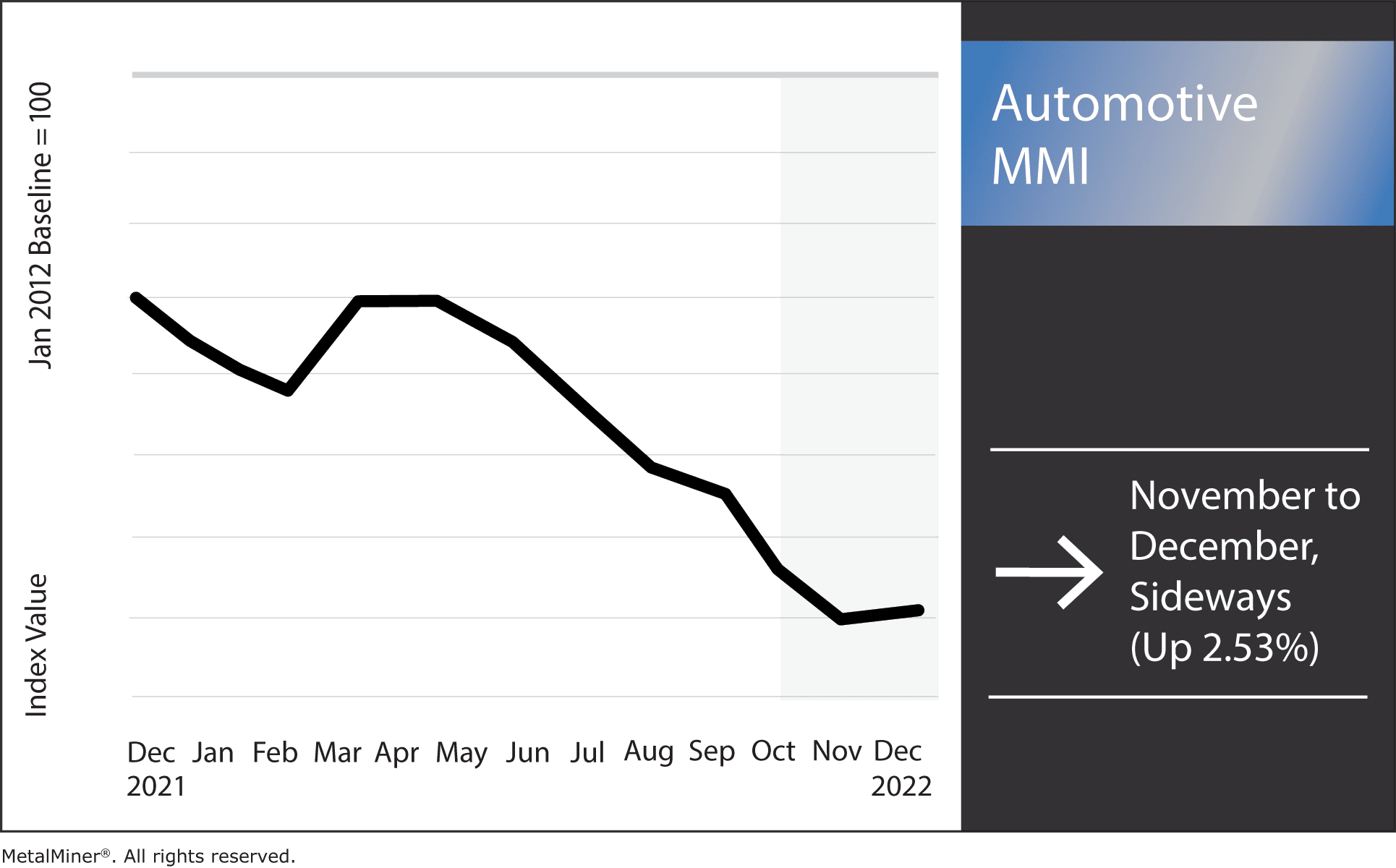

Automotive MMI: Interest Rates Move Up, Consumer Demand Moves Down

The Automotive MMI (Monthly MetalMiner Index) finally broke its downward trend and traded sideways, inching up by 2.53%. Meanwhile, myriad factors continue to pressure metal prices. The demand for vehicles among consumers remains strong. However, low inventories throughout most of 2022 placed a huge strain on the index. Without parts, the manufacturing of new vehicles […]

Automotive MMI – Car Demand Growing, but Steel Supply Strained

The MetalMiner Automotive MMI (Monthly MetalMiner Index) dropped substantially in October, dipping by 9.08%. Manufacturing limitations due to energy shortages and smelter shutdowns remain the ongoing trend in car manufacturing. However, consumer demand for cars, especially in the US, still holds firm. This leaves many in the automotive industry trying to find a balance between […]